A recent survey discovered that millions of Americans 55 or older are in a rush to retire. The pandemic has many contemplating retiring years earlier than originally imagined after adopting a “life is short” mentality.

But before you rush into a decision to retire early you’ll want to consider it carefully. We’ve listed 6 steps below to analyze if you are ready to retire.

Why retire early?

Since the pandemic has made us all consider how we are spending our time, people have become more and more frustrated with their daily grind. Many people would like to spend more time with their families or pursuing hobbies that they enjoy.

However, if you are in a position to retire early it is important to think about why you really want to retire beyond the initial urge to leave the work world behind.

It is important to consider how you will spend your days. Think about your purpose so that you are retiring to something, rather than simply running away from the 9-5. Have a plan, not just a portfolio.

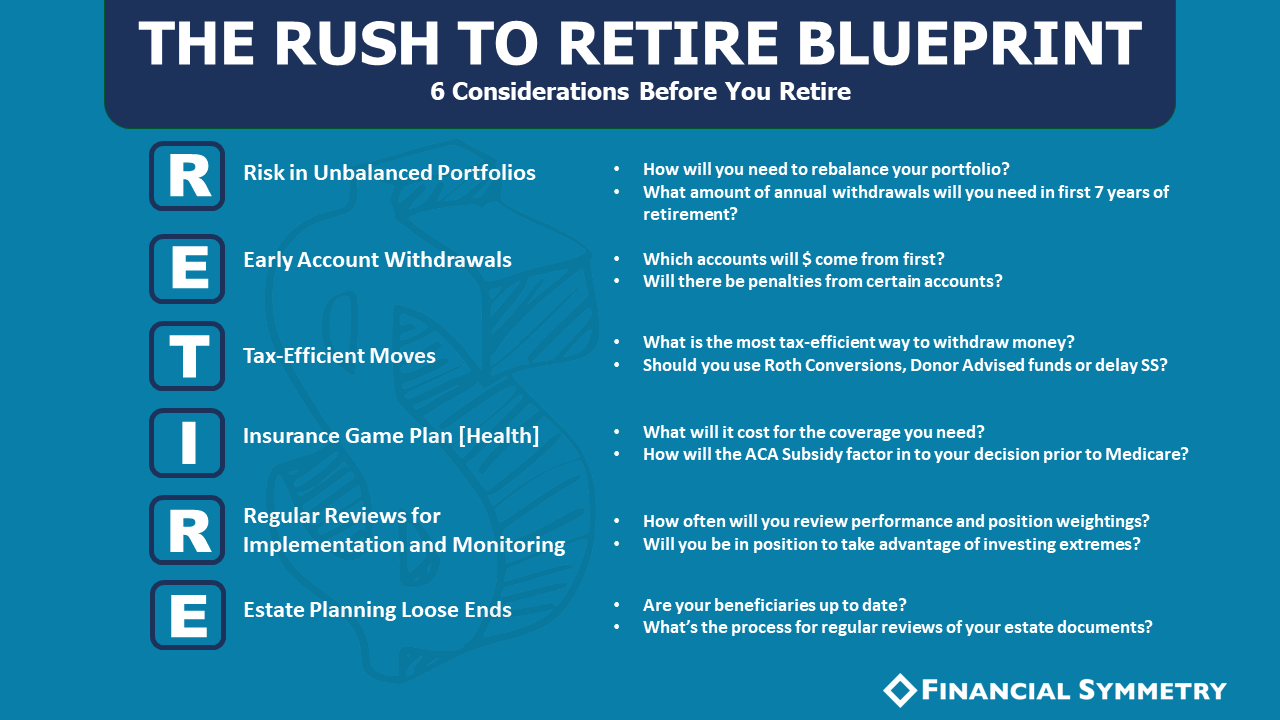

Use the acronym RETIRE to consider early retirement

We have found 6 strategies to consider when thinking about early retirement.

- Risk – Have you considered the impact of sequence of return risk on your portfolio? You may have good returns now but a bear market could ruin that. You don’t want to have to sell low, so make sure your portfolio is allocated with risk in mind. If you want to retire early, you’ll need to have the upcoming 5-7 years of spending available to avoid the risk of having to sell a position when you aren’t ready to. Everyone has their own risk tolerance, so carefully consider yours. In addition to the sequence of return risk, you’ll also need to think about inflation risk.

- Early retirement account withdrawals – If you are retiring early you’ll want to avoid pulling from accounts where there might be a penalty. This means that you’ll have to consider which accounts your income will come from. Be sure to have a diversified mix of accounts to pull from. Give yourself flexibility and make sure you have access to your wealth outside of retirement plans. Have different buckets ready and understand all the tools that you have available.

- Taxes – Take advantage of strategic tax moves. Use Roth conversions to take money from pre-tax accounts and convert it to a Roth IRA when your tax rates are low in certain years. This allows you to take advantage of lower tax rates to fill your buckets with tax-deferred funds. In retirement, you’ll want to think about your lifetime tax rate rather than your yearly tax bill.

- Insurance game plan – One of the biggest issues for early retirees is where to get insurance. You’ll need to carefully plan how you will source insurance and how much it will cost. Most early retirees consider 3 choices: COBRA, a spousal healthcare plan, or the Affordable Care Act. You’ll want to ensure that you understand the expenses involved with each of these choices.

- Regular reviews – How will you know if you are on the right track? Have a plan to monitor your situation periodically. Ask yourself these questions: Have your goals changed? Do you want to pivot? Has your financial situation changed?

- Estate loose ends – Nobody likes thinking about end-of-life decisions, but having your estate documents in place will give you peace of mind. Consider the 3 most important ones: a will, a healthcare power of attorney, and financial power of attorney.

Download the Pre-Retirement Checklist

The question of whether to retire early is one that should not be taken lightly. You can use these 6 considerations to help you contemplate your retirement readiness, in addition, you can also download our Pre-Retirement Checklist to ensure that you are making the right decision for you and your family.

Outline of This Episode

- [1:46] Questions people have about retiring early

- [3:48] R is for risk

- [8:42] E is for early retirement account withdrawals

- [13:06] T is for taxes

- [17:52] I is for insurance

- [20:56] R is for regular reviews

- [23:02] E is for estate loose ends

- [25:42] The progress principle

Resources & People Mentioned

- Download the Pre-Retirement Checklist

- Episode 136 – 3 Not-So-Obvious Retirement Roadblocks

- Navigating Healthcare Between Retirement and Medicare

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh @TeamFSINC

- Follow Financial Symmetry on Facebook