When is enough, enough? Many investors have recently found solace in growing their cash reserves, whether in their checking accounts, savings accounts, or certificates of deposit (CDs).

With attractive yields and recent market turbulence still fresh in mind, it’s easy to assume that loading up on cash is a safe strategy. But there’s a hidden cost to keeping more money than you need.

Not only does excessive cash limit your growth potential, but it can erode your long-term wealth, all because of a mix of emotional biases, historical events, and overlooked risks.

Emotional Drivers and the Stories We Tell Ourselves

The urge to build a large cash cushion isn’t just about numbers; it’s deeply emotional. In the episode, we discuss how our personal histories, often inherited from previous generations, influence our attitudes toward money.

If your parents or grandparents experienced the Great Depression or the 2008 financial crisis, you might have inherited a powerful aversion to risk. As Will Holt points out in our discussion, studies have shown that people feel losses in their portfolio twice as much as they feel the gain.

This “loss aversion” can steer us to holding excessive cash simply because it feels safer. There’s also recency bias at play: The market downturns of 2022 and the COVID-19 shock in 2020 linger in memory, making us forget the equally compelling history of market recoveries and long-term growth.

Cash Is Comforting, but at What Cost?

Cash is visible and tangible. With a quick glance at your banking app, you know it’s there. But this convenience comes with trade-offs. Keeping too much cash simply because it feels good is inefficient.

Over time, this inertia can negatively impact your overall returns and erode the value of your money when inflation is taken into account. It’s not just about missing out on the potential growth of stocks and bonds. Choosing cash for the illusion of safety ignores three critical long-term risks:

Inflation Risk

Over the decades, inflation quietly erodes the purchasing power of cash. Even CDs or short-term treasuries rarely keep up with long-term inflation averages, meaning what looks like “safe money” is slowly losing value.

Longevity Risk

Today’s retirees and pre-retirees may live several decades beyond retirement. If too much is allocated to cash, portfolio growth lags, and funds may not last as long as needed.

Tax Risk

The interest on cash deposits is taxable as ordinary income up to potentially 40.8% depending on your tax bracket, increasing your overall tax liability. In addition, this additional income could eliminate your ability to take advantage of certain credits or deductions.

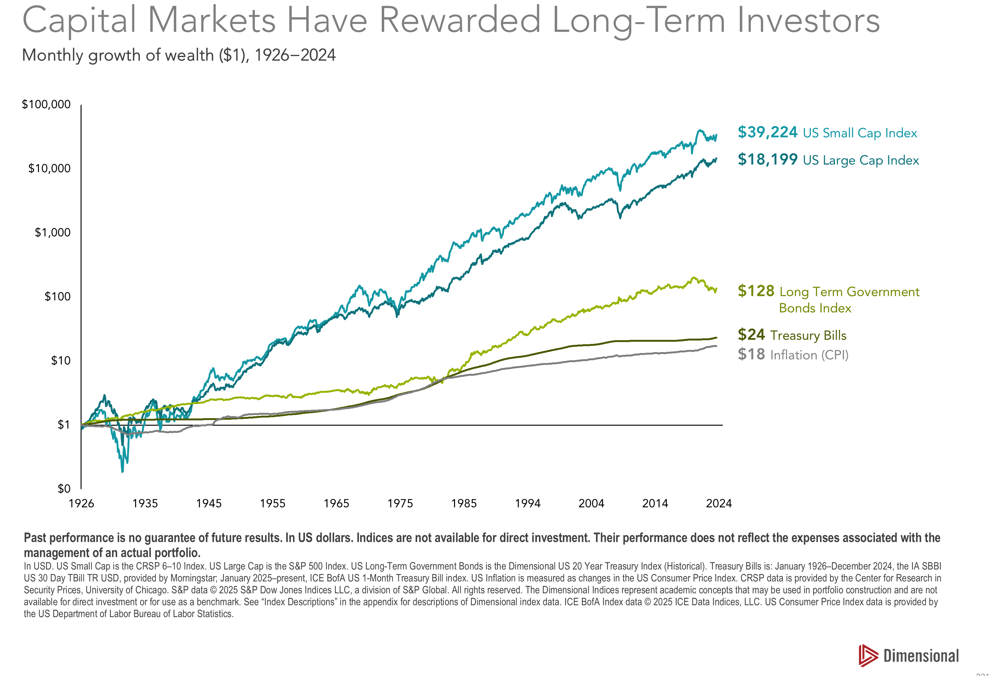

Over the past century, a dollar invested in T-bills (essentially cash equivalents) would have grown to just $24, whereas stocks grew that same dollar to over $18,000 and small company stocks to over $39,000. The long-term gap is staggering.

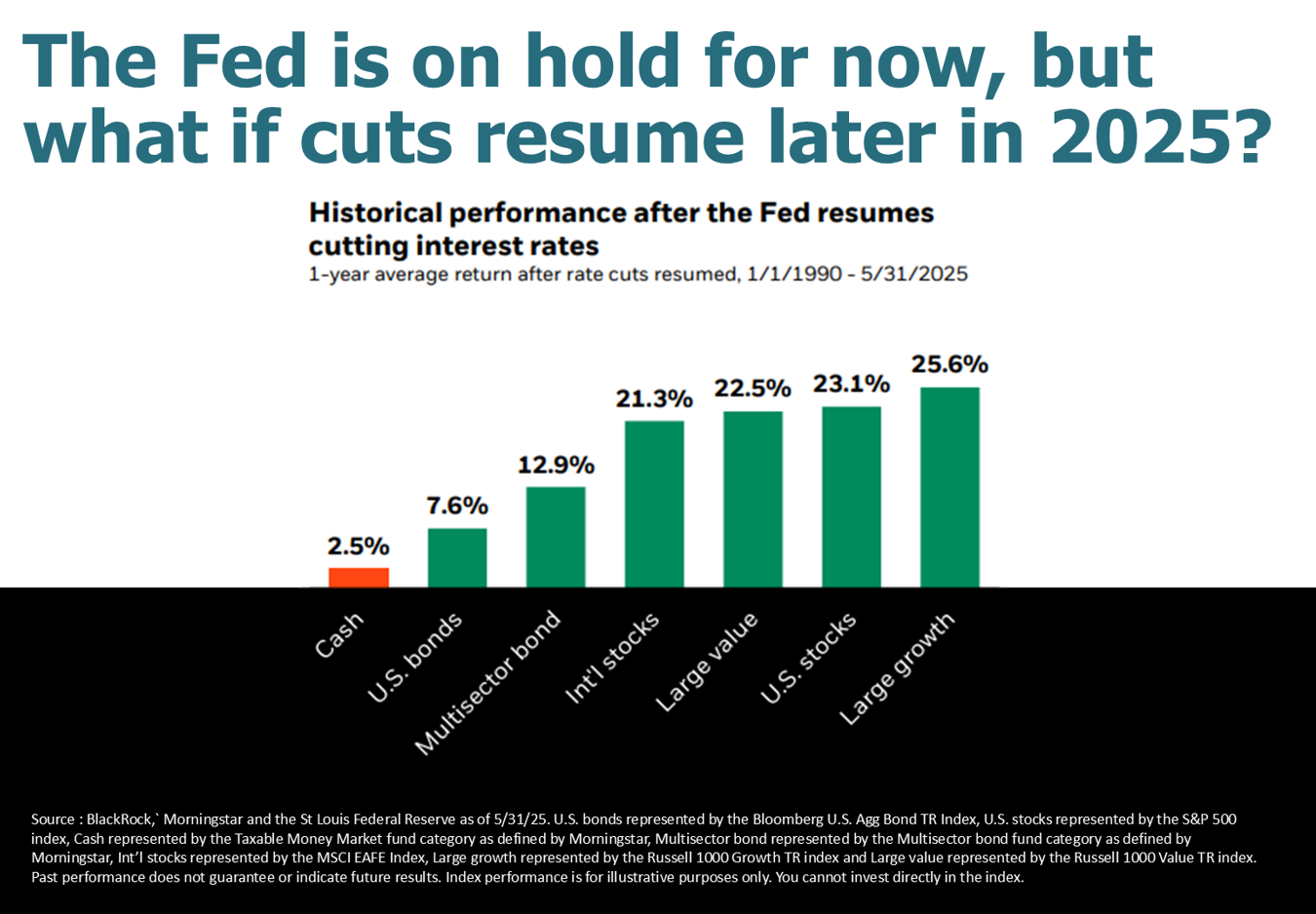

Even in shorter timeframes, the opportunity cost is real. Historically, after the Federal Reserve begins cutting interest rates, stocks and bonds have outperformed cash by wide margins in the following 12 months.

How Much Cash Is Enough?

Answering this question begins with developing a customized and detailed financial plan. This helps you to understand how much you’ll need over the next 5-7 years.

You can then determine the timeline and size of those needs. This helps you maintain a more optimal amount of cash equivalents for your immediate known needs.

Beyond that, a thoughtfully diversified portfolio, including stocks and high-quality bonds, can better protect against both inflation and longevity risk, while providing higher expected returns.

Financial planning can provide guardrails and peace of mind, allowing you to “stick to your plan,” ignore the noise, and avoid emotional pitfalls. Holding excess cash may provide short-term comfort, but it creates long-term challenges.

Through disciplined planning, understanding your personal risk capacity, and engaging with a trusted advisor, you can achieve the right balance, keeping enough cash for immediate needs while putting the rest of your money to work for your future.

Outline of This Episode

- [03:56] Artificial anchoring and recency bias can lead to overly cautious investing decisions.

- [09:14] Cash underperforms stocks and bonds long-term.

- [11:30] Market timing is risky; missing the 10 best days can significantly reduce returns.

- [15:10] Optimize cash flow through strategic sales while considering tax efficiency.

- [19:50] Maximize equities in a portfolio for high returns.

- [20:39] Focus on planning goals for the next 5 to 7 years.

Resources & People Mentioned

- JP Morgan – The strength, weakness and opportunity cost of cash

- Blackrock – Student of the Market June 2025

- Morningstar – Cash Is No Longer Trash, but the Opportunity Cost Might Be Greater Than You Think

- TIAA – The Impact of Holding Cash In Your Portfolio

- FSI – Navigating Market Volatility Podcast

- Will Holt on LinkedIn