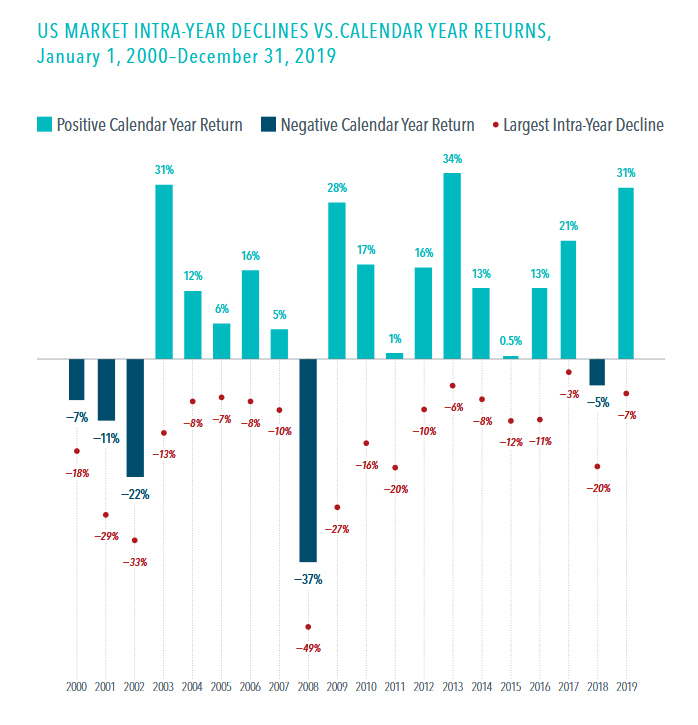

Stock market slides over a few days or months may lead investors to anticipate a down year. But a broad US market index had positive returns in 15 of the past 20 calendar years, despite some notable dips in many of those years.

• Intra-year declines for the index ranged from 3% to 49%.

• Calendar year returns improved on those intrayear slides. The steepest declines saw notable recoveries, and in 15 of the 20 years, stocks ended up with gains for the year.

• Even amid the fnancial crisis in 2009, a 27% plunge gave way to a 28% gain by the end of the year.

Volatility is a normal part of investing. Tumbles may be scary, but they shouldn’t be surprising. A long-term focus can help investors keep perspective.

Source: Dimensional.com, Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.