Do you ever ask yourself, “At what age can I retire?” Or, “Am I saving enough to help pay for my child’s college education or buy a new home?”

These are financial goals and the best way to answer these questions is a financial plan.

Did you know approximately 39% of US adults have ZERO non-retirement savings? And even worse approximately 50% of Americans with children do not have a Will.(1)

What’s keeping you from getting a financial plan?

Many people feel that they must be rich before they can make a financial plan, but the reality is the path to increased wealth starts with a financial plan. Research has shown that those who plan for the future end up with more wealth than those who do not.

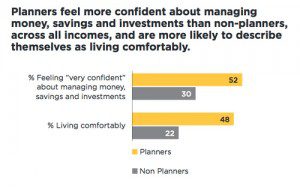

This is further illustrated in a recent CFP® board survey which found that 52% of those with a plan feel “very confident” about managing money while 30% of those without it. (2)

Benefits of a comprehensive financial plan include

-

- Establishing realistic and attainable short-term and long-term goals (retirement, college savings, etc.)

- Helping you find ways to maximize your money (401k, Roth IRA, debt management, etc.)

- Correcting missed money opportunities (Roth IRA contributions)

- Risk management for life’s unexpected events (life insurance, estate documents, etc.)

- Helping maximize tax efficiency

- Simplifying your financial life (consolidating your bank, investment or credit card accounts)

And a completed plan can actually measure your success in obtaining your financial goals

And a completed plan can actually measure your success in obtaining your financial goals

We recommend working with a fee-only financial planner in preparing your financial plan, you can be assured that the advice is independent and objective.

Often, the cost of a financial plan is almost always offset by the savings found throughout the process. Also, you should look at this fee as an investment in your future.

Sources:

- https://www.napfa.org/financial-planning

- http://www.cfp.net/docs/for-cfp-pros—public-awareness-campaign-toolkit/2012-household-financial-planning-survey-summary.pdf