Coronavirus concerns continue to impact the financial markets, as have all the numberless crises that have gone before it.

While the potential human and economic effects are very unsettling, what actions should a prudent investor take given this new development?

It remains impossible to predict when and how this problem will be resolved. Likewise, it is impossible to know when and how the markets will anticipate (or react to) such a resolution. We continue to evaluate all the available information to determine whether any change is necessary to your investment strategy.

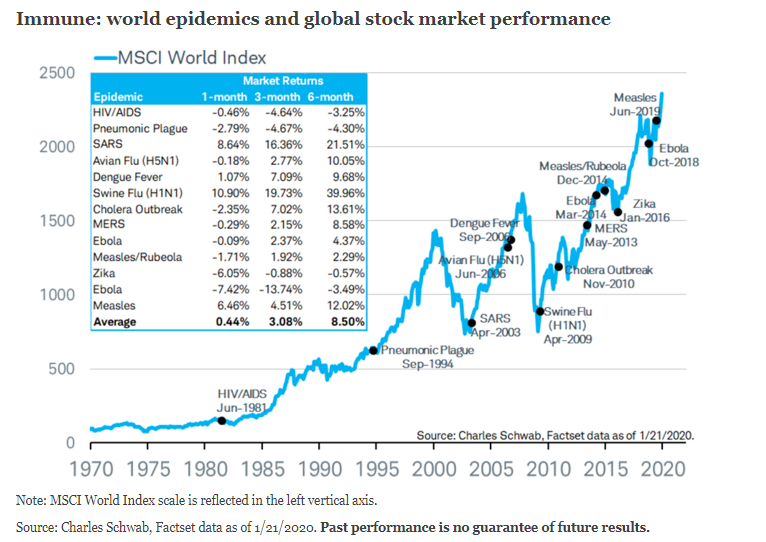

Below is a good graph from Charles Schwab of the history of past epidemics (13) over the last forty years. On average the markets have recovered well after the initial shock. Here is a link to the entire article.

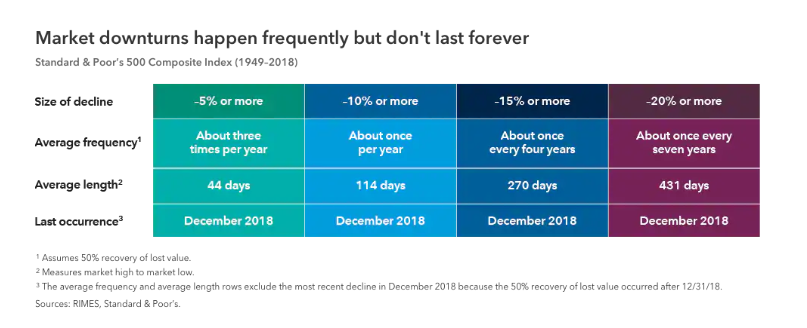

Market Declines Are Normal and Happen Frequently

Markets declines are a regular occurrence. Selloffs provide an opportunity for investors to absorb new information, squeeze out excesses and reset values to more attractive levels.

For existing retirees, we have set-up your portfolio to include 5-7 years’ worth of high quality bonds/cash to absorb market declines. For savers, market declines are great news as it allows you to buy stocks at lower prices through regular contributions.

We understand the desire to try to head off market declines by moving in to safety. However, our view is that the only way to capture the full permanent returns of equities is to ride out their temporary declines.

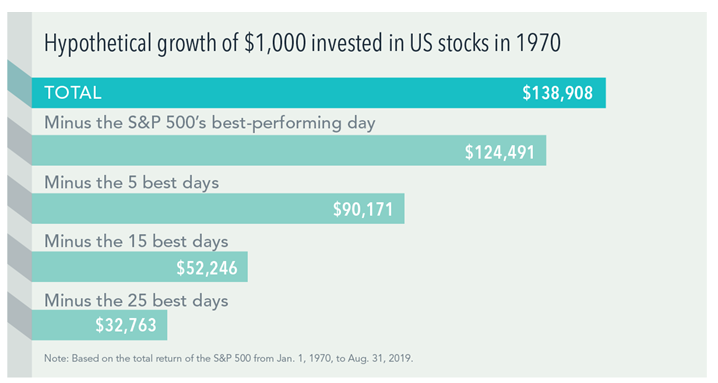

Beware of Timing the Market due to Coronavirus Concerns

The danger of trying to time the market is that you will sabotage your personal investment strategy by getting out at the wrong time and then compounding that by getting back in at the wrong time. See chart below.

Summary

- Fear is a natural reaction.

- It’s impossible to predict the future.

- There is always uncertainty in investing.

- Disciplined investing is hard.

- If you are feeling uncertain, review your financial plan before your portfolio.

Other Helpful Links

- Capital Group: Coronavirus Rattles Markets: What’s Next for Global Growth?

- Dimensional Fund: The Coronavirus and Market Declines

- Our Ebola commentary from 2014

- CNBC: Avoid this investing mistake as coronavirus fears grip the markets

- Episode 71: How to Ignore Stock Market Noise

- Episode 75: The Bear Market Survival Guide