If you are a teen or young adult trying to make sense of money, welcome. In this “What I Wish I Knew About Money as a Teen” series, we will cover topics that form the foundation of personal finance, including saving, investing, budgeting, credit, and debt. We’ll look at the big picture first and then dive deeper into each concept topic in future posts, providing stories, examples, and small steps you can take to set yourself up for success.

Let’s begin with the money habit that makes the biggest long-term difference: starting early.

Compound Interest: Your Future Self Will Thank You

There’s a common myth that you need a lot of money to start investing. But the truth is that building wealth has more to do with time than the amount you start with. The earlier you begin, the better off you’ll be, thanks to compound interest.

Here’s a simple example to demonstrate the power of compound growth: Let’s say you’re 18 and are gifted $10,000 to jumpstart your investment account. If that money earns the average return of 8% per year, it will grow to over $400,000 by the time you’re 66 without you ever adding a single extra dollar.

That’s compound interest. Your money grows, and the money that grows also works for you.

If you can’t start with a lump sum, that is okay. Remember the money habit that matters? Starting early. With $0, if you invest $200 a month beginning at age 18, your portfolio could grow to over $1.27 million by age 66 – all while contributing only $115,200 during that same time period. Postpone investing until 25, and you’ll end up with $500,000 less. Start at 35? That gap gets even wider.

If you’re wondering when to start investing, the answer is as soon as you can, even if it’s just a small amount.

Emergency Savings: Before You Invest, Build a Safety Net

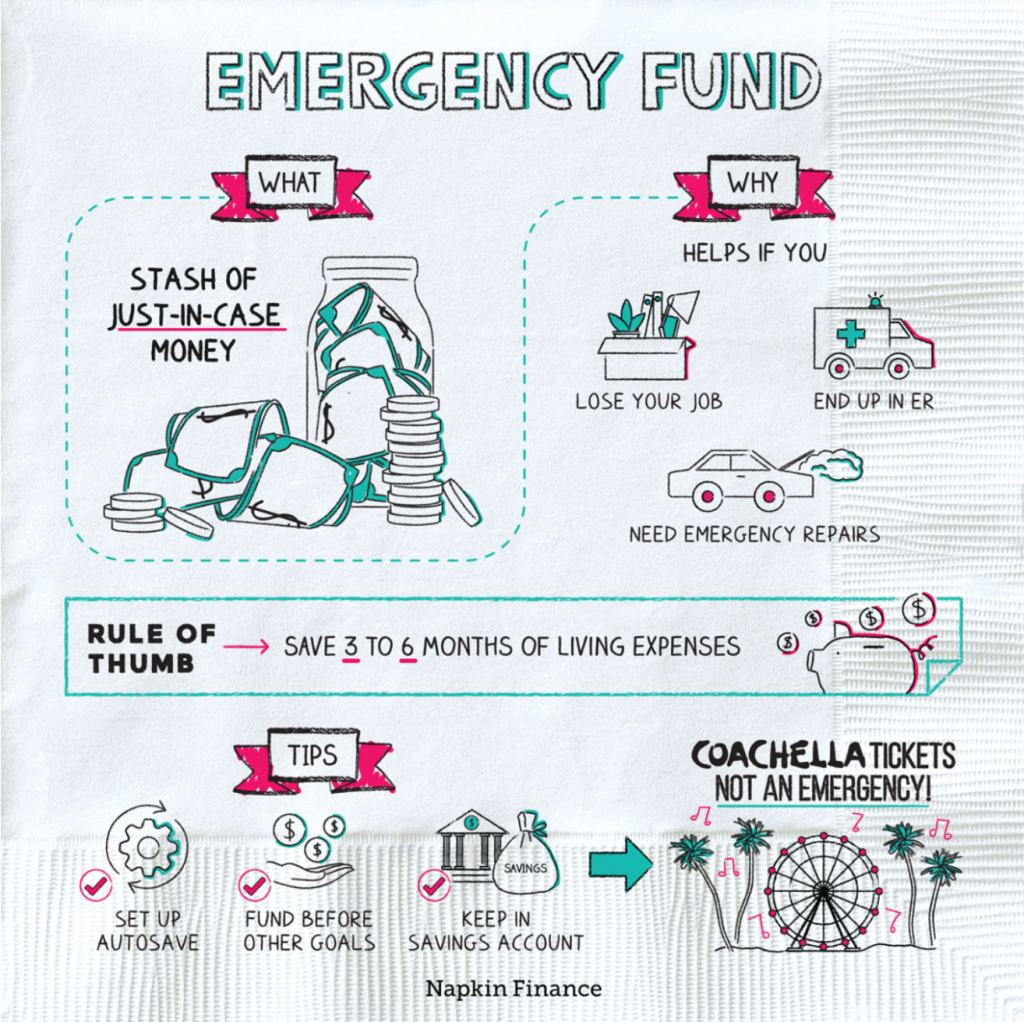

Before investing, it’s smart to build an emergency savings fund, a cushion for life’s surprises, like a car repair or a medical bill. Without savings, you might be forced to rely on credit cards or pull money out of investments at the wrong time.

Aim to save enough to cover three to six months of basic expenses and keep it in a high-yield savings account, if possible. Having emergency savings helps with peace of mind. It’s the foundation that allows you to build everything else with more confidence.

Source: https://napkinfinance.com/napkin/emergency-fund/

Budgeting: It’s Not About Restriction, It’s About Choice

A budget is simply a plan for how you want to use your money. And when it’s done right, it’s a form of self-care.

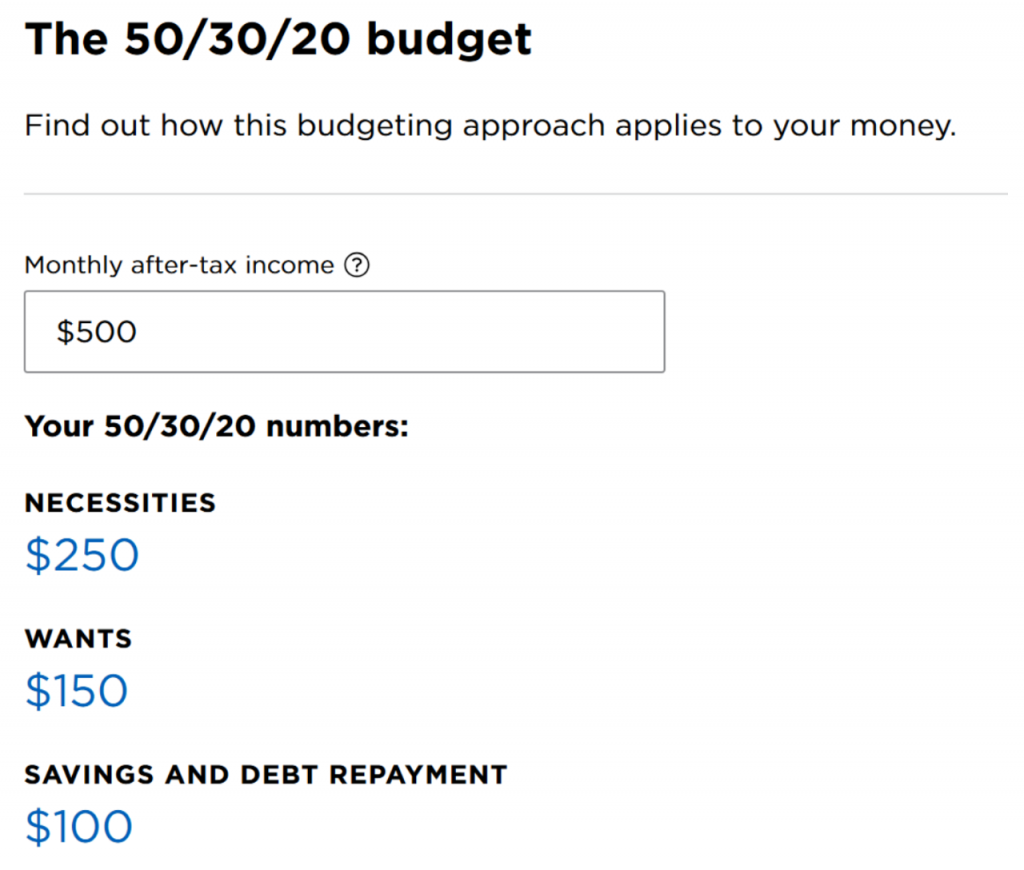

One easy place to start is the 50/30/20 rule:

- 50% for needs (like groceries or transportation)

- 30% for wants (like hobbies or takeout)

- 20% for saving and investing

If you’re a teen with a part-time job or allowance, those percentages might not be exact, and that’s totally fine. Each person’s financial situation is unique, and this rule is intended to serve as a guide. What ultimately matters most is tracking where your money goes and being intentional about how you spend it.

Budgeting gives you clarity and allows you to spend on what matters most to you.

A budgeting app can be a valuable resource for building awareness of where your money is going, while helping you follow the 50%/30%/20% rule with ease. The Nerd Wallet Smart Money App or Goodbudget are great places to start.

Source: https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

Building Credit: Start Small, Start Smart

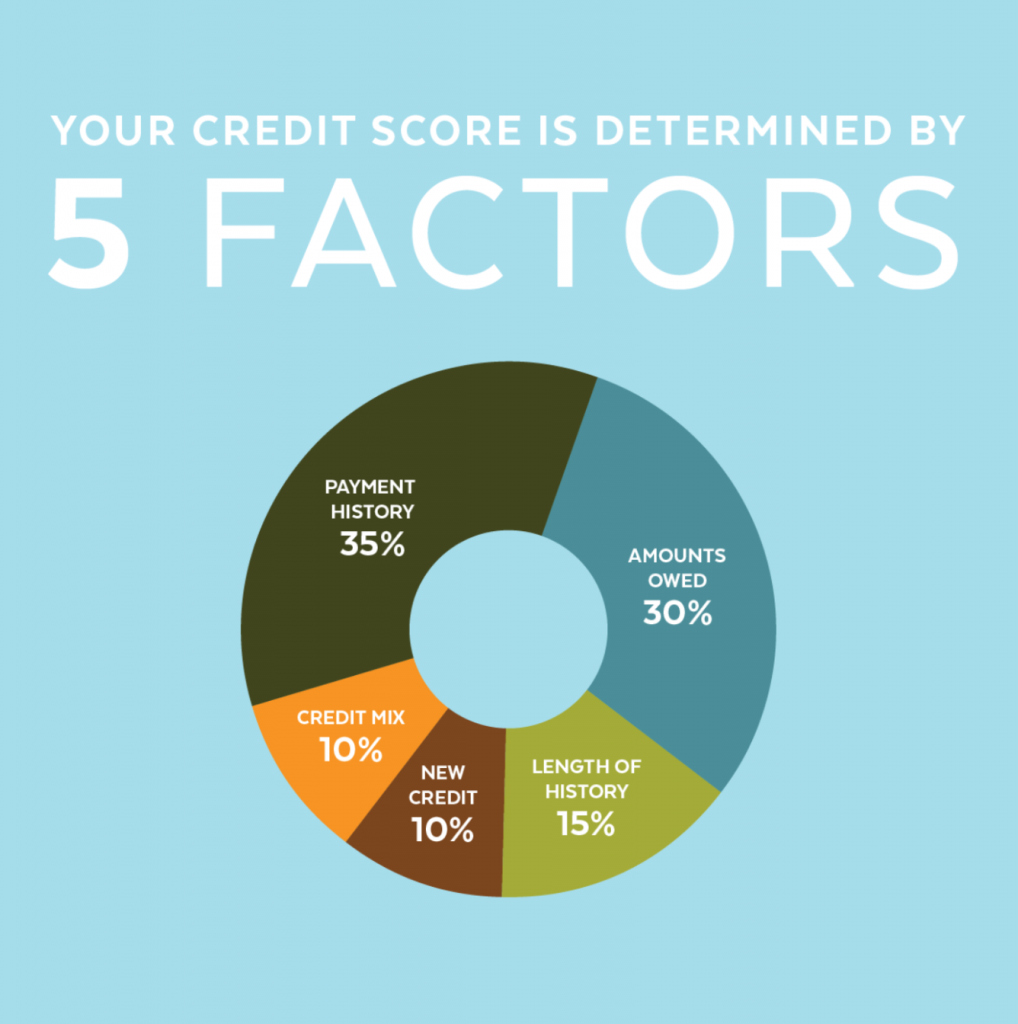

Your credit score is a number that tells lenders how trustworthy you are when it comes to borrowing money. It matters more than you might think. It can impact your ability to rent an apartment, secure a car loan, or even land a job.

You can build credit safely and consistently by:

- Becoming an authorized user on a parent or guardian’s card

- Opening a student credit card with a low limit and paying it off in full each month

- Opening a secured credit card where you set your credit limit with a $100 – $500 deposit.

When it comes to building a good credit score, remember C.R.E.D.I.T.

- C – Check your credit score

- R – Reduce your balances

- E – Establish credit early

- D – Do not miss payments

- I – Increase limits wisely

- T – Think before you apply

Source: https://empeople.com/learn/empeople-insights/fico-score-vs-credit-score/

Credit is a tool. When used correctly, it opens doors and saves you money down the road.

Roth IRAs: Keep More of What You Earn

When investing for the long term, consider opening a Roth IRA. It’s a retirement account that lets your investments grow tax-free.

You contribute money you’ve already paid taxes on, invest it, and can withdraw the funds in retirement without owing a penny in taxes on the growth (if you follow a few rules). That can mean thousands or even hundreds of thousands of dollars in savings for your future self.

Remember our example of investing $200 a month from the age of 18? Well, doing so in a Roth IRA could save you over $170,000 in taxes by retirement compared to a regular account.

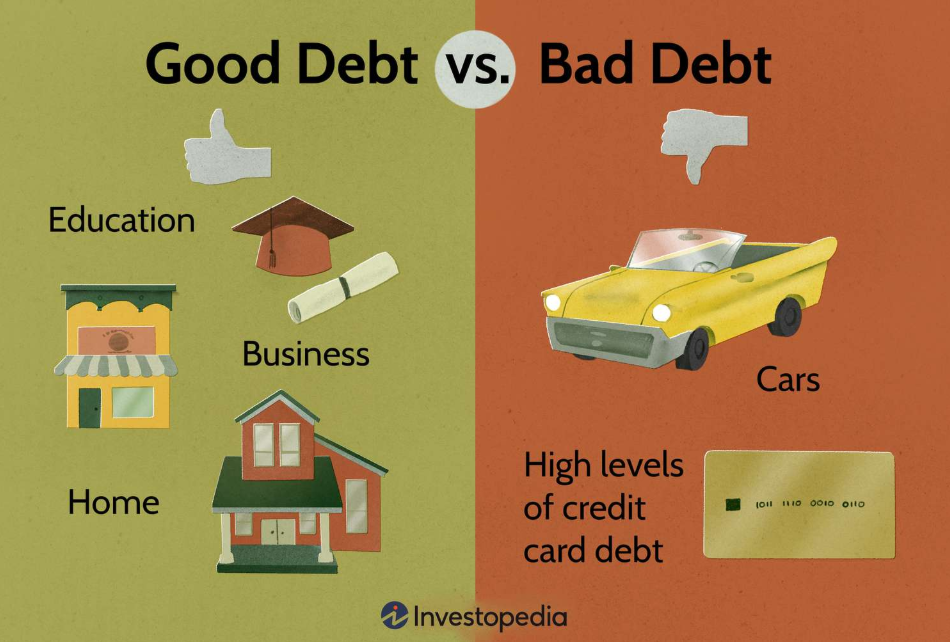

Debt: Not All Debt Is Bad

Debt often gets a bad reputation, but not all debt is harmful. Student loans or a mortgage can be investments in your future. Credit card debt, on the other hand, often comes with high interest rates that can snowball fast.

Source: https://www.investopedia.com/articles/pf/12/good-debt-bad-debt.asp

The key is to understand the type of debt you’re taking on, how interest works, and whether the tradeoff is worthwhile. If you’re already dealing with debt, remember it’s something to manage, not something to feel bad about.

What’s Next

In the coming weeks, we’ll be sharing dedicated blog posts, podcasts, and videos on each topic, featuring real examples and practical tips you can use.