Brexit Rebound – 3rd Quarter 2016 Investment Commentary

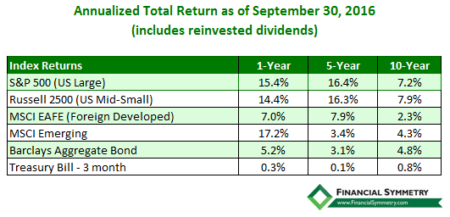

Summary Following the Brexit shock in June global markets recovered strongly over the past quarter, with emerging market stocks leading the way. Prior to the recent recovery foreign and emerging markets underperformed US stocks by a wide margin in…