Update on Our View of the Debt Ceiling Debate

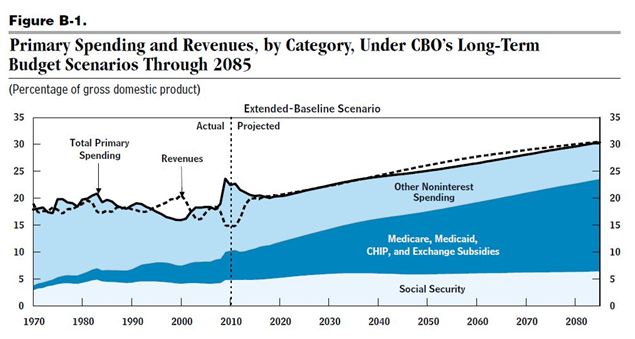

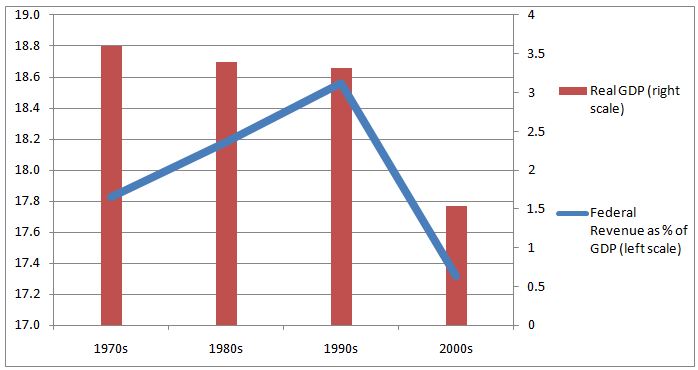

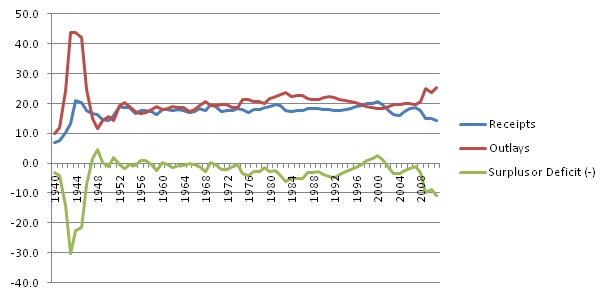

The total United States government spending for fiscal year 2011 is budgeted at $3.82 trillion. Of that amount we are borrowing $1.65 trillion in order to be able to pay all of our obligations. If the debt ceiling is not…