The stock market movements over the past week have prompted many investors to ask how to protect themselves in a falling market.

While market drops are unsettling, they typically do not warrant a change to your long-term strategy. When prices fall, stocks actually become less risky for the long term as future return potential improves with cheaper prices.

Is your investment strategy in line with your goals?

Holding stocks can be very painful in the short term, but that is the price of long-term higher returns from a diversified portfolio. If your investment strategy is still consistent with your long-term goals, then the best thing to do is likely nothing.

Of course, this is easier said than done. Investing sometimes seems designed to cause most investors to do the wrong thing as investors want to sell after the market experiences losses and buy after the market has risen. This is why it is important to try to objectively look at future return potential rather than recent past results.

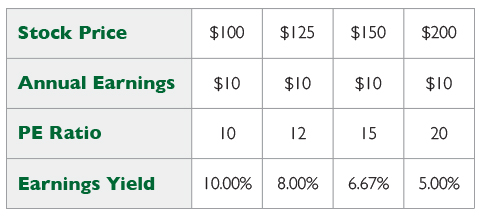

When you invest in stocks, you are essentially investing to participate in companies’ future earnings, so you want to have a sense of whether those future earnings will provide you with a decent return based on the current stock price.

The price to earnings ratio is one of the most common ways to assess and is simply stock price divided by one year’s earnings. You can see in the table below, as stock prices go higher, the PE ratio is higher and the earnings yield is lower.

Diversification can fight lower stock returns

Of course, most investors look at a rise in stock prices and think that it must be a good investment because it has risen and that lower stock prices mean a stock is a bad investment.

Sometimes when it comes to an individual company and its stock, lower prices are a bad sign because individual companies can and do sometimes go bankrupt.

That is why diversification is important, and when it comes to assessing future returns for the stock market as a whole, lower prices are a very strong indicator for higher returns and less risk going forward.

We use a variety of tools and models to gauge return potential, and when it comes to the stock market, we rely most heavily on price/earnings models that attempt to smooth out the business cycle because profit margins and growth rates tend to be high at business cycle highs and tend to be low at business cycle lows.

The following table illustrates our estimates for the US stock market for the next ten years and you can see the inverse relationship between price and future returns.

You can see why our research was indicating that we should be cautious when the S&P 500 was near its recent high, and also why we would become more aggressive if stock prices fell further.

We also have to compare the return potential for the stock market to other alternatives like bonds and cash. Currently cash return rates are near 0%, and are not likely to be substantially higher over the next few years. Ten year treasury bonds are yielding about 2%. This means that even with the S&P 500 at 2100, the stock market is likely to outpace bonds and cash over a ten year period.

The most attractive investment area right now are foreign stock markets which are priced about 40% to 50% lower relative to cycle adjusted earnings than US stocks, so our estimates for 10 year return range for foreign stocks is 7% to 12%.

We understand that the current market environment can be stressful and the constant media coverage can feel like a call to action. If prices continue to fall we will become more aggressive and begin recommending more stock purchases as future return potential will be more attractive. We are available to answer any questions you have or if you would like to discuss in more detail.