As financial planners, we are often asked about how to fund retirement income needs. Traditionally income in retirement has been thought of as a three-legged stool-Social Security, pension, and withdrawals from savings. Today’s retirees still count on Social Security, some receive a pension from their former employer, and most rely on withdrawals from their investments to meet a substantial portion of their income needs.

Unfortunately, many retirees rely on a rule of thumb or use no plan at all when deciding how much to withdraw. Many people have heard of the 4% rule. Essentially this rule of thumb entails withdrawing 4% from your nest egg in the first year of retirement and adjusting that amount for inflation annually. This is advice you would likely find in a Do-It-Yourself investing manual.

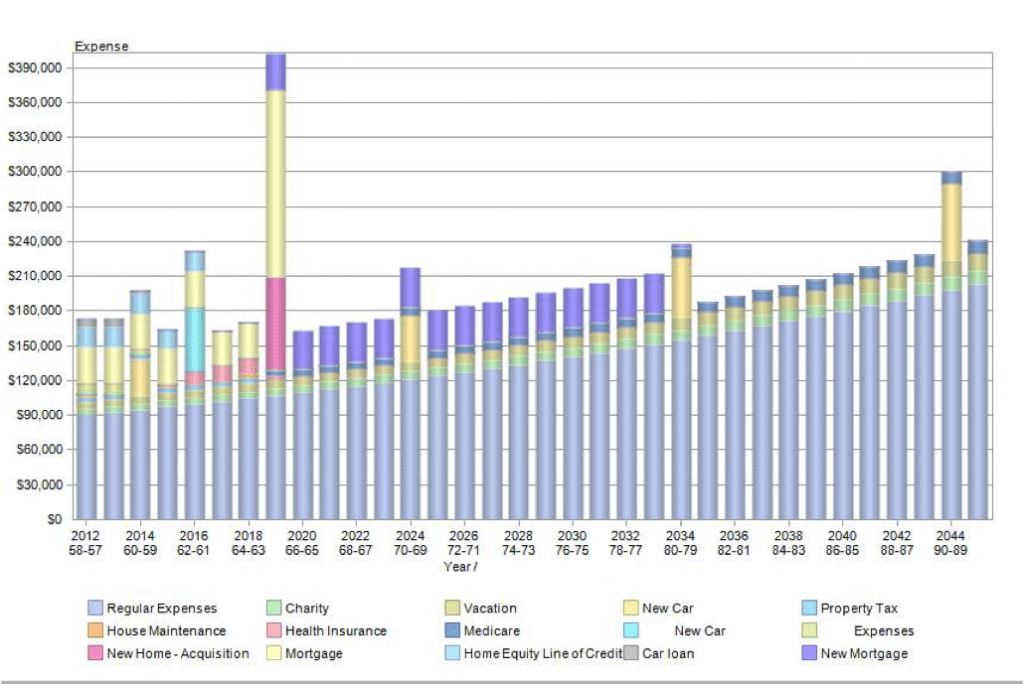

The 4% rule is strong in theory, but it is inherently problematic in practice as it does not take into account lifestyle changes and extraordinary expenses that are likely to occur over 30 years or so in retirement.

Given the dynamic nature of our lives, it is not surprising that the recent Gamma research by Morningstar indicates that using a Dynamic Withdrawal Strategy has the greatest impact on increasing your retirement income. “Under this approach, the percentage withdrawn from the portfolio will vary in a given year based on assumed remaining life expectancy of the retiree/s and the portfolio equity allocation.”

At Financial Symmetry, our financial planners go a couple of steps further in developing custom retirement income strategies and optimizing Gamma. In addition to creating a dynamic withdrawal strategy, our process allows for adjustments based on changes in the tax code and/or lifestyle changes as they arise. This typically also entails evaluating when to start social security, the best pension distribution option, and plan feasibility over time.

The Gamma research highlights the importance of continuously monitoring your financial position and making adjustments regularly to stay on track. Contact one of our financial planners to find out how a dynamic withdrawal strategy can work for you.