As we look ahead to 2026, the IRS has released updated retirement account contribution limits. These annual adjustments are more than simple housekeeping. They shape how much you can save, how efficiently you can build wealth, and how well you can take advantage of tax-favored growth.

Staying on top of these changes is especially important for anyone approaching retirement. The final working years often provide the greatest opportunity to boost savings, and maximizing contributions during this period can make a meaningful difference in your long-term financial picture. If you are already contributing the maximum and plan to continue doing so, understanding the new limits ensures you do not miss out on additional savings or inadvertently exceed the IRS limits.

Key Updates to Review Before Year-End

Before you finalize your year-end planning, take time to review the major changes for 2026 so you can enter the new year with your strategy aligned and your contributions properly set.

Standard Retirement Account Contribution Limits

The IRS updates contribution limits for accounts such as 401ks, 403bs, and IRAs each year. These limits vary depending on your age because tax law provides additional opportunities for individuals nearing retirement.

Catch-Up Contributions and Age-Based Rules

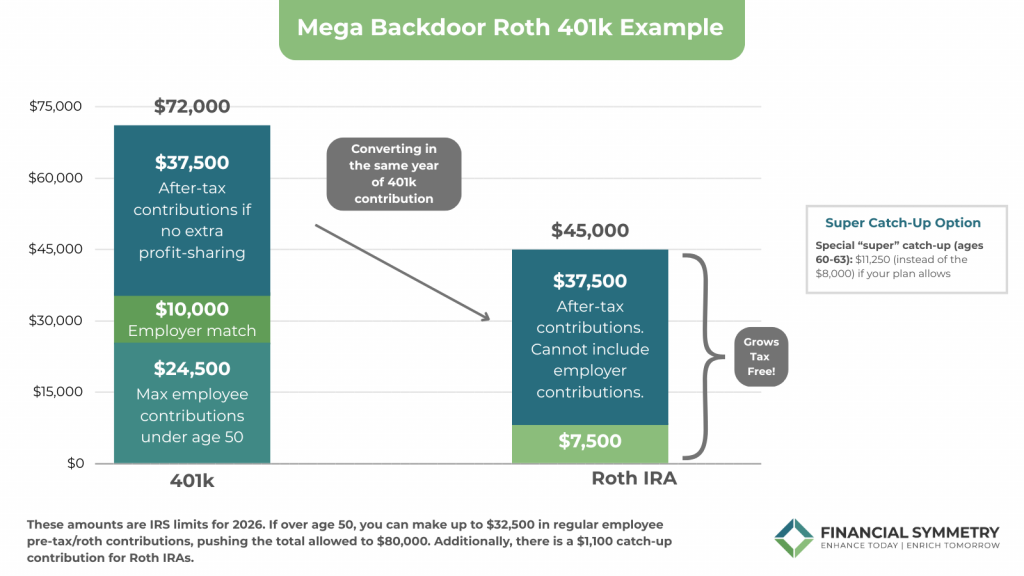

Under the SECURE Act 2.0, individuals age 60 to 63 are now eligible for a special category of increased contributions often referred to as the “super catch-up” within 401k, 403bs, 457bs, and Thrift Savings Plan. This provision allows workers in this age range to save more than the standard catch-up amount of $8,000, giving those close to retirement an extra boost in their final saving years.

Important New Rule for High-Income Earners

One of the most significant updates involves how catch-up contributions must be made for high-income individuals. Beginning in 2026, if your FICA wages in 2025 exceed $150,000, all catch-up contributions must be made in Roth dollars. Pre-tax catch-up contributions will no longer be permitted for these taxpayers.

This change still allows you to save more within your employer plan, but it removes the immediate tax savings benefit of making these contributions on a pre-tax basis. The upside is that Roth contributions grow tax-free and can be withdrawn tax-free in retirement, which may benefit long-term planning depending on your situation.

It is important to confirm that your employer plan allows employees to make Roth contributions. If your plan does not permit Roth contributions, you will not be eligible to make any catch-up contributions under the new rules.

Maximum Individual 401k, 403b, 457b, & TSP Contribution Limits 2026 with SECURE Act 2.0 Updates

| Individuals 50 & Under | Individuals 50+ OR 64+ | Individuals Age 60-63 |

|---|---|---|

| Standard contribution: $24,500 | Standard contribution: $24,500 | Standard contribution: $24,500 |

| Standard catch-up: $8,000 | ||

| Super catch-up: $11,250 | ||

| Total Employee: $24,500 | Total Employee: $32,500 | Total Employee: $35,750 |

Note: The amount that you can contribute between employee + employer contributions is set at $72,000 for 2026 (if you are under age 50). If over age 50, the employee + employer contribution limit is $80,000.

Depending on your employer’s plan provisions, the gap between your employee (pre-tax or Roth) + employer contributions and the annual maximum limit may provide room to execute the Mega Backdoor Roth strategy to increase your after-tax savings, which you can read about more here, and can find a chart explaining this strategy below.

Below, you will find a detailed breakdown of how contribution limits are changing from 2025 to 2026. Use this as a year-end checklist to ensure your accounts are up to date and that you are taking full advantage of every available savings opportunity. Staying aligned with the new limits is a simple but important step toward building your strongest financial future.

If you have questions or want to explore how these updates fit into your tax planning and long-term goals, our team is here to help. Scheduling a meeting with one of our financial experts can give you clarity, uncover blind spots, and help you make confident decisions for the year ahead.

Wishing you a prosperous New Year!

| Account Type | 2025 Limit | 2026 Limit | Notes |

|---|---|---|---|

| 401k / 403b / 457b Employee Contribution | $23,500 | $24,500 | Standard contribution limit for employees under age 50. |

| 401k / 403b / 457b Catch-Up (Age 50+) | $7,500 | $8,000 | Additional amount on top of the standard limit. |

| 401k / 403b / 457b Total Possible (Age 50+) | $31,000 | $32,500 | Combined standard plus catch-up. |

| Super Catch-Up (Age 60–63) | $10,000 | $11,250 | Available only if your plan allows this SECURE Act 2.0 enhancement. |

| Total Possible with Super Catch-Up (Age 60–63) | $33,500 | $35,750 | Maximum employee contribution for eligible ages. |

| Total Employee + Employer Contribution Cap | $69,000 | $72,000 | Overall limit for combined contributions. |

| IRA Contribution (Under 50) | $7,000 | $7,500 | Traditional or Roth IRA; subject to income phaseouts. |

| IRA Catch-Up (Age 50+) | $1,000 | $1,100 | Fixed by statute, not indexed to inflation. |

| IRA Total Possible (Age 50+) | $8,000 | $8,600 | Combined standard plus catch-up for IRA savers. |

| SIMPLE IRA Contribution* | $16,000 | $17,000 (or $18,100 in certain plans) | Limits vary depending on plan structure. |

| SIMPLE IRA Catch-Up (Age 50+) | $3,500 | $4,000 | Standard catch-up for SIMPLE plans. |

| SIMPLE Super Catch-Up (Age 60–63) | $5,000 | $5,250 | Applies only if the plan permits it. |

*Learn more about additional SIMPLE Rules here.

References: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500