Annuity Allocation

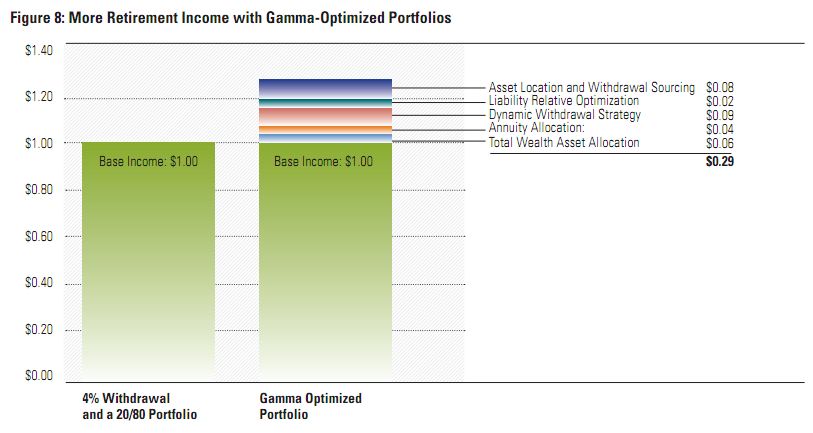

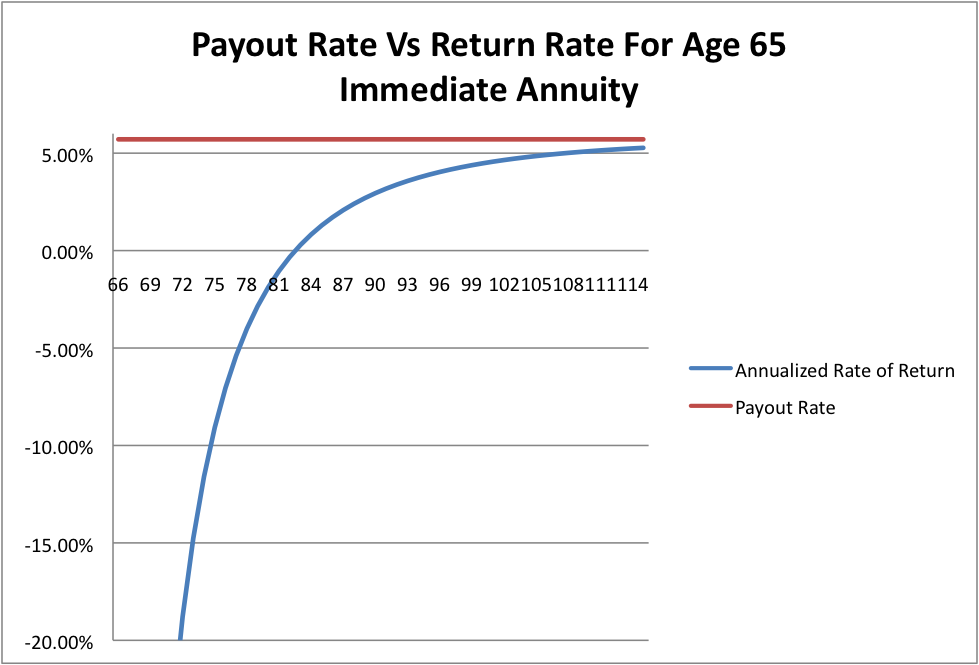

The Morningstar Gamma research cites Annuity Allocation as one of the five ways to increase retirement income. They assume 25% allocation to a fixed annuity with a payout rate of 5.71%. What’s the catch? The most important thing to note…