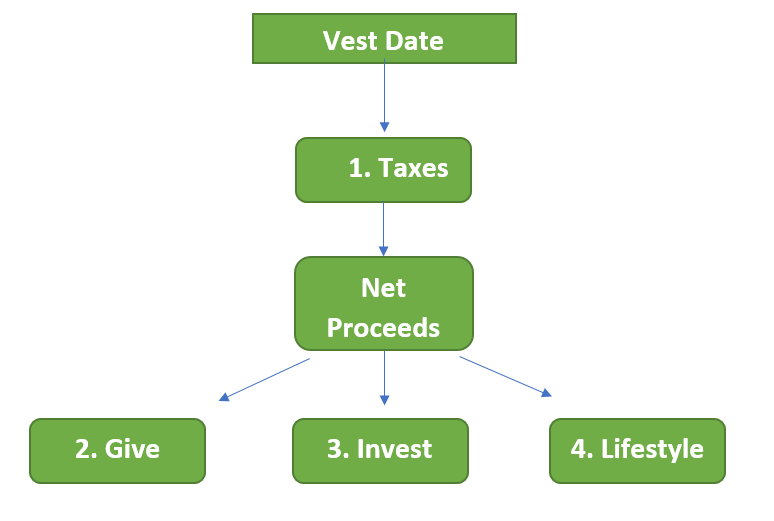

Many companies use non-cash compensation in the form of company stock to reward and incentivize their employees. A common example of this in the Triangle/RTP area is Restricted Stock Units (RSUs) which can provide employees with a potentially fortuitous liquidity event upon the vest date.

When awarded RSUs, you will also be given a vesting schedule at which time the company stock becomes yours to act on as you see fit. There are essentially 4 options for utilization of the stock:

-

Taxes

Upon vesting of the RSUs, you will be taxed at your ordinary income rate for federal taxes along with your specific state income tax rate. As RSUs are a form of compensation, you will also be subject to Social Security and Medicare taxes. Depending on the value of the RSUs at vest date, you’re likely going to be in a higher tax bracket, so you could be looking at 35% Federal, your state tax rate (NC is 5.25%), 6.2% Social Security, and 1.45% Medicare. With FICA taxes there are some further stipulations depending on your income which can be found here. Note if you choose to hold onto the shares after the vesting date then you will also be responsible for capital gains on any appreciation post receipt of shares after the vest date.

-

Give

For those charitably inclined, this can be a good opportunity to gift the proceeds to charity. With the tax implications that come with vesting RSUs, gifting to charity is a good way to mitigate against a rising tax bill. With the recent tax reform changes, you will want to make sure you are in fact itemizing (For 2019 -$12,200 Single/MFS, $24,400 MFJ and $18,350 HOH)on your tax return in order to deduct the charitable gifts. You may need to “bunch” charitable contributions to itemize your deductions which works well with a large liquidity event such as RSU vesting. A good vehicle to accomplish this is a Donor-Advised Fund (DAF) which allows you to make a onetime charitable contribution to an account and later grant out gifts to individual charities at your desired timeline.

-

Invest

One option is leaving the vested shares in the company stock as part of your investment portfolio. If choosing to liquidate then you’ll have the opportunity to invest outside of your company retirement plan. This after-tax money could be used to fund annual IRA contributions, 529 college savings, HSA, or a general brokerage account among many other options.

-

Lifestyle

Of course, you can also use the funds to cover larger ticket items such as house projects/renovations, vacations, or debt payoff. Given the nature of RSUs being tied to your company stock and therefore susceptible to the ebbs and flows of the stock market I highly caution against reliance on RSUs for this lifestyle category. If the stock happens to appreciate then great, but if the stock falls then at least you are not depending on the funds to cover your general lifestyle.

Your specific situation

At the end of the day the decision on what to do with the vested RSUs depends on your current situation and upcoming needs in accordance to your financial plan. When making this decision consider the impact to all areas of your financial life to avoid any financial pitfalls or missed opportunities.