Warran Buffett once said, “the investor of today does not profit from yesterday’s growth.” This is never more evident than with individual investor performance in mutual funds.

Morningstar, the mutual fund research company, annually calculates the difference between mutual fund returns (time-weighted) and investor returns (dollar-weighted). A mutual fund’s published total return reflects a “buy and hold strategy.” (This information is widely available on fund family web sites and Morningstar.)

Reality check

But, very few investors actually buy and hold. Investors move their money in and out of funds as they search for the best return. As a result, a mutual fund receives a great inflow of assets right after a period of good performance and right before a period of poor performance. The gap between investor return and total return indicates how well investors timed their fund purchases and sales. Unfortunately, this return gap is negative.

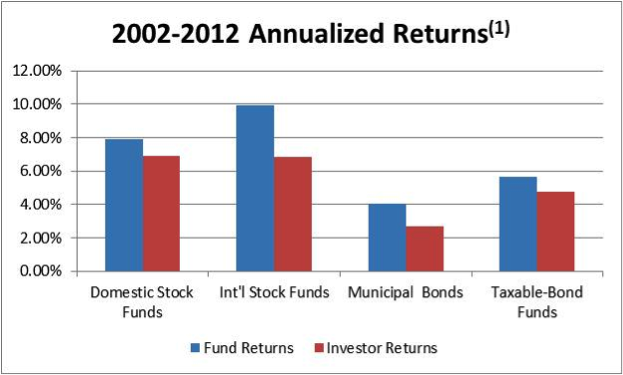

Big surges and big declines in the market spur greed and envy, then fear and anger. Typically, the more emotional an investor, the worse his/her decisions will be. This is noted in the chart below as 10-year annualized return differences between mutual funds and individual investors range from 0.87% to 3.11%. These are materially different as they are compounded over 10 years and significantly reduce long-term investment performance.

We did the research

In additional research done by Financial Symmetry (“FSI”), we calculated the mutual fund vs. investor returns for Vanguard investors over this this same 10 year time period.

Vanguard emphasizes buy and hold, which should result in a smaller return gap, but the results were similar to the Morningstar study. Weighted by mutual fund asset size, the mutual fund returns exceeded investor returns by 1.17% from 2002-2012. Since we weighted returns by fund size, it is heavily allocated towards US stocks, but saw similar differences in the asset classes included in the chart above.

The research shows that individual investors often suffer from poor timing and planning. Investors know they should hold diversified portfolios, but many chase past performance and end up buying funds too late or selling too soon.

Recommendation

Therefore, we recommended investors work with a qualified financial planner on an ongoing basis to help steer them to make rational investing decisions and avoid these mistakes.

Please contact us for further details regarding historical FSI returns.