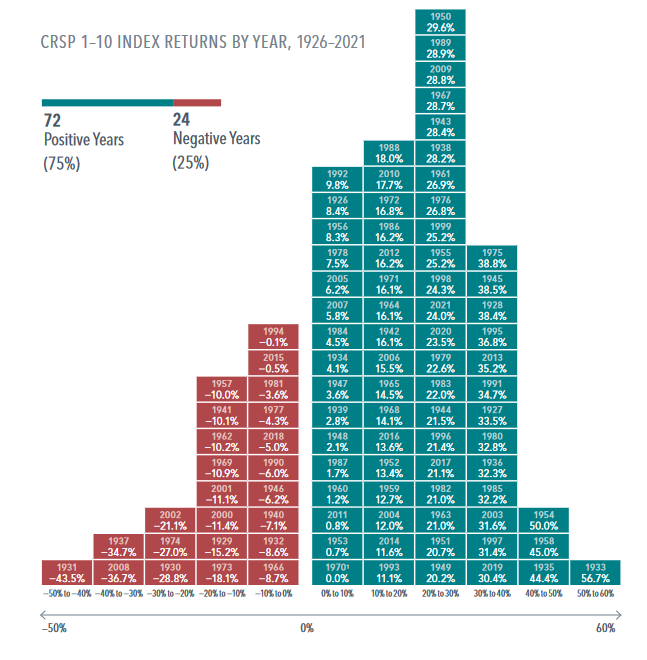

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in the US. That may be reassuring to investors, especially if they find market downturns unsettling.

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in the US. That may be reassuring to investors, especially if they find market downturns unsettling.

- The US stock market posted positive returns in 75% of the calendar years from 1926 through 2021.

- The market gained an annualized average of 10.2% during this period. Yet nearly two thirds of yearly observations were at least 10 percentage points above or below the average.

- Another noteworthy trend: More than two-thirds of the down years were followed by up years. The most recent example: a 5.0% loss in 2018 followed by a 30.4% gain in 2019.

The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

1. Return in 1970 was 0.002%.

Source: Dimensional.com, Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.