We recently hosted our first college planning night to help individuals and families make smart college decisions. The discussion focused on families with children at or near college, but is relevant for kids of all ages.

Paying for college involves a lot more than saving for it via a 529 plan and applying for financial aid. It requires the integration of college admissions, financial aid, taxes, investing and personal finance into a best strategy that helps parents preserve their assets while cost-effectively paying for college. Therefore, to maximize your personal situation Financial Symmetry has partnered with Stratagee, a leader in professional college planning services. We now have access to sophisticated college planning software to help you make smart financial decisions.

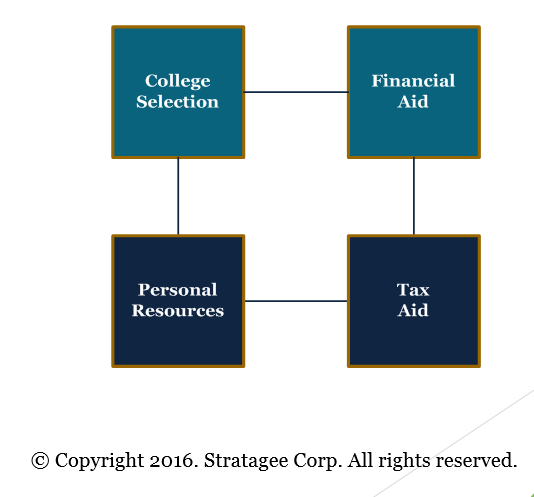

The college planning process focuses on four key components listed below that we analyze as part of our process.

College Selection

First, our college selection software helps parents/children determine potential admissibility of selected schools based on their academic record. Next, we look at potential costs for the selected schools. Currently, costs range from approx. $20,000 for in-state tuition to approx. $65,000/year for elite private schools. These costs are estimates and based on the total cost to attend that school before any aid. Therefore, it is important to determine early in the process if the college will be a reasonable option given the likelihood of your child getting in and the cost of the school.

Need-Based/Merit Aid

There are two primary types of aid which includes merit and need-based aid. Descriptions are below, but for this article we focus primarily on need-based aid.

- Merit Aid – based on the student’s academic, athletic, music and other merits, not family finances

- Need-Based – based on the parent/student’s ability to pay based on their finances

Need-based financial aid is awarded on the basis of your family’s finances and the cost of each college. There are two financial aid forms, the FASFA and the CSS Profile. Most colleges and universities nationwide use the FASFA as their sole application for need-based financial aid. However, there are about 200 colleges which require that the CSS Profile also be completed in addition to the FASFA. The result of completing these forms is the calculation of your Expected Family Contribution (EFC). This EFC is the minimum amount the student is expected to contribute toward the cost of college. The EFC formula takes into account the assets and income of the parent and student, family size and number of dependents enrolled in college in a given year. Therefore, a simple formula is the Cost of Attendance – EFC = Financial Need. We work with families to help them understand the EFC calculation and if there is anything they can do to improve their situation. Finally, even people with high incomes or assets may qualify for financial aid if their child attends an expensive private school.

Tax Aid

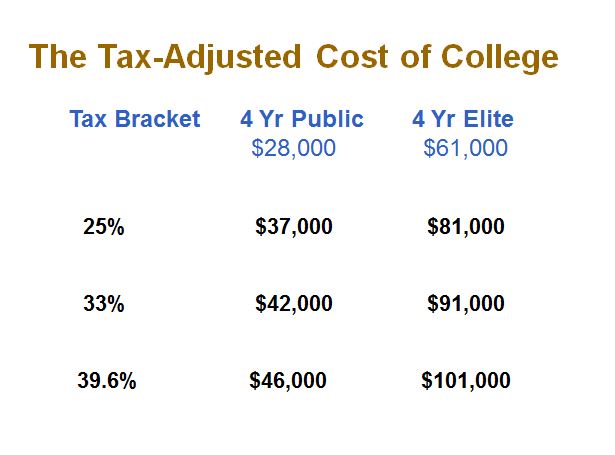

Third, whether your child is eligible for need-based aid or not, and whatever your out-of-pocket cost is at each college, you have to find the most tax-efficient way to pay for it with your personal resources. Below is a chart of the tax-adjusted cost of college after taking into consideration your tax bracket and if you use current income to pay for it. College tax credits, income shifting and investment strategies can all help reduce the tax cost of college. Furthermore, there are complicated strategies which involves gifting assets to the kids to eliminate capital gains and take advantage of college tax credits, but we recommend working with a professional financial planner to implement these.

Personal Resources

Fourth, after evaluating need-based, merit and tax aid what is left are personal resources from the parent or student to help pay for college. This could be existing income, assets, loans or gifts, but it is important to analyze the pros and cons of each option which we do as part of your financial plan.

Conclusion

The cost of college has risen dramatically over the last 10-15 years. Therefore, for most families the real challenge is for parents to pay for college and preserve assets for retirement. As a result, it is important to plan ahead and see how college costs impact your financial goals. Also, to see if there is anything you could be doing differently to receive additional assistance through need-based and tax aid.

Finally, with the four-year cost of in-state public college over $100,000 we highly recommend working with a qualified financial planner that focuses on college planning like Financial Symmetry to help make smart financial decisions. When to start? We recommend not later than when your child enters high school as your income for financial aid starts in January of your child’s sophomore year.