“I expect my investments to double every 7 years. How is that possible in these market conditions?”

This is a question that comes up in meetings regarding the return expectations clients have for their portfolio. The rate of return is a critical assumption in any financial plan, so it is obviously an important concern. Many of us are familiar with hearing that our money should double on a predictable schedule like every 7, 8, 9, or 10 years. But where did we hear it and what does it mean?

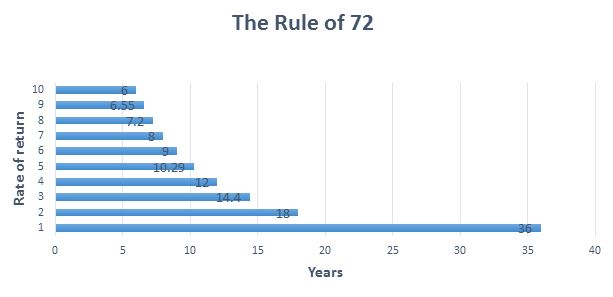

When we ask where clients heard this rule of thumb we usually receive a few responses ranging from a college course to a rich uncle. The basis this comes from is a simple financial concept called “The Rule of 72” and it works like this:

72 /Rate of Return=# of years to double your money

The higher the expected rate of return, the quicker you can expect your money to double.

This sounds simple enough, so where do I sign up for my money to double in the shortest amount of time? A critical component missing from this simple equation, and it is a big one, is RISK. Earning any rate of return above a standard interest rate at the bank (which is presently nearly 0%) is going to involve some level of risk taking. The higher the risk, the higher the potential reward, and the higher the potential loss.

So while The Rule of 72 addresses the time it takes to double your money, the other factor it doesn’t take into account is your personal time horizon.

How long do you have until you need this money?

The more time you have to allow your assets to grow, the more risk you can take as you have time to recover from losses. And therein lies the rub. We can’t expect a decent rate of return without also expecting losses.

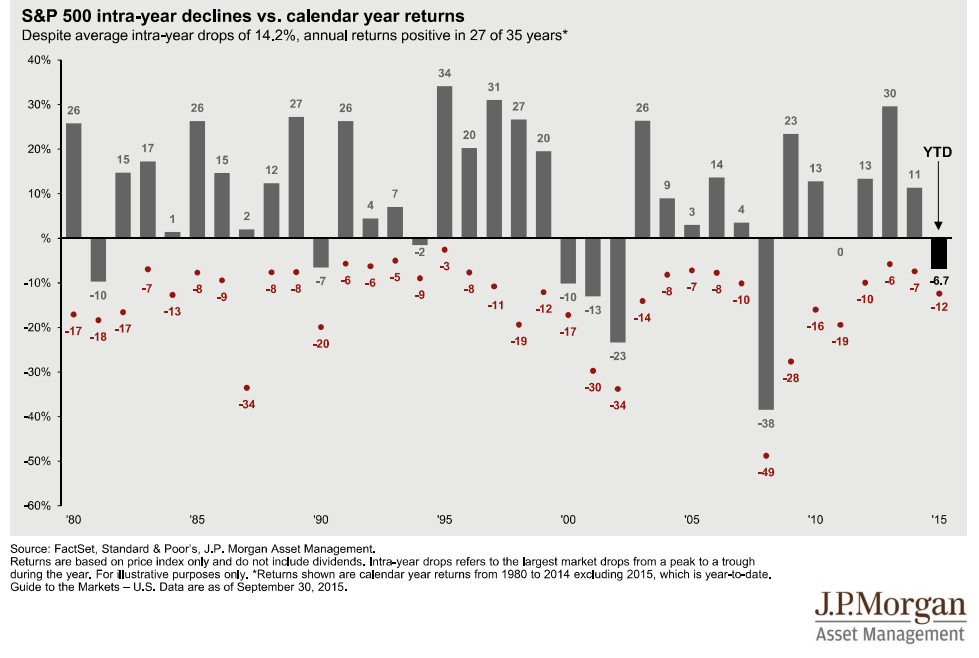

So while we might expect to earn a 7, 8 or even 10 percent rate of return on our investments over the course of our lifetime, we can’t expect to earn that return over a 1, 3, or even 5 year period as the stock market is going to fluctuate; and while we might earn a good rate of return on average, returns in any given year are going to look more like this:

This is why it is so critically important to start with a financial plan that addresses your personal situation. It is also why we use tools to calculate your capacity for risk and develop an investment strategy only after those factors have been addressed.

While we would love to tell you that our process can double your money over a predetermined period of time, that goal is neither prudent nor realistic. What is happening in the markets right now is not as relevant to your financial situation as your long term plan for staying invested and hitting your savings targets.

When considering your expected rate of return or any other financial goal there are numerous factors to consider; more than any simple rule of thumb is capable of addressing. If you have questions about your investment return or other financial goals please contact us today to get started.