As of March 2023, the Center for Medicare Advocacy estimates that over 65 million Americans are enrolled in a Medicare plan. While many of us may be familiar with the general concept of Medicare and its importance when we turn 65, it’s essential to consider how familiar you are with the enrollment process, the basic structure of Medicare, and what plan options are available to you.

Let’s take a closer look at these topics to help guide you in your decision.

Medicare Enrollment

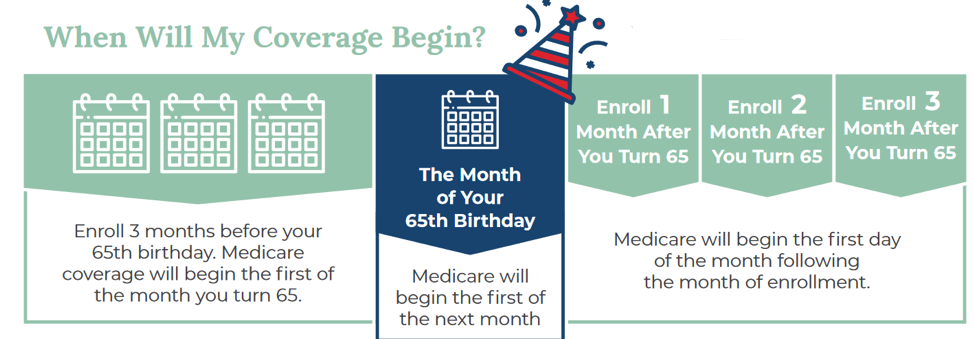

In general, you become eligible to enroll in Medicare in the three months before the month you turn 65 and the three months after. Exceptions apply if you’ve been receiving Social Security disability benefits for at least two years before turning 65 or if you have been diagnosed with a certain terminal or degenerative disease.

As you approach age 65, you will likely come across targeted advertisements and junk mail offering potentially misleading deals or ways to save money on Medicare benefits. We recommend seeking a second opinion before enrolling through these avenues. Make sure to keep and review any correspondence from government agencies such as the Social Security Administration, Centers for Medicaid and Medicare Services, and the Department of Health and Human Services.

If you want your coverage to begin in the month of your 65th birthday, it is crucial to enroll during the preceding three-month period. Late penalties may apply if you wait more than two years to enroll in Medicare.

There are also some exceptions to enrollment if you are still covered under your employer’s health insurance at age 65. If your company has 20 or more employees, you must enroll in Medicare Part A, but not Part B until you are ready to leave.

Completing the enrollment process can be done online or by contacting your local Social Security office.

Medicare Structure

We’ve discussed the basics of enrolling, but what exactly are you enrolling in? Medicare is divided into several parts. Let’s review the fundamentals below:

Part A – Hospital Stays

Generally free for most Americans and provides coverage for hospital stays or skilled nursing (facility, home care, hospice care).

Part B – Medical Treatment

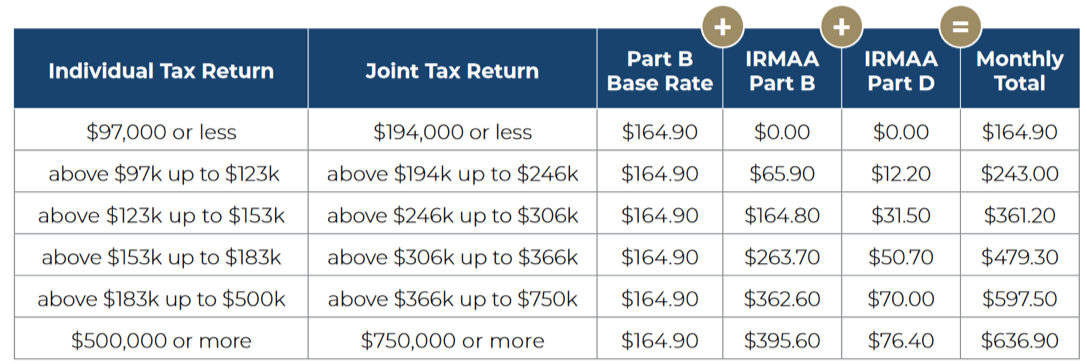

Typically covers items related to the diagnosis and treatment of medical conditions as well as preventative care. Monthly premiums are paid, and the amount can vary depending on your income from two years ago (IRMAA). For example, the following table shows the monthly Part B premium for 2023 based on your 2021 taxable income.

The guidance of a financial advisor, along with comprehensive planning, can help you manage these income brackets to ensure you don’t pay more than necessary for Part B and Part D.

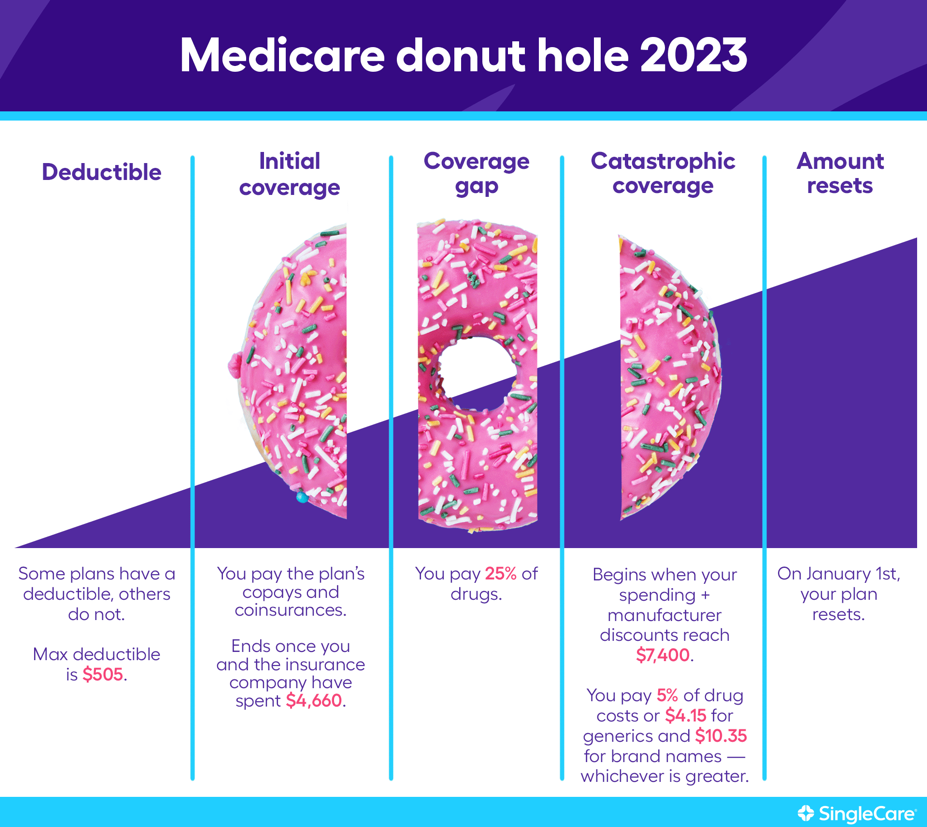

Part D – Prescription Drugs

Helps cover the cost of prescription drugs and provides some protection against rising costs. Congress designed Part D to assist in covering the majority of prescription drug costs for Americans. Individuals who spend more than the average on medications may experience a coverage gap or “donut hole” where they temporarily cover more of the out-of-pocket costs. Here’s an example of what that may look like:

The coverage gap encourages users to seek generic and more affordable drugs. Also, note that the plan resets on the 1st of every year.

Medicare Plans

Now that we have a better understanding of the different parts of Medicare, how do we decide on the type of coverage we want?

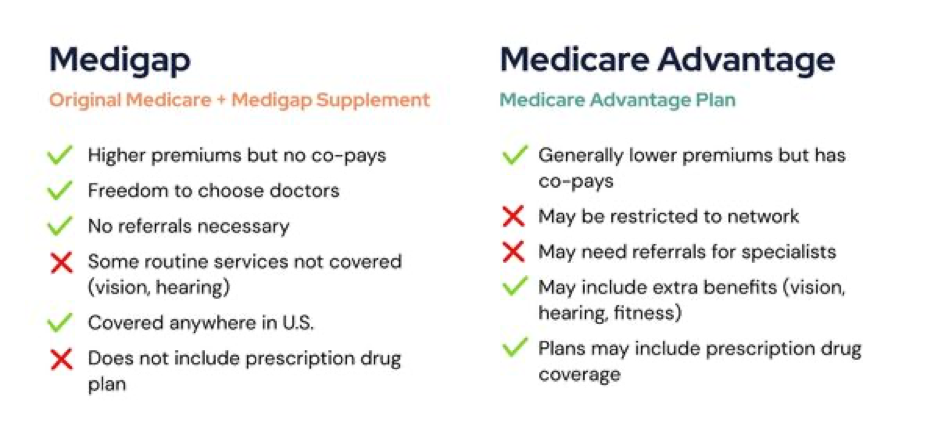

Essentially, there are two ways to set up your Medicare coverage: Medicare Supplemental (also known as Medigap) or Medicare Advantage (also known as Part C). Medicare Supplemental provides coverage in addition to what Parts A and B cover, while Medicare Advantage combines all parts of Medicare into one comprehensive plan.

One key difference between Medigap and Medicare Advantage is that Medigap does not cover extra benefits like vision or hearing. However, if you expect to move or travel often during retirement, Medigap would give you the freedom to see any provider in the US that accepts Medicare.

Time to Call in an Expert?

You may find yourself at a crossroads when deciding between these two options. While you may be in good health today, it’s hard to know exactly how your circumstances will change in the future. Depending on the complexity of your needs, working with a Medicare Insurance Specialist can help you navigate Medicare planning with ease. Similar to working with a financial advisor, here are some reasons why you may decide to work with a Medicare Specialist.

- Competence: A Medicare Specialist is equipped with the expertise and knowledge to evaluate your situation.

- Convenience: Time savings through enrollment assistance and answering your questions.

- Coaching: Ongoing support as your needs change and guidance on any law changes.

- Continuity: Annual check-ins to review any cost or benefit changes in your plan.

Key Takeaways

Medicare is a vital program that provides healthcare coverage to millions of Americans. Navigating the complexities of Medicare enrollment, understanding the different parts of Medicare, and choosing the right coverage can be daunting tasks.

That’s why working with a Medicare Specialist can be a wise decision. These experts possess the knowledge, experience, and understanding of the Medicare system to guide you through the process, ensuring you make informed decisions about your healthcare coverage.

Many of our clients partner with The Wooten Agency to help guide their Medicare decisions. You can review their 2023 Medicare guide here and learn more about how they help their clients.

Medicare planning is just one aspect of a comprehensive financial plan. If you have questions about how to accomplish your personal financial goals leading up to Medicare enrollment, reach out to us and let’s have a conversation!