I was reminded over the weekend while listening to a sermon series of a phrase I’d heard a couple years ago: “Row the Boat”

I’m sure the phrase has been around for a while, but I associate it with the head coach of The University of Minnesota football team, PJ Fleck. The rallying cry he brought as a new coach to his team was one that gave the team something to strive for together and keeps them on the right path to reach their goals. Despite the rigors and adversity, a team goes through during a season, if they stay committed to their plan and defined process by “rowing the boat” onward then they give themselves the opportunity to be successful.

So where in our finances may we need to adapt this concept in order to stay on the path to achieve our goals?

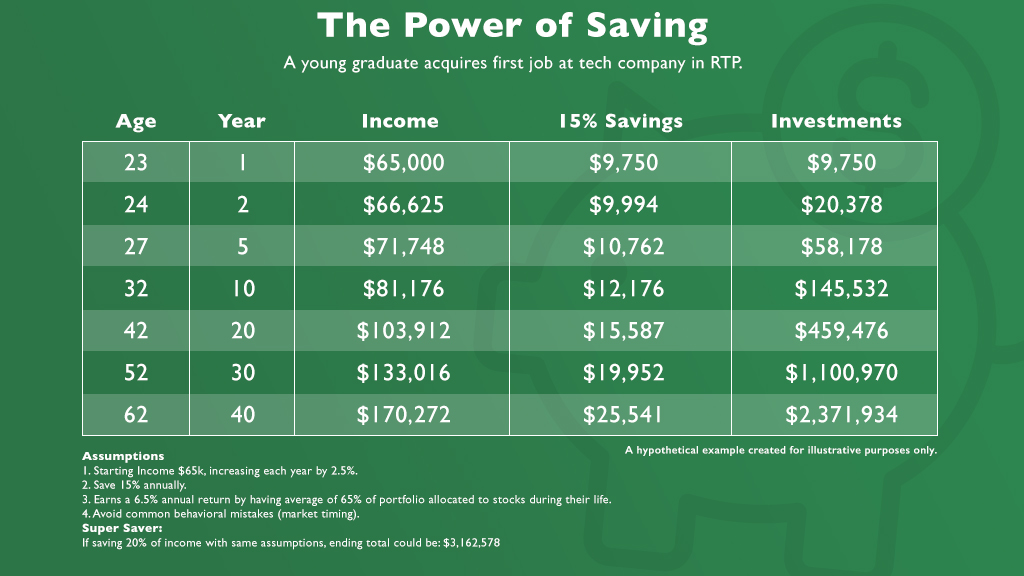

Compound Interest

While the effects of compounding interest are widely cited as a major benefit to investing, the satisfaction that this provides often doesn’t come until later in the investing journey when the portfolio balances are higher and the added contributions don’t have as big effect as they once did when the portfolio was smaller. The chart below highlights this with the compounding interest really ramping up in later in your working/saving years. Notice over $1.2 million (About 50% of total portfolio) comes in the last 10 years. The compounding of over 30 years of consistent saving and investing was key to providing a foundation for compounding interest to work for you.

For further reading on compound interest – The Time is Now, Your Future Self Will Thank You

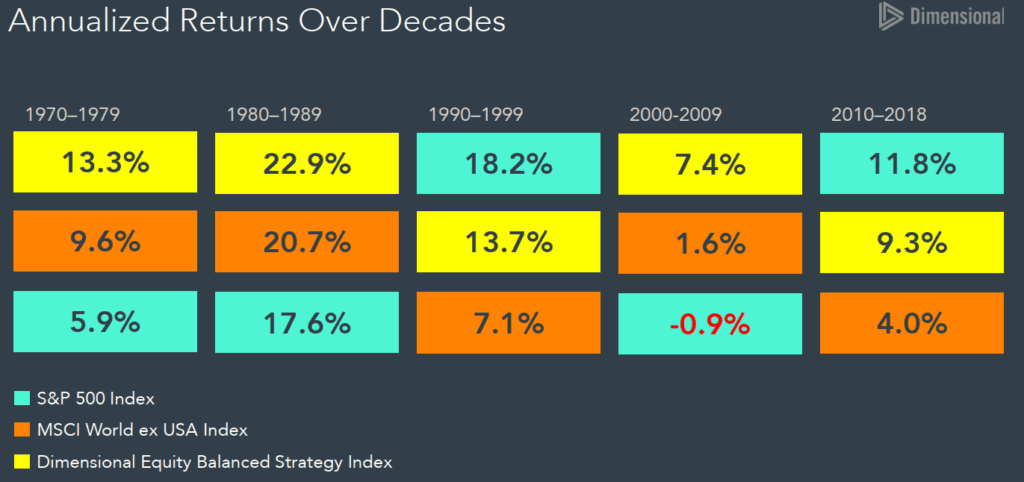

Fear of Missing Out – FOMO

Having a long-term diversified portfolio has been said to be the only “free lunch” in investing. However a diversified portfolio typically means that parts of your portfolio are often underperforming. Especially when compared to the current hot investment choice of the time period whether that be tech stocks or Bitcoin. Or even more broadly defined asset classes such as growth vs. value U.S. stocks or U.S. stocks vs. International stocks.

A diversified portfolio accumulates wealth over a long period of time and likely won’t make you a killing, but also won’t kill your portfolio!

For further reading – Why Should You Diversify?

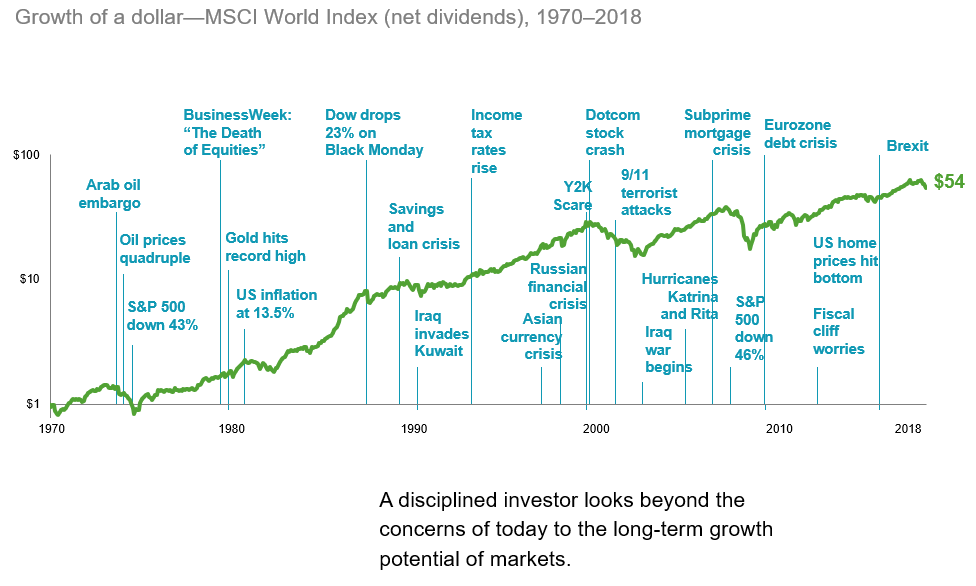

2020 – Pandemic & Election Headlines

Long-term investors have been rewarded historically for their patience and willing to invest through many tumultuous market periods and jarring headlines throughout history. Each year we see these headlines pop up and investors reactions as “this time is different”. 2020 is no different and in some ways feels even more so with the constant social media reminder of the world’s events.

For further reading – How to Ignore Stock Market Noise

Market Timing

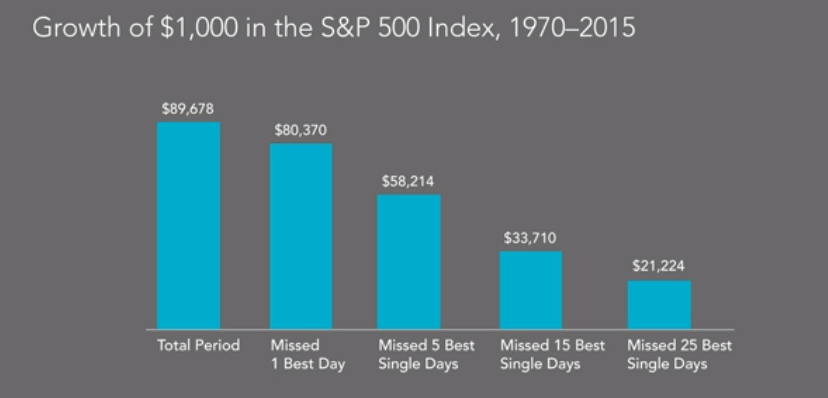

Jumping in and out of the market based on what you think may happen can be a very costly strategy overtime. Missing just a few of the best days in the market as shown by the graphic below can really take a bite out of your potential returns. This becomes even harder at times as the best days in the market can come right after some of the worst days. The next time you have the urge to make a move to “wait until things get better”, ask yourself “what happens if I’m wrong?”

A typical boat has a captain and when considering the phrase “row the boat” specifically your mind may think of those long skinny boats used in the racing sport of Rowing. In this sport multiple members of the rowing crew row the boat with their backs faced toward the direction the boat is going. However they’re rowing in accordance to a pre-determined plan and guided during the race by the only individual in the boat facing the direction the boat is going, the Coxswain. The Coxswain is there to help navigate any turbulent waters that may steer the boat off the path leading them to their goal.

This path in financial planning is the financial plan itself. A living breathing document that will always need adjusting as life events occur whether positive or negative. Adapting to new information and seizing opportunities to help stay on the path or get back closer to the path of the financial plan is the key determinant of whether you’ll have a successful plan or not.

So, when life presents us with curveballs or anxiety inducing headlines, just keep rowing.