You spend half your life preparing for retirement, but that doesn’t mean there won’t be surprises when you get there.

In this episode, we highlight 10 common retirement surprises and provide strategies so you are ready when they arise.

5 positive retirement surprises

By nature, surprises are unexpected and are generally viewed through the lens of good or bad. We like to start out with some potential beneficial surprises. You’ll want to hear which surprises might start out negative but could lead to positive changes.

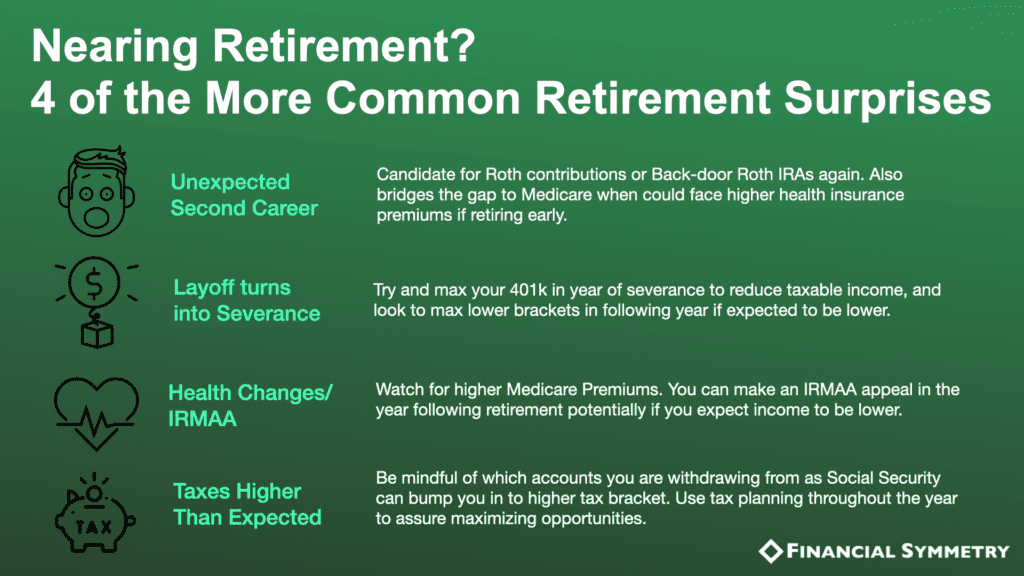

- A second career – Some people find that retirement brings them into a second career. They may find this second round more fulfilling or it could be a way to give back to their community. Being able to contribute and still earn an income is an unexpected surprise for many.

- An unexpected inheritance – While the situation may not be that positive, an unexpected inheritance could completely change your retirement plans. Sudden money requires careful consideration and planning.

- A layoff – Not everyone retires when they want to. If you get laid off close to retirement age you could turn that negative into a positive especially if it includes a severance package.

- Increased travel – If you have family that moved across the country or even across the world this could bring more travel into your retirement itinerary. Although seeing new places is always exciting, it’s important to prepare for the added expenditure.

- A change in family dynamics – You may be surprised by taking on a care giving role in retirement. This role could be for aging parents or even involve raising the grandkids. Another way that family dynamics change in retirement is through grey divorce. Listen in to discover how changes in family dynamics can change your financial outlook as well.

Don’t let negative changes in retirement surprise you

Unfortunately, retirement doesn’t always bring positive outcomes. It’s important to be prepared for negative surprises in retirement, like the list below.

- A decline in health – Health changes can change your finances in retirement. You may find that your Medicare premiums are higher than expected. Find out how you can rectify that by listening to episode 104. Long term care can also have a huge impact on your retirement finances.

- Downsizing didn’t have the expected effect. Sometimes we think that downsizing in retirement will bring substantial financial benefits but that isn’t always the case. Upgraded senior living communities with newer amenities and other unexpected upgrades that come along, could keep home spending at similar levels.

- Inflation can be the silent killer of retirement savings. Even if you pay off your home, taxes and insurance are still there, and they tend to increase over time. Is your portfolio prepared to battle inflation?

- Taxes continually surprise us. Many people discover that in retirement they are still paying high tax rates.

- A market correction – sometimes the timing of market corrections can come as a surprise (although it shouldn’t!) How you respond to a market correction may be one of the more consequential decisions you make throughout retirement. Learn how to factor your risk tolerance into your portfolio, so you can be prepared for any eventuality.

Outline of This Episode

- [2:30] What are you going to do in retirement?

- [4:38] You receive an unexpected inheritance

- [6:01] Turn a negative into a positive

- [10:12] A caregiving role can be a surprise

- [13:42] Healthcare costs can be surprising in retirement

- [16:02] Sometimes downsizing doesn’t provide the expected financial benefits

- [19:35] Taxes can be surprising

- [20:21] Market corrections can come as a surprise

Resources & People Mentioned

- BOOK – The New Retire Mentality by Mitch Anthony

- Episode 104 on IRMAA Appeal

- Episode 98 on Long term care

- Article – Grandparents playing role as day care provider

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook