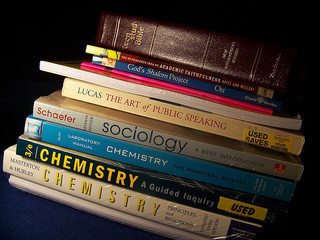

This month’s issue of Money magazine features an article entitled Busting the 5 Myths of College Costs.

This month’s issue of Money magazine features an article entitled Busting the 5 Myths of College Costs.

The landscape of saving and ultimately paying for college has been constantly changing over the past several years and it is important to consistently review your plans and adjust strategies accordingly.

5 Myths of College Costs

- Saving for College will hurt your chances of getting financial aid.

- You can’t afford a private college.

- A liberal arts degree won’t pay the bills.

- Student loans will cripple your child financially.

- Starting at a community college, then transferring is a great way to cut the cost of a BA.

Consider the Specifics

Some of the myths are surprising and the article makes the point that unique considerations need to be taken into account for each student when selecting a college and exploring funding options.

As financial planners, we recommend balancing goals to pay education costs for your children with your own long term goals.

Contact us to discuss the best strategies for your family. You can also explore the cost of universities across the country at CNNMoney.

Photo credit: Flickr – wohnai