The Mega Backdoor Roth IRA could be the secret weapon you have yet to use in your retirement saving strategy. If you consider yourself a super saver, looking for alternative ways to save tax efficiently, this could be a great option.

This strategy is of most interest to those maxing out all other tax-efficient savings accounts. Including standard employee 401k contributions, Roth IRA, 529, and HSA.

In this episode, you’ll see why we call this the secret weapon for super savers, as we breakdown who the Mega Backdoor Roth is for, why you might be interested in it, and how it compares to other IRAs.

Who should take advantage of the Mega Backdoor Roth IRA?

In order to take advantage of the Mega Backdoor Roth IRA, you first have to have access to a 401k that allows after-tax contributions. These are contributions on top of your regular $19k allowable contributions to a 401k in 2019. Hence the “Mega” moniker.

So if you are already maxing out your 401K, Roth IRA, 529, and HSA contributions then the Mega Backdoor Roth IRA could be a great extra additional savings opportunity.

Many get confused as to why it’s called a Mega Backdoor Roth IRA when we are talking about your 401k. Good question. The name derives from where the money will be after you complete the consolidation process.

You’re now seeing more larger companies and solo 401ks allow for “in-service” distributions. Meaning, you could withdraw portions of your 401k savings, while still employed.

The real benefit with this savings strategy, is when you can save the extra after-tax contributions and then roll them to a Roth IRA in the same year. Meaning, you could get a larger amount in to a tax-free savings account to grow for years to come.

What’s so great about the Mega Backdoor Roth?

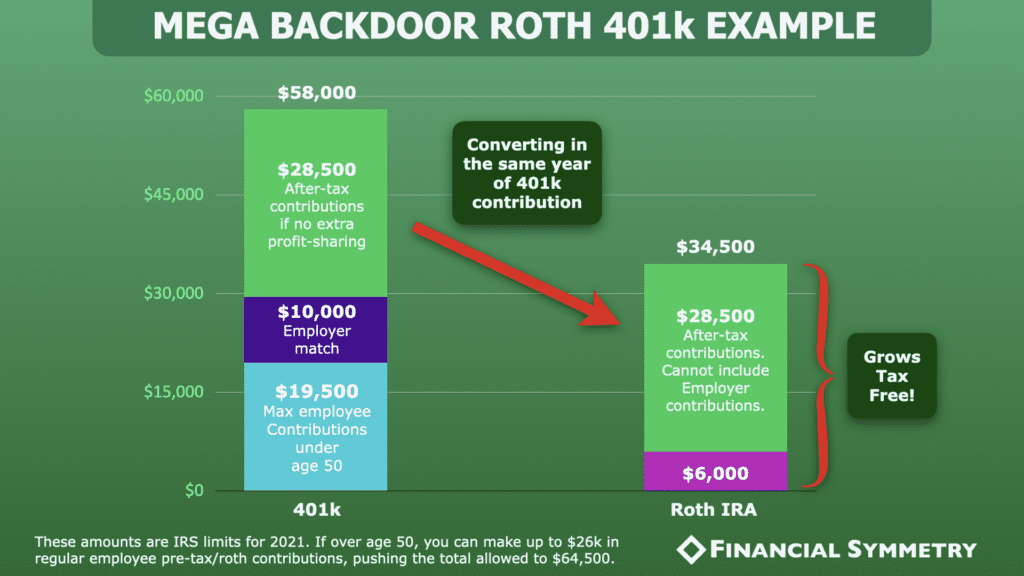

If done correctly, the Mega Backdoor Roth can allow you to contribute up to 6X what you can contribute to a regular Roth IRA. With a regular Roth IRA, you can contribute only $6,000 per year in 2021. The Mega Backdoor Roth allows you to contribute up to $38,500 extra each year on top of your normal employee 401k contributions.

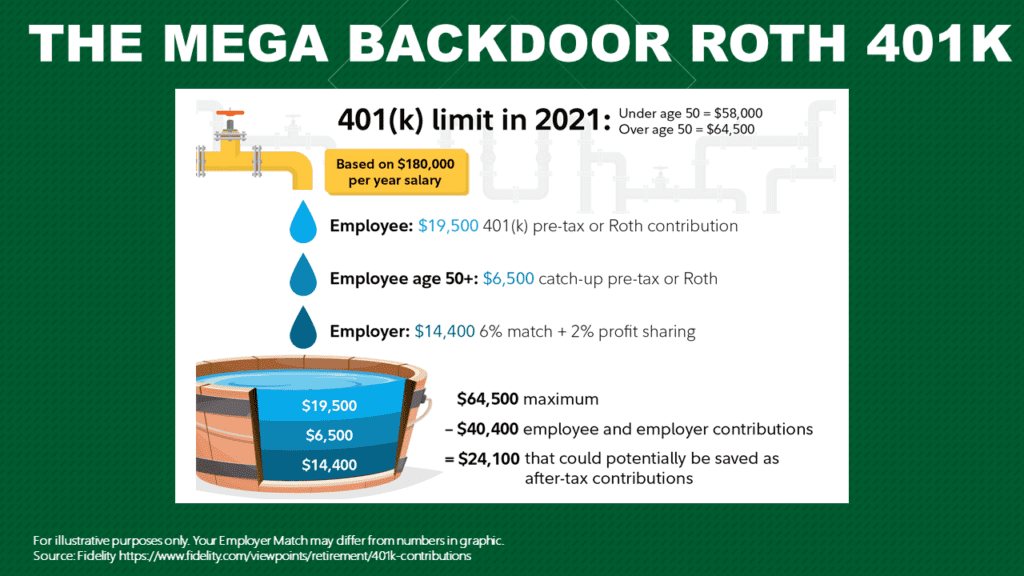

Many people don’t know this, but the limit for 401K contributions is $58,000 or $64,500 and for those over 50 in 2021. Many people assume that the limit is only $19,500. But this $19,500 limit is for pretax contributions. You can actually contribute up to $38,500 more after taxes are withheld (depending on your employer match amount).

You can ask your employer if they contribute to after-tax contributions. If you aren’t sure then you should contact your HR department. They may not even know about the Mega Backdoor Roth, but if you communicate with them you could get it started in your company.

What is the difference between the Mega Backdoor Roth and the regular backdoor Roth?

If your income for a married couple is over $208,000 in 2021, then you are ineligible to contribute to a typical Roth IRA. Instead, you can implement the Backdoor Roth IRA strategy. But this strategy has multiple steps to assure it’s done correctly which we wrote about in a previous post.

To be a good candidate for this strategy, you need to first move existing pretax accounts to an existing 401K, if you have one. The next step is to contribute $6,000 to a regular non-deductible IRA. After completing this, you can convert the non-deductible IRA to a Roth IRA. The issue with the Backdoor Roth is that you can only contribute $6,000 per year.

The Mega Backdoor Roth allows you to contribute much more and would be a provision of your 401k account. Essentially, it’s the amount above your normal employee contributions ($19.5k in 2021; or $26k if over age 50) plus your employer match contributions. It’s important to consider all of your options to see if the Mega Backdoor Roth is right for your circumstances.

Download the Pre-Retirement Checklist

Download the Pre-Retirement Checklist here to assure you are taking the steps you can now, to retire with confidence.

Outline of This Episode

- [2:27] Who is the Mega Backdoor Roth for?

- [4:31] What is the difference between the Mega Backdoor Roth and the regular backdoor Roth?

- [12:33] How do you know if you can take advantage of the Mega Backdoor Roth?

- [17:59] What are the risks?

Resources and Links Mentioned In Show

- Thecollegeinvestor.com Article – Understanding the Mega-Backdoor Roth IRA

- Morningstar.com Article – Heavy Savers, Meet the Mega-Backdoor Roth

- Article – High Earners Can Still Get into a Roth IRA

- Article – How to Start a Retirement Plan for Your Small Business

- Christine Benz, Morningstar Article – The Time is Right for After-tax 401k Contributions

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook