When it comes to investment markets, determining “The Fairest of them All” depends not just on where you are investing, but also on the initial conditions.

We’re going to look at two different time periods to get a sense of the attractiveness of three primary investment areas – Cash, Bonds and Stocks.

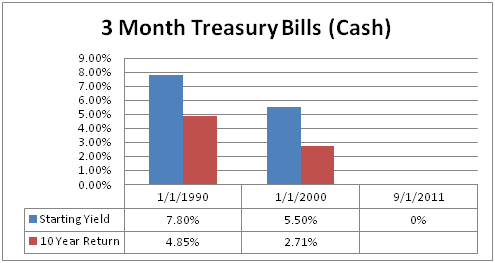

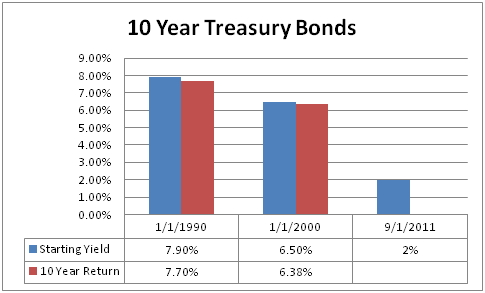

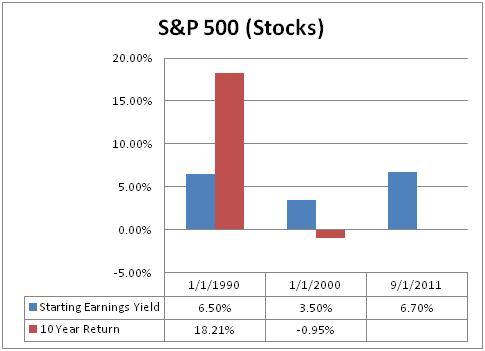

For cash we use the three month treasury bill yield. For bonds we use the ten year treasury bond yield. And for stocks we use the earnings yield on the S&P 500. The earnings yield is the reported earnings per share as a percent of the price per share.

The 2000s

First is the beginning of 2000, and the starting yields.

- Cash 5.5%

- Bonds 6.5%

- Stocks 3.5%

Over the next ten years, the annualized returns were

- Cash 2.71%

- Bonds 6.38%

- Stocks -0.95%

Notice that for bonds, the return for the ten year period was just about the same as the starting yield. This makes sense since we measured the return of ten year bonds over ten years.

For cash, the return being lower than the starting yield was a reflection of falling interest rates over the ten years.

For stocks, despite the fact that reported earnings are now about 70% higher, the return was negative. This is because the very low earnings yield was indicating that stock prices were significantly overpriced.

The 1990s

The second time period we’ll look at is the ten year period starting in 1990. The starting yields were:

- Cash 7.8%

- Bonds 7.9%

- Stocks 6.5%

Over the next ten years, the annualized returns were

- Cash 4.85%

- Bonds 7.70%

- Stocks 18.21%

Once again, the return on ten year bonds was almost identical to the starting yield, while cash earned less than the starting yield due to falling interest rates.

Now let’s take a look at current starting yields (see graph below).

- Cash 0.0%

- Bonds 2.0%

- Stocks 6.7%

What does it all mean?

So the current valuations are the mirror image of what we saw at the beginning of 2000. And while we don’t know exactly what returns will look like over the next ten years, the initial conditions mean the odds are that stocks will provide the highest return of the three.

We do not think stocks are likely to earn over 18% a year like the 1990’s as we are not expecting stocks to reach a point as overvalued as they were in 1999.

Our guess is that bonds will have the worst returns given that we wouldn’t expect returns to be higher than the starting yield of 2%. We do however expect cash to average more than the current 0% as we expect interest rates will rise at some point this coming decade.