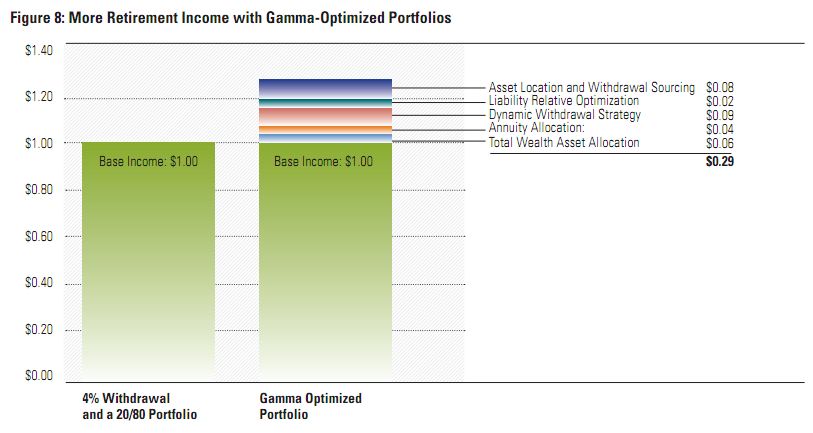

A recent study from Morningstar suggests that implementing solid financial planning strategies can increase a retiree’s investment income by 29%, which they equate to an additional 1.82% in investment returns every year. If we consider a $1 million nest egg applying the standard 4% annual withdrawal rate, that is nearly an additional $12,000 in your pocket every year! This illustrates the benefit a solid financial plan can bring to the table.

The Morningstar research introduced a new concept called “Gamma.” Gamma is intended to determine the additional retirement income that can be achieved by smart financial planning and presents a new way to measure the value potential in a financial planning relationship.

Many investors understand that comparing their investment performance to index benchmarks is one good way to see the value provided by their financial advisor. In the investment world, this is known as alpha-the excess return provided through active management.

Other benefits of working with a financial advisor, such as tax efficiency and smart asset allocation, are much more difficult to measure. The Morningstar research attempts to do just that by quantifying the additional value of financial planning strategies, “Gamma.”

The report notes that “Individual investors invest to achieve goals (typically an inflation-adjusted standard of living), and doing the things that help an investor achieve those goals (i.e., adding Gamma) is a different type of value than can be attributed to alpha or beta (a measure of risk) alone, and is in many ways more valuable. Therefore, asset-only metrics are an incomplete means of measuring retirement strategy performance.”

This research identifies five strategies that can add to retirement income. We’ll look at each of these in more detail in future blog posts.