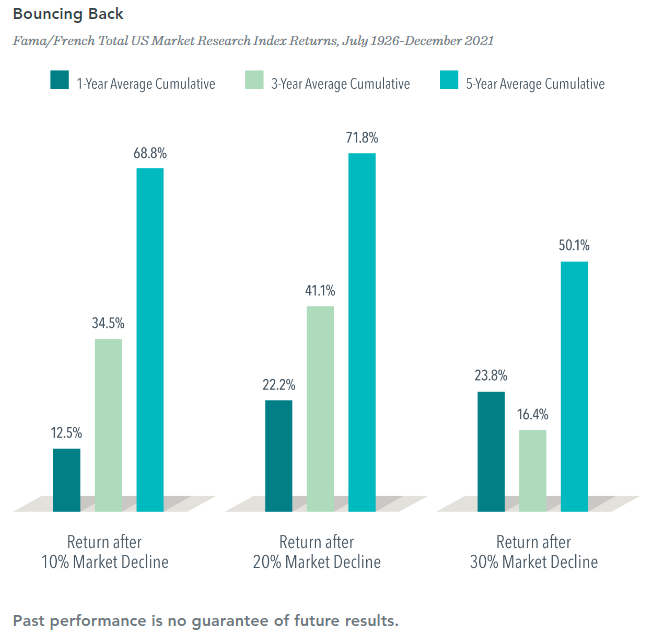

Too many investors become anxious when the stock market is falling and excited when the stock market is rising.

Too many investors become anxious when the stock market is falling and excited when the stock market is rising.

Unfortunately, that is why the average investor dramatically under performs the broad markets as they sell after prices have fallen and buy after prices have risen.

The key to controlling emotions is understanding the purpose of your investment portfolio is to serve your personal financial goals.

Reducing Worry with a Financial Plan

If you want to worry less about short-term market gyrations, the solution is to have a sound financial plan with reasonable return assumptions based on current market prices.

This means using lower return assumptions when prices are high, and higher return assumptions when prices are low.

For our clients, as stock prices have continued to move higher over the last several years we have adjusted return assumptions down accordingly.

If prices were to continue to fall we will raise our forward return assumptions, and if they rise too quickly we will lower forward return assumptions to align with the new price level.

A Viable Financial Plan Brings Confidence

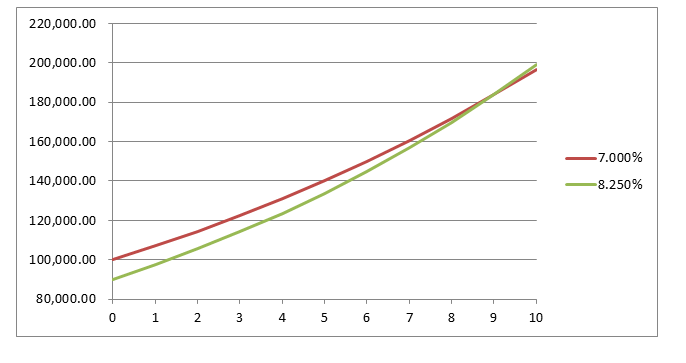

If your financial plan is viable, drops in the market will then have no effect on your long term financial security as long as you don’t let your emotions control your investment decisions – i.e. if you have more money but returns are lower, it is the same as having less

money with higher returns.

For example, if you have $100,000 invested for ten years at 7%, the ending value is equal to having $90,000 invested at 8.25%

Buy Low, Sell High

As an additional risk reduction strategy, our portfolio management approach is to decrease exposure to stocks as prices get expensive, and increase exposure as prices get cheap – buy low and sell high.

So start with a sound financial plan built on reasonable assumptions, implement a well-executed investment strategy, and then don’t worry about market gyrations.