Investors have heard plenty of negative news internationally in 2012, the two biggest stories being the European Debt problems and slowing growth in China. Given that these negative stories have been common the last couple of years, it’s natural to wonder whether investing overseas is a good idea right now.

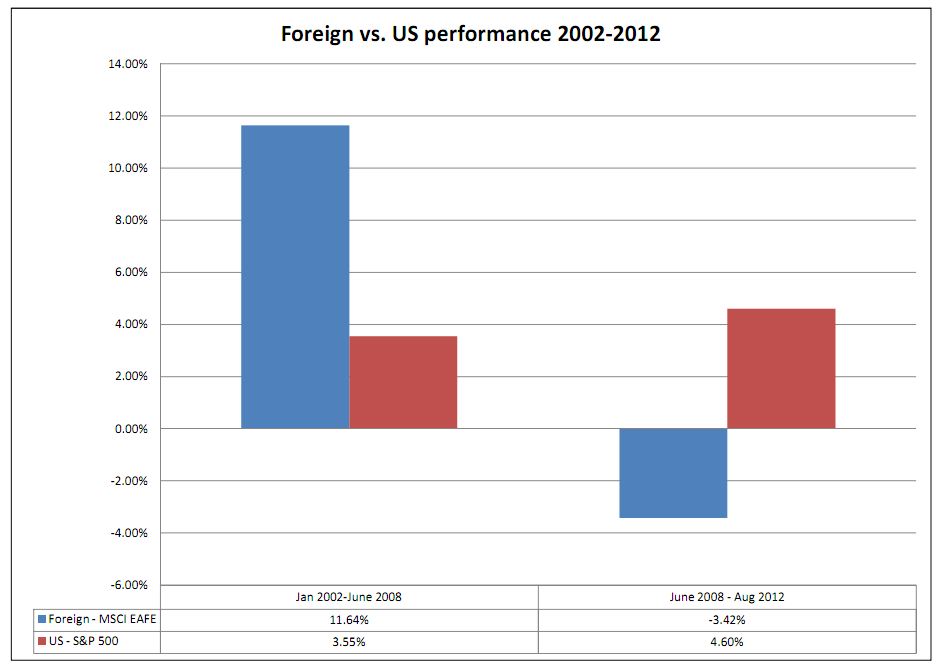

To answer this question, we take a look back to see how foreign funds have performed compared to where they are now. Prior to the last few years, foreign funds actually outpaced their US counterparts, from 2002-mid 2008 with emerging markets leading the charge in a big way during that time. Since mid 2008, as the stream of negative headlines heightened worries as to what the ultimate outcome might look like in Europe, this performance trend reversed and foreign funds produced weaker returns than large cap US holdings.

One of the cornerstones of a successful investment strategy is that fear equals opportunity. Of course this is not what our emotions tell us. When things have been bad, we are more prone to react out of fear, as we feel we should be more concerned about not losing more rather than taking advantage of the opportunity presented by lower prices.

It’s not always fear that causes investors to sell after a period of poor performance. In several studies, institutions have been shown to fire investment managers who’ve experienced a period of underperformance and hire those that have enjoyed a period of outperformance- only to then see their new manager’s hot hand turn cold.

So we have to be careful to recognize that when things seem dire, and performance has been disappointing, there very well could be opportunity ahead. Allowing a sound research-driven process to guide decision making can help to spot interesting prospects in the face of unattractive environments. While a repeat of the 2002 outperformance path is still questionable, as there are still problems to sort out internationally, we do know that foreign stocks remain cheaper than US holdings, and cheaper prices historically often leads to superior performance.