Will I really be better off paying you than I would be doing this on my own?

This is a valid question we frequently hear from planning clients who have enjoyed working with us on an hourly basis, but are hesitant to move forward with us on a continuous arrangement due to the ongoing costs associated with that service.

While multiple studies have shown that individuals with financial advisors are twice as likely to be on track to meet their retirement goals and the average investor consistently underperforms the funds they are invested in, consumers continue to be hesitant to pay for ongoing financial advice.

Who You Calling Average?

It could be that individuals prefer not to identify themselves as an average investor. After all, we are all above average drivers and better looking than most of our peers.

We also work with a lot of extremely smart, successful people-engineers, doctors, attorneys, etc. It can be hard to admit that abundant professional success in your particular field may not translate to managing money.

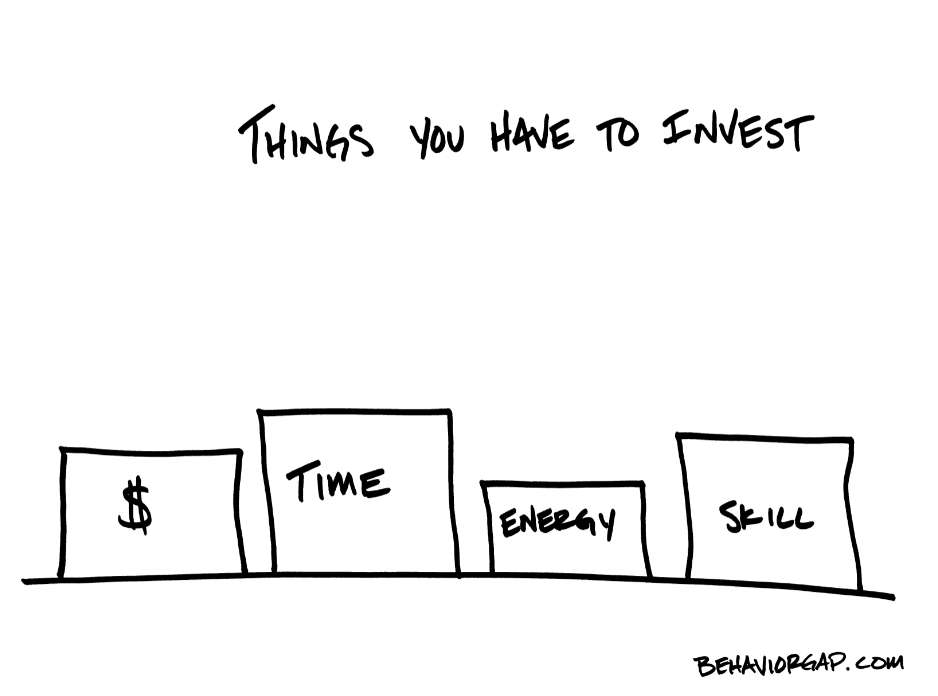

Time, Knowledge and Inclination

In order to be a successful investor over the long term it is essential to have the time, knowledge and inclination to implement your strategy consistently. We frequently work with clients who have one or two of these traits, but it is difficult to consistently implement without having all 3 as part of an ongoing process.

Compensation Confusion

The evolution of the financial services industry is likely to blame for consumer’s hesitation to pay for financial advice.

The advent of fee-only financial advisors is relatively new. Fee-only means we are paid solely by our clients; we receive no commissions or kickbacks from anything we recommend. This allows us to provide unbiased advice in the best interest of our clients with the utmost transparency. This also means you can regularly see how much you are paying for our advice in contrast to the broker or commission-based models where fees are mostly taken off the top in the form of higher expense ratios so it feels like you are “not paying anything for this.” Unfortunately, this service model does not uphold a fiduciary standard, meaning the advice may not be in your best interest.

How does your Investment Strategy Measure Up?

All that being said, how can you really tell if you are better off after paying a financial advisor than you would have otherwise been?

It can be tough to quantify, but the easiest solution is typically to look to investment performance.

- How have your returns been compared to a similar index?

- And which index should you use?

- The S&P 500, a 60/40 blend of stocks and bonds, maybe a Target Date Index Fund?

- And what time period should you evaluate?

Since strategies can fall in and out of favor it is important to evaluate returns over the long term, ideally periods of 10 years or more. In our 24-hour news cycle society, 10 years can feel like an eternity.

Enter a Financial Advisor

This is where advisors come in.

While we can’t promise to outperform the S&P 500 every year or guarantee a rate of return in your golden years, we can commit to maintaining a long term focus and helping you stay on track toward your goals. This commitment results in regular, scheduled attention to your financial situation. Which manifests in working continuously to identify new opportunities in the financial markets and tax code to help you build wealth over time.

I frequently compare it to paying for house cleaning, yard maintenance or a personal trainer, although those things are tougher to ignore when not done consistently. Our financial lives can more easily take a backseat in our busy lives and problems and opportunities can fly under the radar, limiting potential wealth over time.

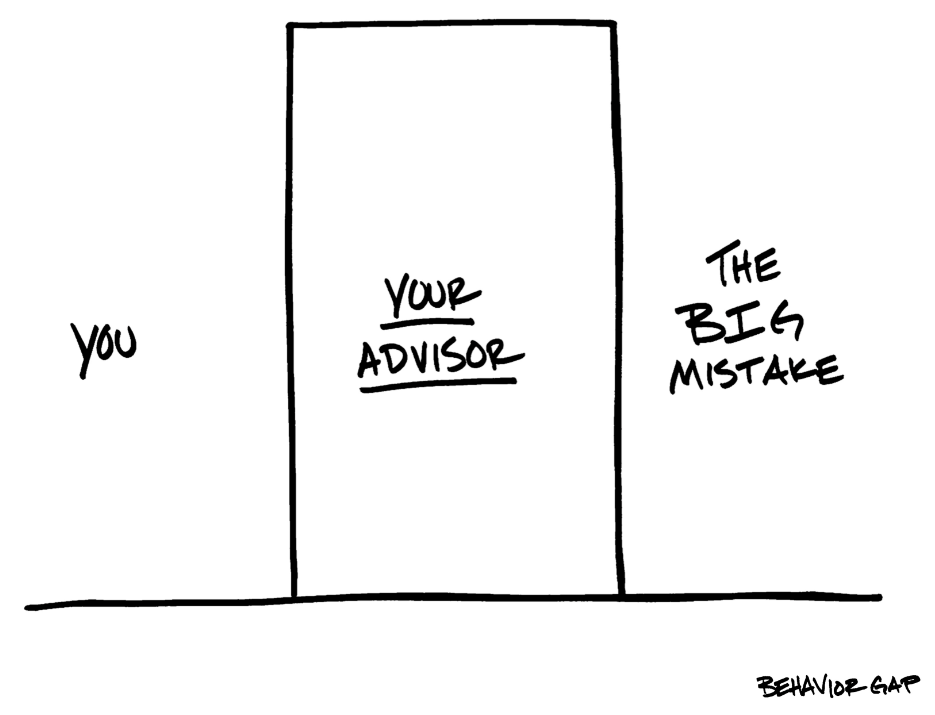

You could avoid paying financial advisor fees by constructing your own portfolio of low cost index funds or ETFs. The internet makes this part fairly easy. The hard part is staying on track and maintaining discipline over time.

Most investors also avoid the question, “what happens if I do a poor job on my own?” The likely result is you’ll need to work longer and/or spend less than planned. Therefore, many view a qualified fee-only financial planner as an insurance policy against their own mistakes or missed opportunities.

Value Outside of Investments

There are also multiple other ways we add value that have nothing to do with investment return, but increase wealth over time. Some examples of additional value we have provided for our clients are:

- Helping you stay invested and even add more to stocks through the financial crisis. While it’s been a while since we have seen a significant downturn in the markets we know how damaging running for the exits can be in a bear market. Working with a trusted advisor can help you stay the course in your investment strategy and earn the rewards of the next bull market.

- Correcting Cost Basis reporting on your Tax Return. We have seen many mistakes on tax returns from incorrect cost basis reporting of stock options to shares being listed at their original cost basis instead of the higher step up date of death basis for inherited shares. Identifying these errors can save you thousands in taxes.

- Roth Conversion correction on tax return saving you $4k. For many of our high income clients we recommend non-deductible IRA contributions/Roth conversions. This is a strategy we frequently see reported incorrectly on tax returns, resulting in over payment.

- Mortgage Terms/Options. Many times clients come to us with higher mortgage rates than the going rate. We’re also able to identify other buying opportunities than the standard 80/20 option. This can save not only thousands of dollars a year in interest costs, but may also help you avoid taxes and a 10% penalty on early retirement account distributions for a down payment.

- Social Security Claiming Strategies. Most retirees claim Social Security benefits at the earliest age possible, 62. However, unless you have significant health concerns, delaying Social Security benefits until age 67 or even 70 could literally add hundreds of thousands of dollars of income, increasing your lifetime purchasing power and overall financial health.

- Tax savings on Roth conversions/Realizing LTCG at 0%. Looking at a multi-year projection can reveal changes in your tax rate over time that can open the door for incredible tax savings. This is particularly true for clients who retire prior to full Social Security age. If you own stocks with significant unrealized gains, utilizing the 0% capital gains rate for taxpayers in the 10% and 15% brackets could save you $10k+/year in taxes. The same holds true for making Roth conversions at a lower tax rate now vs. your expected future tax bracket.

A Process vs. a Snapshot

Is it worth it to pay for advice? Price is what you pay, value is what you get.

The examples above demonstrate how just one of these strategies can easily be worth years of management fees. This is why we argue that paying for ongoing financial advice is not an expense, but an investment in your overall financial health.

After all, financial planning is an ongoing process, not a one-time project. The path toward your long term goals will not be a straight line, course corrections and adjustments along the way can ensure you meet your goals with your portfolio intact.