As we did last year, Financial Symmetry has covered several current events on our blog throughout 2012, and here are what we think the Top 10 Economic Stories of the Year have been:

As we did last year, Financial Symmetry has covered several current events on our blog throughout 2012, and here are what we think the Top 10 Economic Stories of the Year have been:

(Click the plus (+) symbol to expand the story.)

10) Facebook Fail

Facebook made its debut in the stock market with an initial public offering (IPO) in May and was one of the more hyped financial stories of the year. As is the case with many IPO’s, many institutional insiders were able to get a more attractive entry price, well before the average investor had a chance.

After the hyped initial price, the stock began a decline over the next few months which led to a low price in early September equaling around a 54% drop from the opening share price. Facebook also had to deal with the actual mishandling of the IPO itself which led to lawsuits and a PR debacle.

9) Apple Takes A Wrong Turn

For years Apple has been leading in the smartphone and tablet markets. But technology is notoriously fast paced and it can be hard to continue with winner after winner.

In 2012, the newest iPhone changed the mapping software to their homegrown Apple Maps. Unfortunately Apple Maps is nowhere near the quality of Google Maps and has resulted in a PR disaster. Apple Maps has even stranded people in the desert.

8) QE Infinity

In September 2012, the Fed announced its third round of easing (QE3). It pledged to continue to act until the economy was significantly improved, rather than creating another program with a fixed endpoint.

In December 2012, the Fed went further, offering an explicit target. It said it would hold rates at near zero so long as the unemployment rate was above 6.5% and inflation at or below 2.5%. The Fed would continue its monthly purchases of $85 billion in Treasury securities and mortgage-backed securities. Both steps were intended to reduce unemployment, a shift away from decades when inflation was the primary focus.

The Fed has made clear that it will continue to stimulate the economy even when the recovery has strengthened, suggesting it is now willing to accept higher inflation to encourage growth.

From an investing standpoint it is important to work with your financial planner to make sure your portfolio is positioned appropriately for your long term goals. While changes in Fed policy and the economic environment can lead to short term market volatility, they typically do not warrant broad changes to your investment strategy.

7) The biggest story not getting any attention...

In late 2010, a popular Wall Street Analyst predicted hundreds of billions in defaults on municipal bonds in the next five years. Fortunately in 2012, except for a limited number of cases that has not occurred.

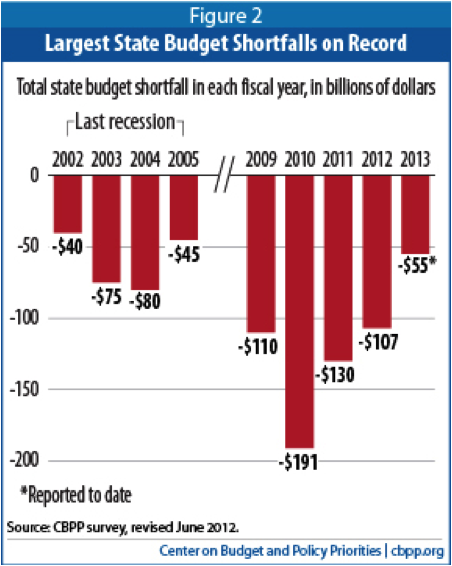

State budget shortfalls have declined since 2010 and expect in 2013 to be at the lowest level since 2005 (as noted in the chart to the right).

In addition, state and local spending was a benefit to GDP in the 3rd quarter of 2012 for the first time in a few years as states have had more money to spend on investments and hire employees.

There are still risks involved given potential federal cuts with the fiscal cliff outcome, but the dire forecast from a few years back seems unlikely to happen.

6) European Debt

The European Debt Crisis continued to be a major story in 2012. We highlighted the situation’s current status in May describing Germany’s power position in the continued debt fallout across the continent.

In the latter half of the year, a bond-buying program along with a statement assuring that large banks will be placed under direct supervision of the European Central Bank (ECB) has given investors more confidence, which has also been reflected in foreign stock investments the last quarter of the year.

Our take:

5) Housing Construction Continues To Improve

As we reported here in 2011, residential construction is one of the keys for continued economic improvement here in the United States. While some have been surprised at the continued downtrend in unemployment, we see that it is tracking very closely to the improvement in residential construction.

Last year permits were running at an annual pace of about 600,000 and unemployment was at 9%. Now permits are close to a 900,000 annual pace, and unemployment is down to 7.9%. As we work our way back up to a level of residential construction necessary to keep pace with household formation, about 1,200,000, we expect unemployment to continue falling to 6.5% or lower.

Our take:

4) JP Morgan

One of the biggest financial stories of 2012 was the announcement of JP Morgan’s trading losses. When first announced in early May, CEO Jamie Dimon estimated trading losses of $2 billion since the start of April. As the Spring and Summer wore on that figure continued to increase and estimates rose to as much as $9 billion in losses. Dimon admitted that the losses were the result of “errors,” “sloppiness” and “bad judgement.”

The losses stemmed from aggressive trading in the credit default swaps market in JP Morgan’s London office. The trader, Bruno Iksil, is also known as the “London Whale” for his large, risky bets. His boss, Ina Drew, announced her retirement shortly after the news was released.

The losses came as a shock after Dimon had been praised for keeping JP Morgan profitable through the financial crisis. Our blog post at the time pointed out the overconfidence bias that may have played a role in the risky trading practices. This news item also illustrates the risk of having too much invested in an individual stock and betting heavily on companies that have performed well in the recent past.

Our take:

3) Fiscal Cliff

Ongoing political dysfunction has tarnished our image globally and hurt confidence at home. Expiring tax cuts and increased spending are set to kick in automatically on January 1st if Congress and the White House can’t come to an agreement.

The net result of the automatic spending and tax increases would take an estimated $600 billion out of our economy in 2013 which would almost certainly push us into recession.

However, since tax rates go up automatically on January 1st, it dramatically changes the dynamics. A vote before January 1st for keeping only some of the rates where they are is seen as a vote for a tax increase which is something that some in congress have vowed never to do. A vote after January 1st on the exact same bill would not be a violation of their pledge since it would instead be a vote for a tax decrease. We therefore think that a negotiated compromise becomes easier and is more likely after January 1st.

Our take:

2) Hurricane Sandy

US stock trading was suspended for two full business days in October as the Northeast was pummeled by Hurricane Sandy. In addition to closing the stock market, the “Superstorm” also caused mass flight cancellations across the country, led to closure of the NY subway and transportation systems, and resulted in power outages in many states. The last time the stock market was closed for two days due to weather was a blizzard in 1988.

While stock market closures are rare, their occurrence due to forces of nature or other disasters serve as a stark reminder that money is not the most important thing in the world. In times of crisis, the health and safety of the people in affected areas must come first.

[/vc_column_text]

1) 2012 Election

The economy was the main issue for voters, but healthcare and tax reform were also in the

discussion as well. Our country’s demographic makeup is changing with minorities and younger voters having a bigger say. Quality statistical analysis trumped the pundits by correctly forecasting the election.

Our take: