Planning for Busy Professionals

Planning for Busy Professionals

- How much longer do you need to work, and how much can you spend now to meet your retirement goal?

- What’s the best way to pay for college for your children?

- What tax-saving strategies are available to you?

- Can they buy a beach house?

- What should they do with their various accounts, and how should they be invested?

The Situation

Bill and Susan are both busy professionals, and they have three children. They haven’t had the time to dedicate to their finances in the past, and now they are left with a lot of questions about how they can get their financial lives in order.

Questions to Answer

- How much longer do they need to work, and how much can they spend?

- What’s the best way to pay for college for their children?

- What tax-saving strategies are available to them?

- Can they buy a beach house?

- What should they do with their various accounts, and how should they be invested?

Planning

Some possible recommendations for this situation (depending on their personal circumstances) may include:

- A financial plan will help Bill and Susan determine how much longer they need to work, and how much money they can spend. We can run through different scenarios to see which has the best outcome for their situation.

- To pay for college for their children, Bill and Susan can invest in a 529 account (here’s a list of 7 ways that you can use a 529 account) or other options. In addition to investing in a 529 for their children, they may be eligible for a complicated tax strategy where they’d gift appreciated stock to them. This is a tax-saving strategy for Bill and Susan that they can implement, while still helping their children pay for college.

- A potential tax-saving strategy for Bill & Susan, given the new law, is to group charity contributions in certain years through a Donor Advised Fund. When contributing to a Donor Advised Fund, there is an income deduction up to 50% of adjusted gross income (AGI) for cash and 30% for publicly-traded securities. There is also no tax on investment income.

- When evaluating whether they can buy a beach house, a financial plan can help look at the long-term impact of this purchase and whether it is feasible.

- Bill and Susan have many different investment accounts spread across different custodians. To help simplify their financial lives, they can consolidate like accounts (you can read about the secrets of a successful 401k rollover in this blog post)

Implementation and Monitoring

- Implement a long-term disciplined investment strategy that includes the appropriate asset allocation, and asset location across all their investment accounts.

- Save time by making sure everything gets done, avoid missed opportunities or big mistakes.

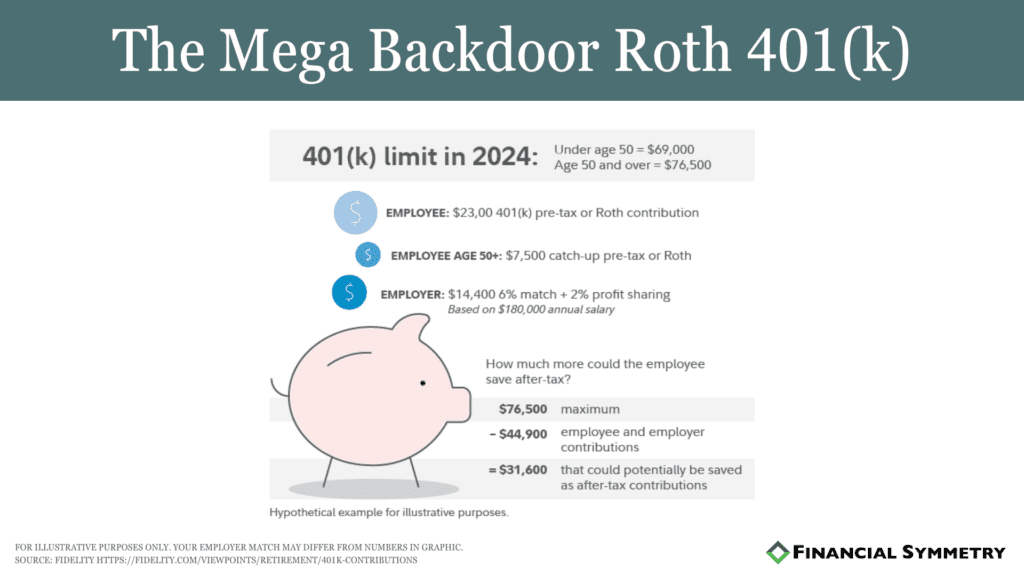

- Evaluate opportunities for Backdoor Roth and Mega-backdoor Roth. If your income for a married couple is over $203,000 then you are ineligible to contribute to a typical Roth IRA. Instead, you can implement the Backdoor Roth IRA strategy. But this strategy has multiple steps to assure it’s done correctly which we wrote about here. To be a good candidate for this strategy, you need to first move existing pretax accounts to an existing 401K, if you have one. The next step is to contribute $6000 to a regular non-deductible IRA. After completing this, you can convert the non-deductible IRA to a Roth IRA.

The Mega Backdoor Roth allows you to contribute much more and would be a provision of your 401k account. In order to take advantage of the Mega Backdoor Roth IRA, you first have to have access to a 401k that allows after-tax contributions. The Mega Backdoor Roth allows you to contribute up to $40.5k extra each year on top of your normal employee 401k contributions.