There has been quite a bit in the news lately regarding the United States government hitting the legal debt limit set at $14.3 trillion. The Treasury Secretary has sent a letter to Congress warning them that if they fail to act by August 2, there will be dire consequences associated with what would amount to the U.S. government defaulting on its obligations for the first time ever. Right now there is unwillingness in Washington to forge a compromise that would cost lawmakers political points with their constituents. The polarized atmosphere in our nation’s capital has caused Republicans and Democrats alike to dig in and wait until the other side blinks. The more extreme positions on both sides of the aisle are getting a lot of press, but it’s important to remember that the most appropriate and likely solution is somewhere in the middle.

Recently, Fitch Ratings became the latest ratings agency to issue warnings of impending downgrade on U.S. debt. A statement issued by Fitch’s warns that U.S. Treasury bonds would be rated as “junk” if the government misses any debt payments by August 15. However, we interpret this as a lack of confidence based on short-term political wrangling rather than the real issue of our long term fiscal position. Notice Fitch references the risk of “stalemate” leading to failure to raise the debt ceiling.

In other words they are afraid that in essence our government will choose to not pay its debt rather than the United States being unable to pay its debt.

Unfortunately, politicians are making hay by confusing two wholly separate financial problems- 1) the short term which is a high deficit caused by the worst recession since the Great Depression, and 2) the long term projection of US government debt.

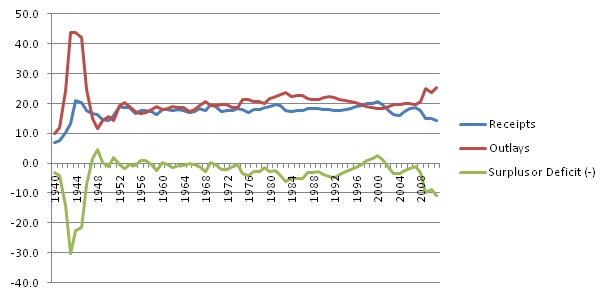

For the short term problem we fortunately have examples of two other episodes where we had large deficits- the 1940’s and the 1980’s. As you can see from the following chart, our current deficit is bigger than the 80’s but smaller than the 40’s. Not only did the country not collapse after those episodes, but we thrived.

Notice that in the 1980’s we saw both decreased revenues and increased spending just like now. Given that the 1980’s policies were successful in getting the economy going, it makes sense that we used Reaganomics on steroids to help pull us out of this deeper recession.

As for the long term, the fiscal problem is mostly about two issues: 1) the appropriate level of tax revenues going forward and 2) getting a handle on rising health care costs. We’ll be posting some additional blog posts to explain why these are not unsolvable problems.