Many investors have become disillusioned with their investment strategy. After all, at the end of the 2000s, most investors were left with less than they started with at the beginning of the decade. So a desire to do something different (try something, anything else for goodness sakes!) is completely understandable.

Lots of people have made money in gold, right? How about collectibles? Hedge funds? Wine? As many investors discover, the world of alternative investing is cluttered with hard to understand rules that can create an uphill climb from the outset. Take for example this recent story in Businessweek:

http://www.businessweek.com/magazine/content/10_31/b4189050970461.htm

The investor’s urge to do something different was driven by his desire to make up for losses in his portfolio. So as he watched the price of oil plummet in early 2009 to $34 a barrel, he saw an opportunity to get in at a low price (buy low thinking is good!) and had his broker invest in an exchange traded fund, or ETF, that is designed to track the price of crude oil.

What he didn’t know about was something called contango. Not only does this word sound like the famous dance, but it also a figurative dance as well.

As this investor learned, the contango trap happens when the price of oil, or other commodity, is rising, but the ETF designed to track the price of oil loses money. Huh?…

It basically comes down to an inability to take delivery of the oil. The ETF is a pool of investment dollars, not an empty oil tanker. In order for the ETF to stay in the game, it has to renew its futures contracts. So when the contract it currently holds is close to expiration, it buys another one at (you guessed it) a higher price, thus eroding the value of your original investment.

It’s not just individual investors learning hard lessons by using strategies involving alternative investments, there are plenty of examples of big pension and endowment funds gambling their assets on risky and overly complicated investments.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aHQ2Xh55jI.Q

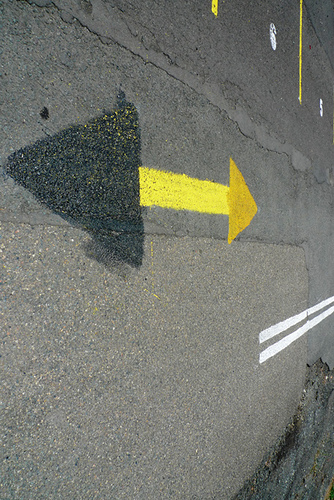

The moral of the story is to control the impulse to go in a different direction just for the sake of trying something different. If you are going to go down a new investment path be sure that you have charted the course by using a sound, straight-forward strategy.

As a rule of thumb, the more complicated an investment is the less likely the investor fully appreciates the risks they are taking. As Warren Buffett once said, “Never invest in a business you cannot understand.”

Photo Credit: Rndoam