It’s been over 10 years ago that my family and I set off on an adventure visiting colleges and universities across North Carolina. It was spring break of my junior year of high school and I was in search of where I wanted to apply and attend college.

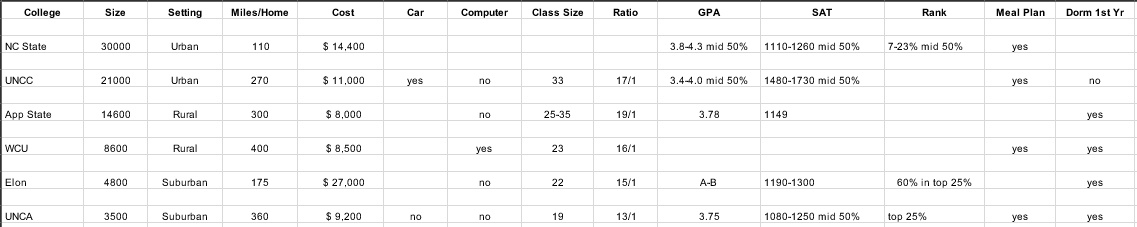

I had a detailed spreadsheet to help me organize my likes and dislikes of each school. This list included things such as average class size, distance from home, total enrollment, dorm life, meal plan options and if I could have a car on campus as a freshman among many others.

My parents also had a detailed spreadsheet, however theirs looked much different than mine. Their list was highlighted by tuition cost, average GPA and SAT scores for incoming freshman, expected financial aid, scholarship opportunities, and the overall likelihood of me getting into each college and how to pay for it.

We were actually able to recently dig up some of the old spreadsheets that we used!

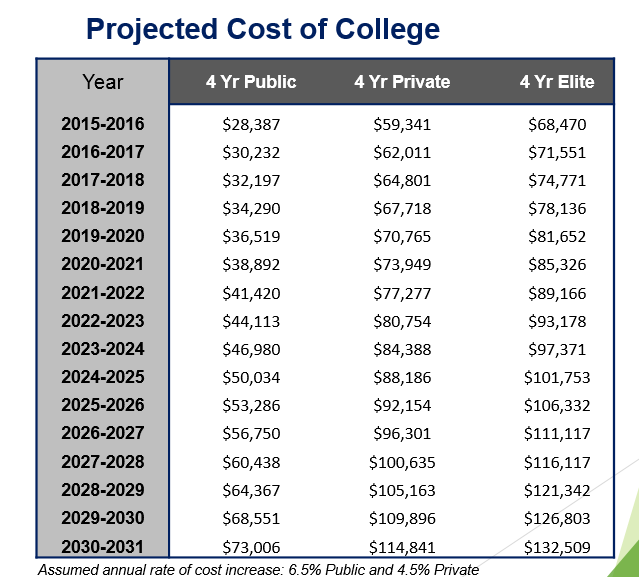

The eye opening thing to me is the approximate cost of college then (approx. 2006) vs. now (2016). The same NC colleges above vs. the approximate cost now according to our new college planning software program: Stratagee.

Research shows nationwide projected cost of college going forward as:

College is certainly a large expense that is often a goal of parents to cover for their children.

- How does the parent know if they can afford to do so?

- Does this impact when I can retire?

- Will my child be eligible for financial aid?

- Are there way’s to more efficiently pay for college?

These are common questions that we receive on this subject and ones that we think are very important to cover with parents in this situation. The first place to start is the financial plan where we can access the overall cost and how much the parents can afford to pay the college toll on their path to retirement. With the help of our college planning software we can then look at individual colleges and the likelihood of acceptance, financial aid, and expected family contribution (EFC). Strategies can then be implemented to improve efficiency of paying for college as well as increased chance of financial aid.