When it comes to investments, too many people take a haphazard approach when what they need is an investment decision process that makes the most of a number of different available resources.

When it comes to investments, too many people take a haphazard approach when what they need is an investment decision process that makes the most of a number of different available resources.

This episode is aimed at helping you understand what goes into a good investment decision process and how the team at Financial Symmetry approaches investments for its clients. Including:

- how they impact a good investing strategy

- how consumer sentiment figures in

- why it’s important to make use of the technical data available

You’re going to get an inside look into the way the Financial Symmetry team helps their clients make the best investment decisions possible.

We initially recorded this podcast on February 1, 2018 and given the market events of the last week we recorded a brief update to kick it off.

- Quick Summary

- YTD through February 9, 2018 the S&P 500 is down ~1.84%

- If you are happy with your 12/31 balances you’re unlikely to see a material change

- S&P 500 1, 3 and 5 year returns of 15.78%, 10.87% and 13.89%, respectively. All above long-term trend

- Volatility (up and down markets) is normal. Historically, the market declines 10% one time a year, 15% about every 2 years and 20% every 3.5 years.

- The decline is primarily driven by strong economic news and the expectations of higher interest rates

- You can’t have return without risk. This is why stocks provide the highest return over the long-term.

- What you can do about it

- If it has been difficult to stomach the market moves it may be time to re-evaluate the risk in your portfolio.

- Stop watching the news! Their job is to sell headlines not help you reach your retirement goals. Talk to your financial advisor instead.

- If you are a saver this is a good news. Chance to buy stocks at lower prices.

- For a retiree or someone withdrawing funds make sure you have access to short to intermediate term bonds over the next 5-7 years. Re-evaluate the stock risk in your portfolio.

- Focus on what you can control such as spending, taxes, insurance, etc.

A good investment decision process helps you avoid big mistakes that destroy long-term benefits

Too often, individuals make their financial planning decisions based only on what looks attractive in the moment.

The fear of missing out is real. But there are many resources and data points available that take historical trends and other factors into consideration in a way that could enable your investment decision process to be much more helpful.

A good investment decision process can help you avoid the big mistakes that will sink your long-term strategy. It’s those spontaneous decisions based on what looks hot at the moment that we’re talking about, so make sure you listen and learn what you can do to avoid those kinds of pitfalls.

What IS a short-term market indicator and why does it matter?

One of the things that should be a part of every investment decision process is the consideration of short-term market indicators.

What are they? They are the things we can see at the present moment that give us clues as to where the economy might be headed. For example:

- Are we coming out of or going into a recession?

- What is the current consumer sentiment about the economy?

- Are there technical trends and stats that inform us of what may be coming?

These are things the average person doesn’t take time to look into or consider but are vital components of the investment strategy that the Financial Symmetry team brings to bear on its client’s investment decisions. You can hear the unique approach that the team takes, on this episode.

It’s easy to sell fear – but it’s not a sound way to make investment decisions

On many of the talk news programs and in some of the high-profile financial publications you hear talk about warning signs that the economy may be about to go down the tubes.

Of course, they could be right with their predictions but making decisions based on fear is one of the weakest options for the smart investor. It’s easy to sell fear, but it’s not always the best way to determine how to invest your hard-earned money.

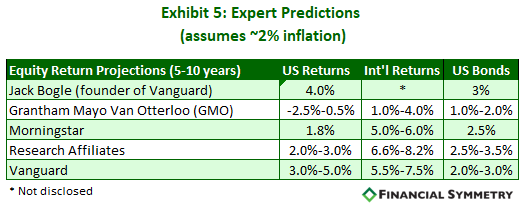

In this episode, Mike and Chad discuss why fear is not the best motivator for good financial decisions and how you can take a different approach that enables you to create a long-term strategy that actually works. They also describe the lower return expectations different experts are predicting going forward.

The best investment strategy won’t help if the rest of your financial life is a mess

Even though this episode is focused on making the best investment decisions possible through a good investment decision process, that process and strategy won’t do you much good if the rest of your financial life is a mess. What are those areas?

- Do you have enough life insurance?

- How are you spending compared to the spending plan you’ve made?

- Do you have an adequate estate plan in place?

- Are you being tax-efficient?

These are only some of the fundamental questions you need to address before you get too involved in making a long-term investment strategy. If you don’t, you can wind up wasting a lot of time with no benefit to show for it.

Outline of This Episode

- [0:27] Investments, forecasting, and good investments strategy

- [2:50] Summary of 2017: Extremely strong markets worldwide

- [6:01] The process the Financial Symmetry team uses – it’s a bit unique

- [9:08] Where are the different market indicators today (2/1/2018)

- [12:05] How is consumer sentiment these days?

- [17:14] How do we use the technical data to make better investment decisions

- [21:11] Valuations: what are they and how do they work?

- [31:07] What you really need to do is to focus on things you can control

Resources & People Mentioned

- Core Components of Our Investment Strategy

- The Financial Symmetry Approach to Financial Planning

- Blog Post: Should I Own International Stocks

- Episode 44: What Behavioral Economics Means To You

- Meb Faber’s article about Moving Averages

- Jack Bogle’s forecast of the next 4 years

- Vanguard’s outlook summary

- Morningstar’s Forecast

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh @TeamFSINC

- Follow Financial Symmetry on Facebook

- csmith@FinancialSymmetry.com

- meklund@FinancialSymmetry.com