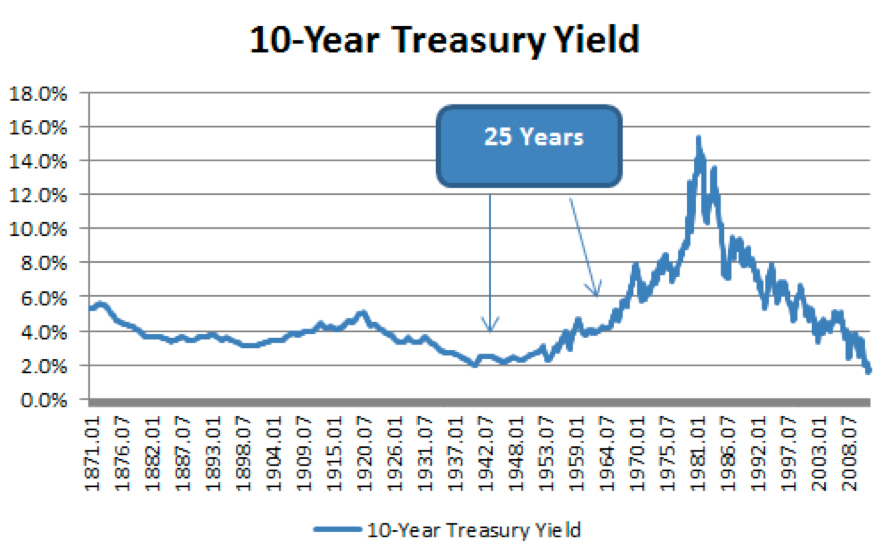

When Will Interest Rates Rise?

That is a question asked by many investors today. One way to analyze this question is look at previous situations in US history when bond yields reached levels seen today. As noted in the chart, the previous treasury yield low…