As Certified Financial Planners, an important part of our job is keeping our skills current through continuing education. Through membership with NAPFA we commit additional hours to education to keep our skills current and best serve our clients. To further these efforts I recently attended the 2015 NAPFA Fall Conference in Indianapolis.

As Certified Financial Planners, an important part of our job is keeping our skills current through continuing education. Through membership with NAPFA we commit additional hours to education to keep our skills current and best serve our clients. To further these efforts I recently attended the 2015 NAPFA Fall Conference in Indianapolis.

NAPFA conferences gather many prominent financial advisors and thought leaders in the industry in an effort to foster open communication and collaboration. The content and connections exceeded my expectations and provided valuable insights. As I organize my thoughts and share them with the FSI Team I wanted to share my 5 favorite messages:

1. Leaders create the space for others to move up the ladder

In his keynote speech David Marquet, author of “Turn the Ship Around!,” drew on his experience leading the USS Santa Fe. He emphasized that leaders get people to think, not do; and detailed tools to create an intention based organization with passionate and engaged people. Some of the tools we have been implementing at FSI and others were learned that we can use to better support both clients and staff.

2. We’re better together

Speaker Meredith Jones noted that the finance industry is “male, pale, and stale.” This quick, funny quote pointed out the predominance of men in the finance industry and the lack of diversity. She went on to describe advantages women bring to the field of investing and encouraged us to continue growing the number of women in the industry.

I also sat in on a panel about incorporating gender diversity at your firm. The panel noted that while the number of women in the industry is increasing, many firms are composed of either all male or all female employees. There is growing recognition that a diverse team allows for the best ideas and most comprehensive service to clients. Implementing gender diversity requires trust, respect, transparency and accountability.

3. “Be intentional about your priorities, live those priorities every day”

In a session on Work/Life Balance, Stacy Francis, CFP® shared this quote. The session focused on prioritizing and making the most of your time, both in and out of the office. As the mother of two young children this is something I am always trying to improve upon. Lately I am becoming more conscious of how I am spending my time and what activities are most productive and meaningful both personally and professionally.

The sentiment can also be applied to financial goals and I think it is particularly poignant as we transition into the holiday season when most of us have a tendency to overspend. Each time I pull out my wallet this holiday season I plan to ask myself, “is this purchase in line with my personal and financial goals?” Allocation of resources, both time and money, should always be a top consideration in any wealth building or preservation strategy.

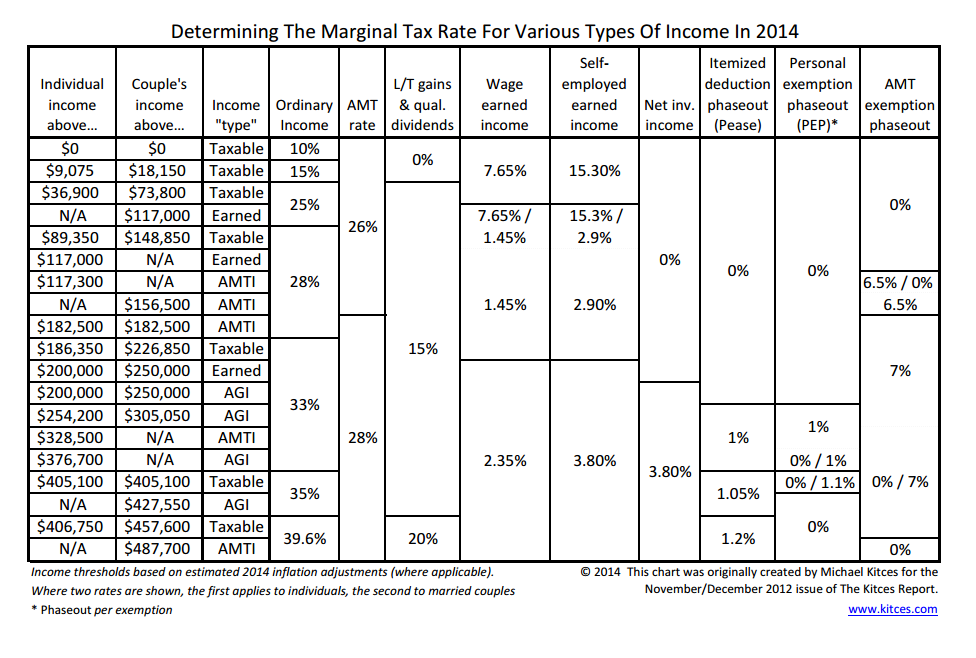

4. Tax Bracket Arbitrage-smoothing income over time at the lowest possible rate

Michael Kitces is a thought leader in the financial planning industry and always creates great content for keeping our skills current. His session on tax planning discussed specific strategies to lower the total taxes paid over your lifetime. Making use of these strategies can literally save you tens of thousands of dollars, but they require a working knowledge of the tax breakpoints as detailed in the chart below and a multi-year forecast of your overall financial situation. Contact us to find out if there are additional tax savings available to you.

5. Best in Class Technology + Best in Class Advice = Happy Clients

In a keynote session on “Going Digital,” Craig Cintron, CFP® addressed the risks and opportunities that new technology brings to financial planning. We are constantly evaluating new technology to better serve our clients. Over the past 10 years our process has changed dramatically from doing reviews primarily on paper to almost entirely digital. The tools available to us also continue to grow and change. We have implemented several new systems over the past several years and we will be rolling out a few new exciting changes in the coming year that we look forward to sharing with you. Our goal with new software and technology implementation is always to simplify and provide the most meaningful information possible.