Recently the Internal Revenue Service has been sending out a lot of CP11 notices regarding the 2020 Recovery Rebate Credit being reported incorrectly on 2020 tax returns. If you find yourself receiving one of these letters from the IRS stating that you owe them additional taxes, a penalty, and interest, we hope the following information will help you out.

What is the Recovery Rebate Credit?

There were two rounds of stimulus money that stemmed from 2020 legislation. When the March 2020 CARES Act was signed, it included stimulus payments of up to $1,200 per qualifying adult and up to $500 per qualifying dependent. Then in December 2020, the CAA was signed which sent stimulus of up to $600 per individual who qualified, though some of those payments were sent out in early 2021. Both of these were pre-paid tax credits, similarly to the advance payments going on currently for child tax credits. If it turned out on your 2020 tax return that you were owed more stimulus money than was paid out to you, you received the rest as a credit on your tax return.

Why is the IRS saying I owe more tax plus a penalty and interest due to this credit?

If you received this particular CP11, it means that you underreported how much stimulus money you received on your 2020 Form 1040 and, therefore, received too much of the Recovery Rebate Credit on your tax return resulting into little federal tax being paid to the IRS.

The IRS knows how much they sent you, so if they say you owe money, chances are they’re right.

What should I do if I receive and IRS CP11 Notice about the Recovery Rebate Credit?

If you received one of these IRS notices, the best (and really the only) solution is for you is the following:

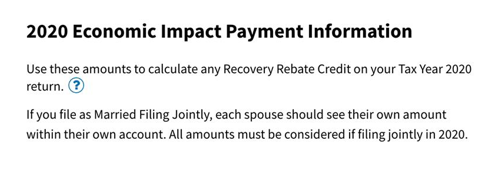

- Create an account with the IRS using this link: https://www.irs.gov/payments/view-your-tax-account If you are married filing jointly, both spouses will need to create their own accounts.

- Confirm that you underreported your stimulus payments.

- Pay the tax, penalty and interest that you owe.

We’ve looked at some of these for clients already and haven’t found a way to avoid the penalty or interest.

The IRS website states that you should not call them about this. The following clips are from the IRS website:

- Do not call the IRS. Our phone assistors don’t have information beyond what’s available on IRS.gov.

- Previous payment information is no longer available in Get My Payment.

- The first and second Economic Impact Payments no longer appear in Get My Payment. To find the amounts of these payments, view or create your online account. You can also refer to Notice 1444 for the first payment and Notice 1444-B for the second payment. The IRS mailed these notices to your address of record.