After years of saving, you are excited about the potential for your next chapter, but still have that nagging unknown feeling, that makes you wonder if you are ready.

During your working years, you have saved diligently in your various retirement accounts but now there’s a whole new set of decisions to make to retire successfully.

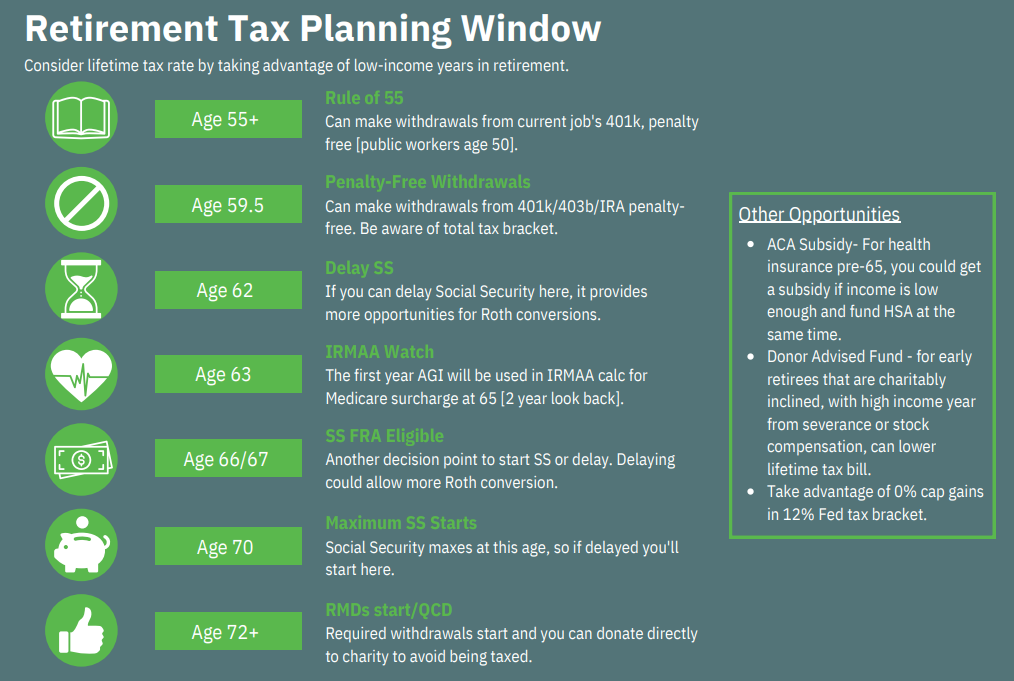

You’ll have to create your own retirement paycheck, source your own healthcare pre-medicare, decide when to take Social Security and/or your pension, and decide which accounts to withdraw from first to limit taxes.

Typical questions before retiring:

- When should you start Social Security?

- How will you handle health insurance cost?

- How should the way you are invested change?

- How can you minimize taxes throughout retirement?

- What if you have a long-term care health issue?

To have the most confidence, it helps to run multiple scenarios to evaluate potential outcomes. By creating a retirement plan, you can gain peace of mind about your retirement transition.

Are you ready to retire with confidence?

It’s easy to get started. Just provide us with some basic info here and we will be in touch to see if we are a good fit to help you.

You can see a preview of the steps we take in our planning experience here.

Additionally, we’ve included a hypothetical example below of the journey a potential client might have.

A Retirement Case Study

Martin and Louise are making plans for their upcoming retirement lifestyle.

- Martin has been an employee of a large engineering firm for over thirty years.

- They own their home outright and have no debt.

- Much of their savings has been accumulated in Martin’s employer-sponsored retirement plan.

- They don’t have large Roth IRA balances, but have been building cash in their bank account due to market volatility.

- Both Martin and Louise are currently eligible to begin receiving Social Security but haven’t reached the required age for maximum benefits.

- One of their main goals is to travel the country extensively visiting family and friends.

Questions to be addressed:

- Are they invested properly?

- When should they begin receiving Social Security?

- How much will they need to draw from investments annually to meet their goals?

- Is their lifestyle sustainable over the long term?

- What tax opportunities are available?

Planning:

Because Martin is planning to work a few more years it makes sense to hold off on taking Social Security in order to avoid punitive taxation.

Since Martin and Louise don’t keep a strict budget, the first step is to begin using expense tracking software. This helps them understand how much they are spending and establish a base level of consumption spending that helps determine extraordinary items such as travel, car purchases, and home maintenance that will not happen each year.

Digging in here, helps them understand what they will need to draw from their investments each year to meet their goals. After setting suitable targets for each category, monthly transfers are set up to their checking account, which will replace the paycheck they had during their working years. This also helps them stick to their expense targets by not having excess cash on hand.

When evaluating the options in their employer 401k plan, the investment options do not appear to be the best match for their risk tolerance. The choices available are all variable annuity subaccounts with high costs and substandard returns. So Martin decides to roll those assets into a traditional IRA account where the allocations can be structured appropriately using a wider investment selection with lower cost. This approach can offer more flexibility with their withdrawal needs each year.

Martin and Louise are excited about their next chapter. They decide to delay Social Security until age 70. Since they have bank savings to use for spending, this allows for more flexibility in making Roth conversions each year at a lower tax rate. This also lowers their overall 401k/IRA balance to reduce required withdrawals when they turn 72.

They begin scheduling trips to visit their friends and family with the extra free time they now have.

Download the Pre-Retirement Checklist

If you have questions about your potential to retire, download our Pre-Retirement Checklist to get you started preparing.