Have you wondered if a Roth IRA Conversion will save you more in taxes?

2020 has offered a unique opportunity for some taxpayers to capitalize by making a Roth conversion. This is because the CARES Act allowed for a required minimum distribution holiday in 2020. Thus lowering the required amount many retirees normally have to take from their retirement accounts.

Mechanically, this strategy involves converting savings from pretax retirement accounts, such as 401ks and Traditional IRAs, to a tax-free Roth IRA. While this strategy can help you save tax, it involves analyzing multiple pieces and timelines of your financial picture.

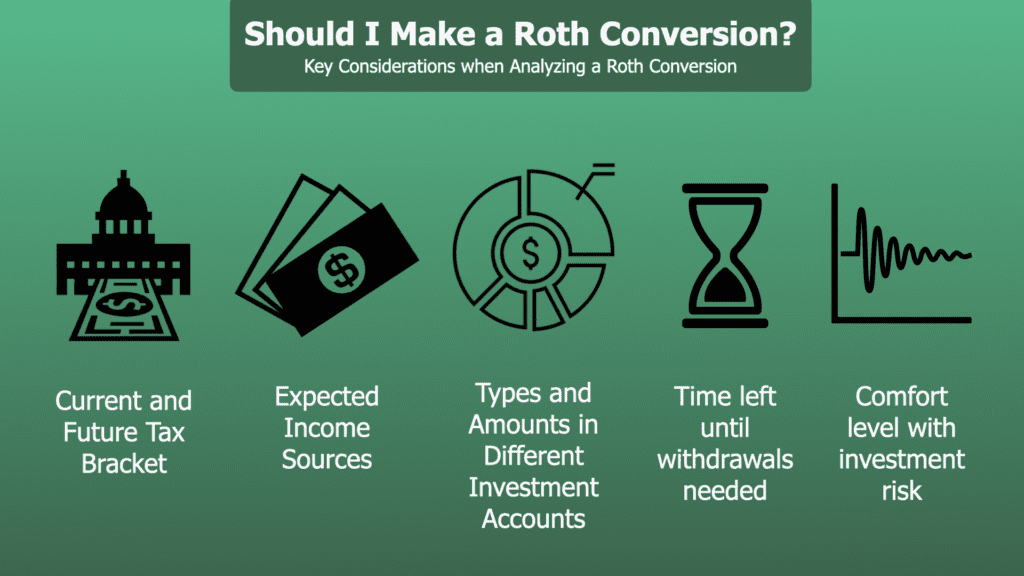

To make the best decision requires an in-depth evaluation of your specific situation. Primary items to consider:

- Current and Future Tax Bracket

- Expected Income Sources

- Types and Amounts in Different Investment Accounts

- Time left until withdrawals needed

- Comfort Level with Investment Risk

Early Retirement is Good Time to Consider a Roth IRA Conversion

The goal of this strategy is to transfer a specific amount from a pre-tax account to a Roth IRA during lower income years resulting in lower tax rates in the future. Generally, real opportunities present themselves once a taxpayer has retired, has not claimed Social Security or taking required minimum distributions (RMDs). That’s because you have more flexibility due to fewer forced income sources. Not you? Not to worry, as this strategy can be beneficial in other situations where income is expected to be lower than future years. Even still having after-tax savings is helpful to cover cash flow needs as well as the increased tax payment.

Download our Should I make a Roth Conversion checklist to assure you’ve considered critical decisions in dealing with a Roth IRA Conversion.

How a Roth IRA Conversion Impacts Health Insurance

Deciding if a Roth conversion strategy will work for you is complex. In addition to the immediate tax impact, you should consider how it may impact your healthcare premium. Increasing income above specific modified adjusted gross income (MAGI) levels could create more unexpected tax in several areas. Pay special attention to your MAGI levels if you are enrolled in an Affordable Care Act health plan or Medicare. Each has their own MAGI tables to watch where extra tax could occur.

If using an ACA health plan, and your MAGI is $1 over the 400% poverty level for your family size, you could forfeit any subsidy you otherwise could get if income was lower. This calculator from healthcare.gov has instructions to help you add back items to calculate your MAGI. If your Roth conversion pushes you above this limit, it could drastically reduce the benefit.

From the Medicare premium perspective, if the amount you are converting to a Roth IRA is too high, it could trigger a higher Medicare Part B premium down the road. You can use this chart from medicare.gov to see where your expected income will fall with the corresponding price increase.

Social Security and Roth IRA Conversions

If already taking Social Security, you’ll need to watch how a Roth IRA Conversion may affect the taxation of those benefits. We call this the Social Security bubble. That is when being in certain income ranges can cause more of Social Security to be taxable. This could occur from a RMD, pension or extra IRA withdrawals related to a Roth IRA Conversion. We walk through an example for a single and joint taxpayer in our article “When Should I Take Social Security?”

How Tax Reform Changed the Roth IRA Conversion

Tax Reform in late 2017 added an additional wrinkle to the Roth Conversion strategy: Recharacterizations are no longer allowed. Prior to reform, if you implemented a Roth Conversion and then determined it was not beneficial when preparing your tax return, you could move the funds back to your pretax account. Under new tax law, after the conversion is complete, you are unable to recharacterize and will have to pay tax on the amount converted. Given that the conversion is now a permanent decision, determining the appropriate amount to convert requires an in-depth analysis that will carry through to other areas of your tax picture.

The goal of a Roth conversion strategy is to achieve the lowest overall tax rate across multiple years. Good execution requires ongoing analysis because things change from year-to-year that must be adjusted to maximize efficiency. Coordination of current and future tax brackets is a must to make the most of opportunities and to avoid mistakes.

Resources and Helpful Links:

- WSJ – Roth IRA Conversions: What You Need to Know

- Schwab – Roth IRA Conversion Calculator

- Fidelity – Roth IRA Conversion: 7 Things to Know

- Financial Planning Magazine – The secret to more tax-efficient Roth IRA conversions