What do gold, cryptocurrencies like Bitcoin (BTC), paintings, furs and diamonds all have in common? Things you’ve seen on a “Real Housewives” episode, you say? Maybe so, but here’s what we had in mind.

Each is an asset that produces no cash flow. They’re like buying a goose that lays no eggs.

Unlike stocks and bonds, whose prices are directly linked to the earnings or income they are expected to generate in the future, the prices of assets with no cash flow are determined by the forces of supply and demand. If demand for the asset exceeds its available supply, the price will go up. Ultimately, prices reflect what the market will bear — what buyers are willing to pay and what sellers are willing to take.

If you remember the Tickle Me Elmo and Beanie Babies craze in the ’90s, then you’ve seen these mechanics of supply and demand at play. After selling out at retailers, these plushy, stuffed animal figures sold secondhand for thousands of U.S. dollars (USD). Limited supply and high demand sent prices soaring just for the right to hold one. Today, you can pick up a brand-new Tickle Me Elmo for less than $50.

However, stuffed animals and gold aren’t the same in the eyes of most investors. Gold is often perceived as a diversifier, an expected hedge against inflation, or a safe haven for the fearful to park their cash. This article examines why so many seem to be interested in the “yellow stuff” these days and what investors need to know for their portfolios.

Why All the Talk About Gold Lately?

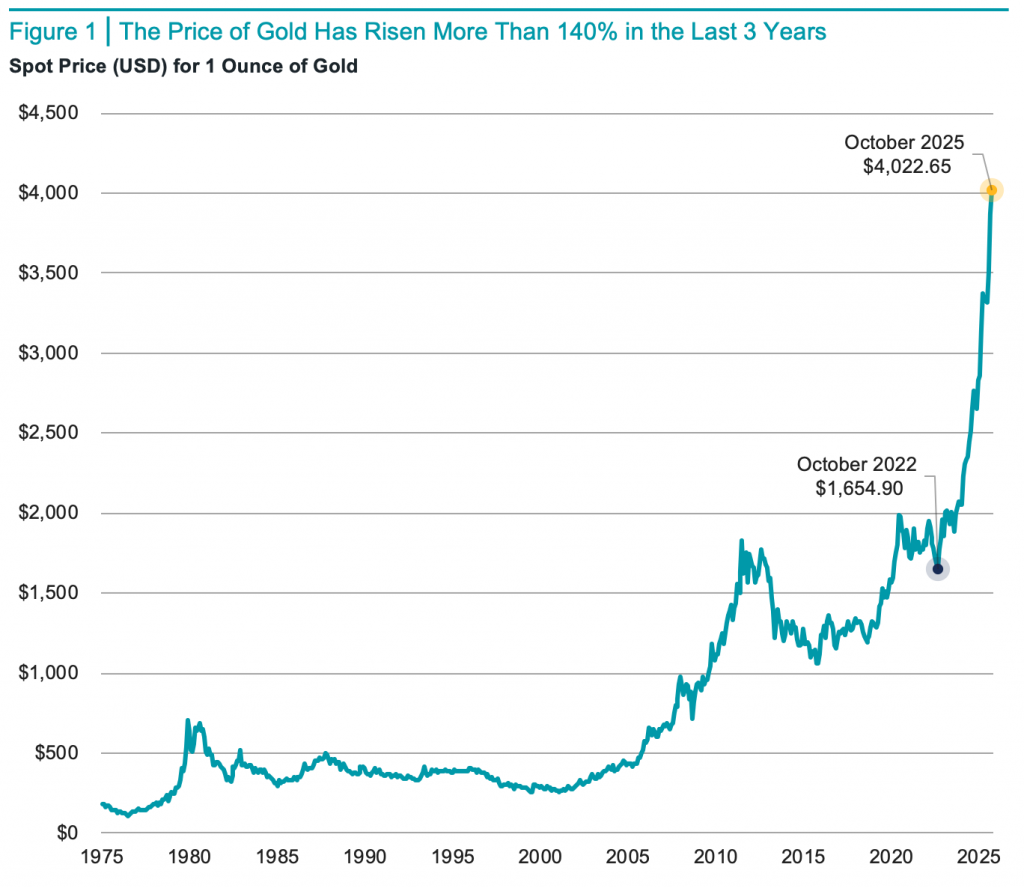

If you look at the recent returns from gold, it’s easy to see why it’s caught investors’ attention. Figure 1 shows the spot price of an ounce of gold in USD since 1975, after gold futures contracts began trading. There’s a noticeable spike in the price in the last few years.

At the start of October 2022, 1 ounce of gold was worth about $1,655. By the end of October 2025, that same ounce of gold was valued at about $4,023, representing a 143% cumulative gain in just three years.

Why Has the Price of Gold Gone Up?

As previously mentioned, the price of gold increases when demand exceeds supply. But what can we say about the factors driving demand, and what do we know about supply?

Let’s start with supply, which is inelastic for gold. When supply is elastic, it will rise with prices to meet heightened demand. However, the supply of gold doesn’t function in this way because gold is a finite resource that is time-consuming to mine. Each year, the increase in the gold supply remains relatively small, regardless of the fluctuations in its price.

For example, in 2024, global gold production represented an increase of less than 2% in total supply. As a result, the price of gold tends to be highly sensitive to changes in demand.

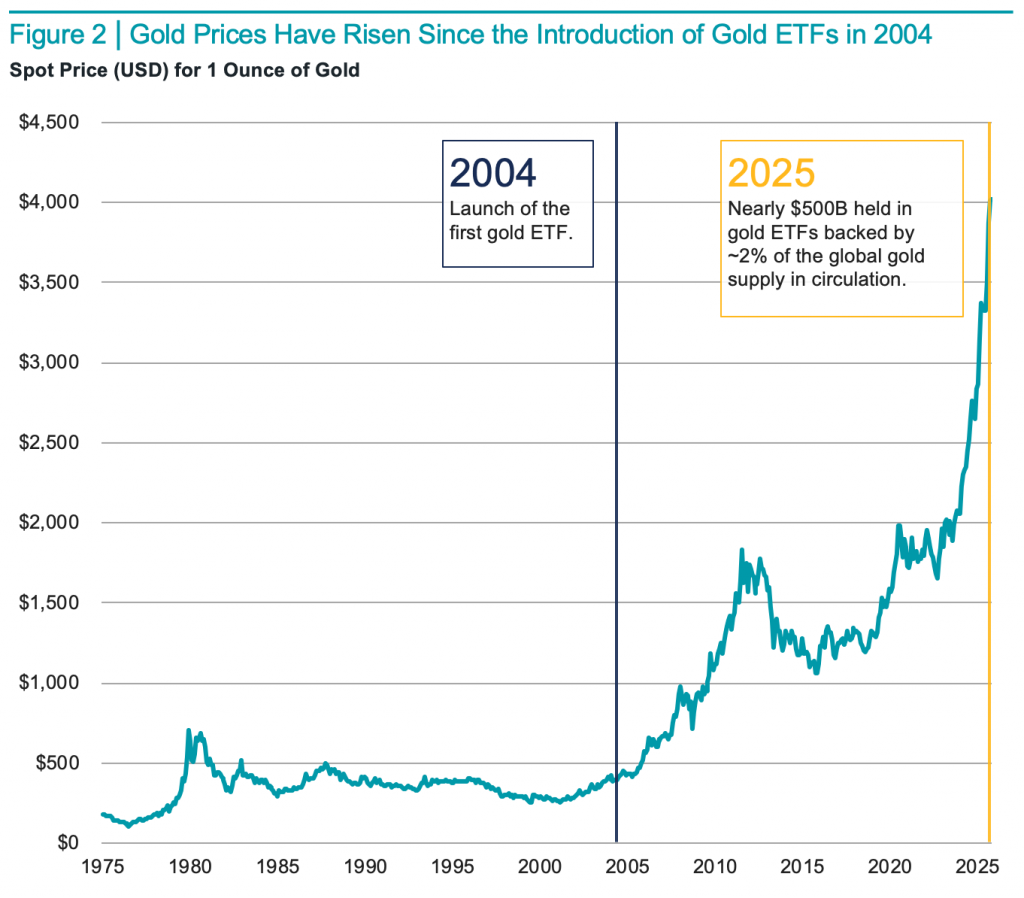

On the demand side, researchers have identified a few effects that may have contributed to higher demand and prices for gold in past years.1 In 2004, the world’s first exchange-traded fund (ETF) backed by physical gold was launched. Before then, buying gold typically meant purchasing and storing it yourself. This wasn’t desirable for many investors and likely left some demand unmet. Gold ETFs appear to have provided a convenient outlet for this pent-up demand for gold.

In Figure 2, we revisit the gold price data from Figure 1 to highlight the point in time when gold ETFs first became available. The subsequent price increases don’t confirm causality, but it’s plausible that demand taken up by gold ETFs has played a role.

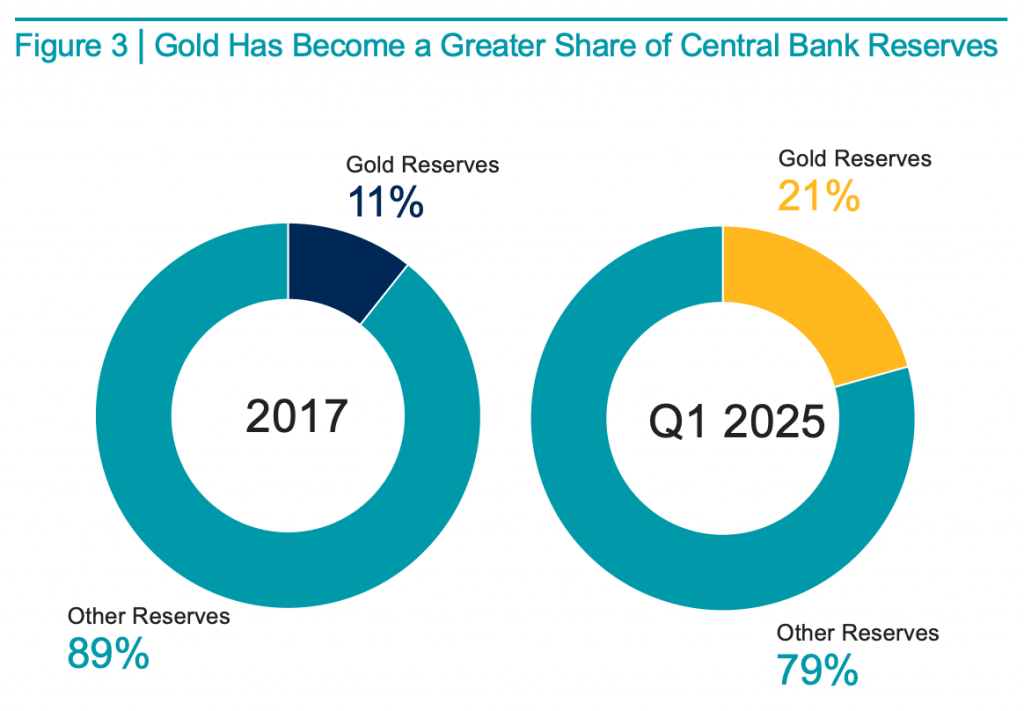

Another potential contributor to gold demand has come from central banks. According to the International Monetary Fund, central banks have added more than 2,000 metric tons of gold to reserve assets since 2017. This represents more than 1% of the world’s in-circulation gold supply. Coupled with rising prices, the share of gold in global central bank reserves has increased significantly over this period, as shown in Figure 3.

While some have suggested that non-U.S. economies have been “de-dollarizing,” buying gold to diversify reserves heavily held in USD, recent Federal Reserve (Fed) research sheds some doubt on this theory.2

The Fed study found that 62 countries increased their gold reserves between 2008 and 2023, but only a few of them clearly reduced USD reserves while increasing gold reserves — specifically China, Russia and Turkey. For about half of the remaining countries, increases in gold weren’t found to come at the expense of USD reserves. For the other half, there wasn’t enough public data to draw a conclusion. The USD remains the global reserve currency, accounting for approximately 60% of all reserves, and it is also still China’s largest reserve currency.

What about investors who are chasing hot returns driven by the fear of missing out (FOMO), or fearful investors buying gold as a perceived safe haven? Both could also play some role in the recent demand. Regardless of the source, it all adds up.

What Might We Expect from Gold Returns in the Future?

Well, no one knows for sure, but the work of researchers Erb and Harvey again provides useful context, both from historical and theoretical perspectives. They conclude that over the last 2,500 years, gold has roughly maintained its value after accounting for inflation.

For example, they find that the wages paid in gold to ancient Roman military officers are about the same as the amount of gold U.S. Army captains could purchase with their full annual salaries today. This suggests that, over the very long term, gold has generated a zero real return.

In the short term, however, gold is volatile and at times yields positive real returns, while at other times negative real returns. This is consistent with what you would expect from an asset whose prices fluctuate solely in response to changes in supply and demand.

Their findings imply another important takeaway. If the expected real return of gold is zero, it is reasonable to expect that returns for gold going forward will be lower after a period during which gold prices rise much faster than inflation. This is similar to stocks trading at elevated valuations. The higher prices suggest lower expected returns than when prices were lower.

But just like stocks whose prices and valuations can stay high for long periods, the same can happen with gold. If strong demand for gold persists, we may continue to see the price go up, even if it’s already high. However, when demand drops because investors believe the price is no longer worth it or for other reasons, we can expect the price to fall.

So, Should Gold Have a Role in Diversified Investor Portfolios?

Some say yes, and some say no. Warren Buffett has long been in the “no” camp, describing gold as an “unproductive” asset because it doesn’t create anything of value or generate income. He compares buying gold and hoping someone will pay more for it later to gambling rather than investing.

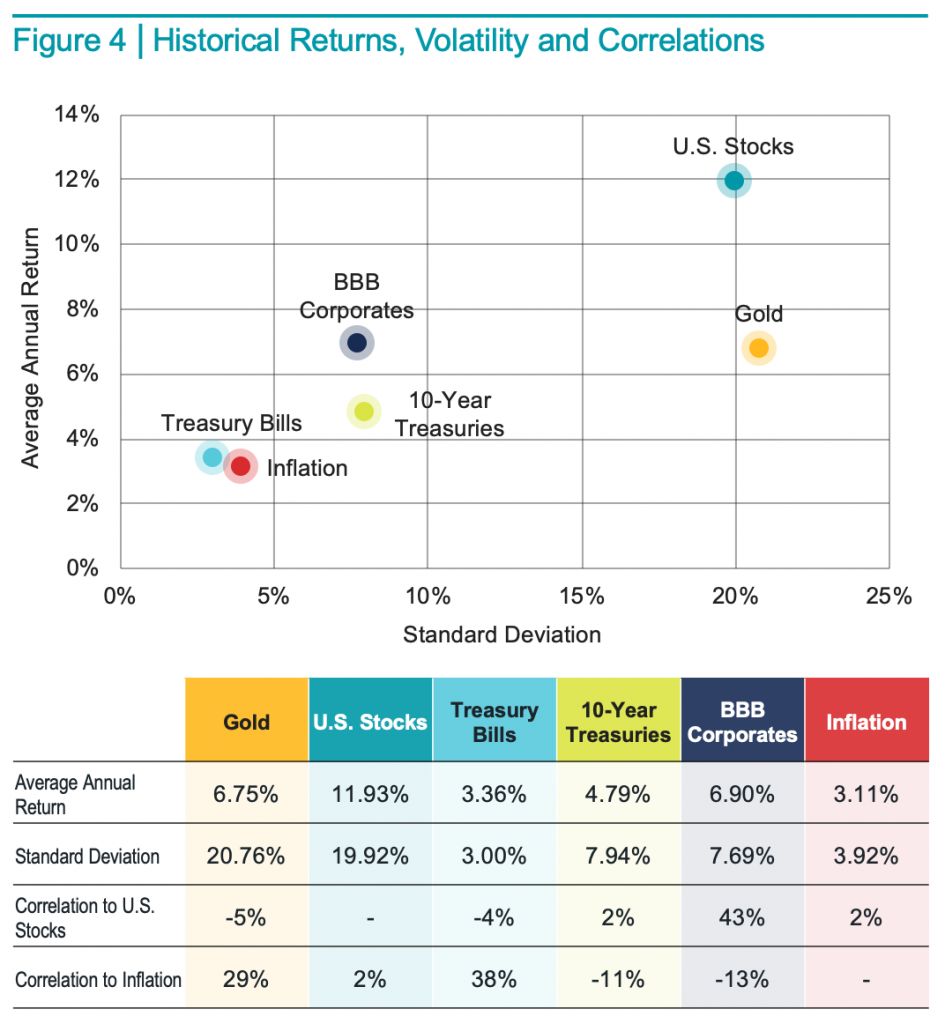

However, that’s just one person’s opinion, so let’s look at the data for a more objective context. In Figure 4, we present an analysis based on annual returns from 1928 to 2024 for gold and other common asset classes in investor portfolios, including stocks and bonds.

There are several key takeaways. Gold hasn’t had a zero real return in at least the last 96 years. However, its 6.75% nominal average annual return amounts to less than 4% after accounting for inflation. That’s less than half the real return of U.S. stocks but with higher yearly volatility (standard deviation). BBB-rated corporate bonds, compared to gold, have provided a slightly higher average return with less than half the volatility.

Nominal return is the percentage gain or loss on an investment without adjusting for inflation.

Real return is the nominal return minus inflation, showing how much your money grew in terms of purchasing power.

Gold has exhibited near-zero correlation to U.S. stocks but so have Treasuries over the long term. When paired with equities, both have historically tended to help buffer overall portfolio results when equity markets perform poorly, but bonds have achieved this with significantly lower volatility.

Nothing is guaranteed, of course. Most bond asset classes didn’t provide a positive return when equities declined in 2022, but gold also doesn’t have a perfect track record of rising when stocks fall.

As an inflation hedge, the effectiveness of gold is also questionable. There is some positive correlation, but gold’s much higher volatility compared to inflation makes it an imperfect hedge at best.

What’s the Goal?

There may be reasonable uses for gold in investor portfolios; however, there might be potentially better options to help achieve an investor’s goals. Importantly, that’s what matters for any investor considering gold as a holding: What’s the goal? Only after this is clear can you determine if it makes sense for you.

That assessment is crucial. As anyone who hoarded Beanie Babies and saw their prices plummet may attest, simply buying any asset because others have recently had success with it is never advisable. In our view, that’s just gambling, not investing.

End Notes

- Claude B. Erb and Campbell R. Harvey, “Understanding Gold,” October 7, 2025. Available at SSRN.

- Colin Weiss, “De-Dollarization? Diversification? Exploring Central Bank Gold Purchases and the Dollar’s Role in International Reserves,” International Finance Discussion Papers, Board of Governors of the Federal Reserve, September 2025.

Source: Avantis Investors is an investment advisor registered with the Securities and Exchange Commission.