This is the second post in our “What I Wish I Knew About Money as a Teen” series.

If you’ve ever wondered why your money seems to run out so fast, you’re not alone. Whether you’re just starting your first job or are still getting an allowance, learning how to budget and build an emergency savings fund is one of the best ways to care for your future self.

Let’s break it down.

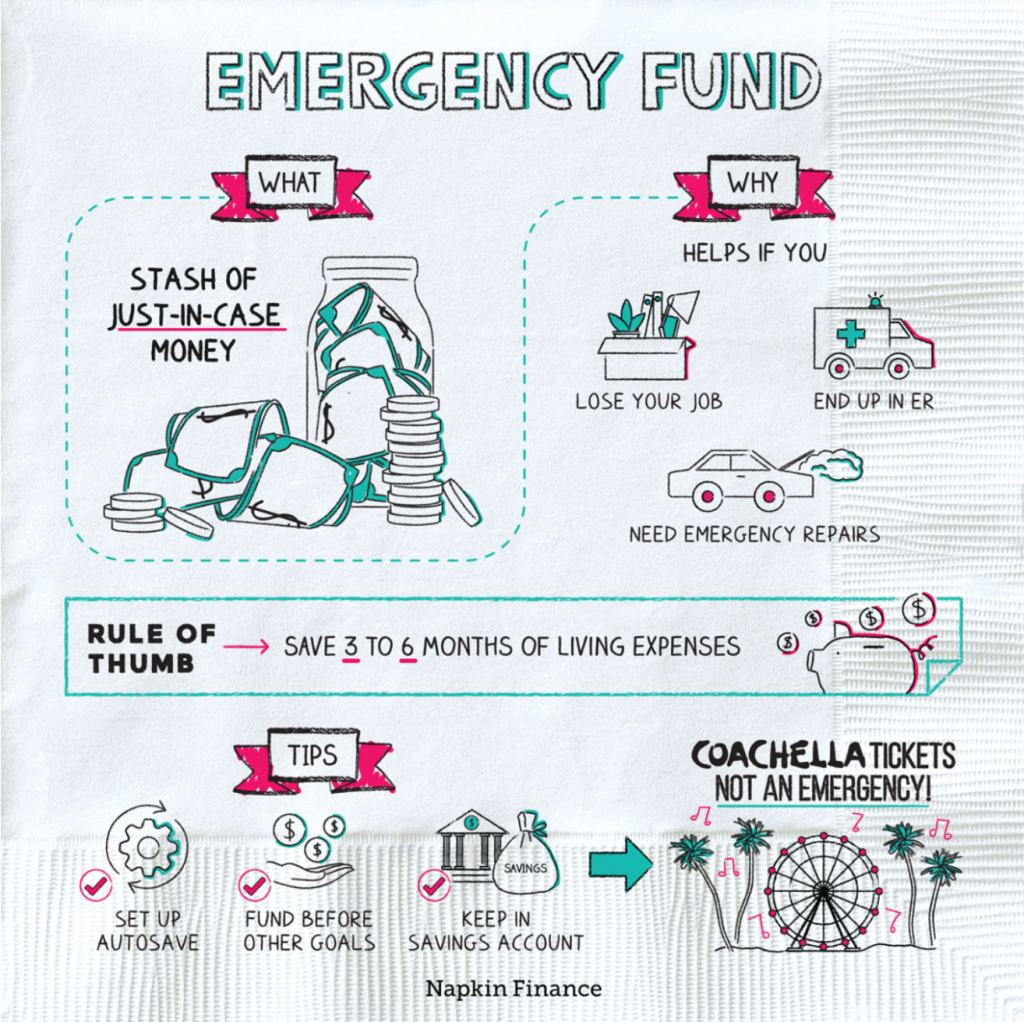

What Is an Emergency Fund?

An emergency fund is exactly what it sounds like: money you set aside for life’s unexpected curveballs. Think of a broken phone, a surprise vet bill, or replacing your favorite pair of headphones.

How Much Should You Save?

A full emergency fund usually covers 3–6 months of essential expenses, but even 1 month goes a long way. That might include:

- Rent and utilities

- Groceries

- Transportation (gas, insurance, bus fare)

- Cell phone and internet

- Loan or credit card payments

If you’re living at home and don’t have many bills, that’s okay. Your “essentials” list will simply be shorter. This can be a good time for you to make a list of what you would like covered in the future.

It’s not about saving a huge amount all at once; it’s about building good habits.

Source: https://napkinfinance.com/napkin/emergency-fund/

Where Should You Keep It?

You’ll want to keep your emergency fund somewhere safe but still accessible, and where it can earn a little interest.

A high-yield savings account is a great option. These accounts, often offered by online banks like Marcus by Goldman Sachs or Ally Bank, will help your money grow a bit on its own until you need it.

The most important thing when selecting a high-yield savings account is to make sure there are no monthly fees or minimum balance requirements to keep the account open.

What If You’re Not Making a Lot of Money?

This comes up a lot: “I only make $50 or $100 a month. Should I even bother saving?”

The answer is yes! Even saving $20 a month adds up, and more importantly, it helps you build the habit of setting money aside. You don’t have to be perfect. Just be consistent.

“Every dollar of savings buys a claim check on the future.” –Warren Buffett

When you save, you’re also building financial independence.

How to Budget: Where Does All My Money Go?

Once you’ve started saving, the next step is figuring out how to stop your money from disappearing without a trace.

That’s where learning how to budget comes in.

Budgeting is not about being strict or telling yourself “no” all the time; it’s about being aware and knowing where your money is going so you can decide if it’s truly going to where you want.

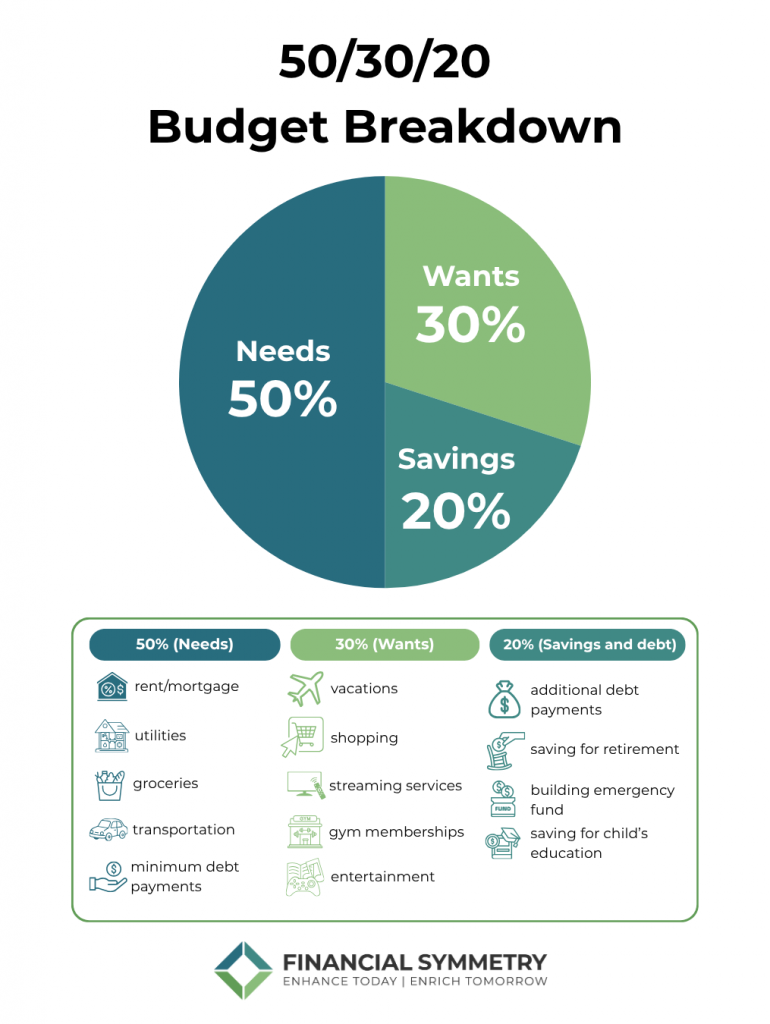

Try the 50/30/20 Rule

This is a simple budgeting framework that works with any income level.

If you earn $500 a month, you’d divide it like this:

- $250 (50%) for Needs – things like rent, transportation, phone bill, groceries

- $150 (30%) for Wants – the fun stuff: dining out, shopping, entertainment

- $100 (20%) for Savings – like your emergency fund or saving for something bigger

You can adjust the percentages based on your situation. The goal is just to give every dollar a purpose and to start noticing patterns in your spending.

You’ll know your budget is helping you when:

- You can name how much money is coming in and where it’s going.

- You’re making progress toward a goal, like building your emergency fund or saving for your first car.

- You feel less stressed when surprise expenses come up because you’re prepared.

Take One Step Today

If you’re ready to start, here’s what you can do:

- Open a high-yield savings account (or ask a parent to help if you’re under 18).

- Save your first $20. If you’re working, consider automatically saving $20 each paycheck.

- Track your spending for a week using a budgeting app or a simple budget spreadsheet.

Coming Next in the Series:

In our next “What I Wish I Knew About Money as a Teen” blog post and podcast, we’ll talk about debt and building credit, what to know, what to avoid, and how to start on the right foot.