What is a stock?

It is an ownership of a company which represents a claim on future earnings. Many have been told to buy stocks because they are the best long-term investment, but few know where these returns actually come from.

In its simplest sense the long-term return of stocks break into two pieces: income from dividends and capital gains from price changes.

What All Is Included In Stock Returns?

- dividends

- earnings per share (EPS) growth

- change in valuation (price-earnings ratio, or P/E ratio)

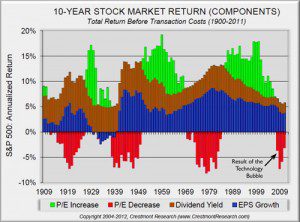

Returns from dividends and earnings per share have been relatively consistent over time, but the change in the price-earnings (P/E) ratio is much more volatile. This is reflective of what investors are willing to pay for those earnings and the change in the P/E ratios do impact returns in the short-term as noted in the chart below from Crestmont Research.

Over the last 100 years the combination of the dividend yield and EPS growth have resulted in market returns of approx. 9.5% and the change in P/E valuation has had a minimal impact (approx. 0.1%) per the Little Book of Common Investing (Exhibit 7.1).

Dividend yield and EPS growth is also referred to as the fundamental return of the stock market. These returns have been relatively consistent over time. The change in P/E valuation can also be called the speculative return and has a much greater impact on short-term results as noted by the green and red bars above.

These fluctuations in speculative return are why we follow a tactical asset allocation strategy at Financial Symmetry, Inc. to best position our clients for future changes in the market, but not forget the benefits of long-term investing.