Rental real estate is hot right now, especially in the Triangle area. Over the past two years, I’ve had many of my clients ask about rental real estate and whether it could be a good avenue to pursue to diversify their assets away from the stock market.

Rental real estate is hot right now, especially in the Triangle area. Over the past two years, I’ve had many of my clients ask about rental real estate and whether it could be a good avenue to pursue to diversify their assets away from the stock market.

It’s all over financial media, and it’s one area of finances that people are likely to tell others about, while most areas of finances are rarely discussed in public settings.

As someone who’s seen the ins and outs of many households’ finances and has seen people delve into rental real estate both successfully and unsuccessfully, I encourage you to do a lot of research/homework before deciding whether rental real estate is right for you.

If you’re curious about whether buying rental real estate property is a good financial choice for you, in this post, we’ve outlined some things to consider before making your decision.

Type of Rental Real Estate

There are many different types of rental real estate. Here are some of the potential options to choose from:

- Vacation

- Residential

- Low income

- High end

- Multi-unit

- Single family home

- Townhome

- Condo

- Short-term

- Intermediate-term

- Long-term

- Rental-only

- Rent plus personal use

Long-Term Growth

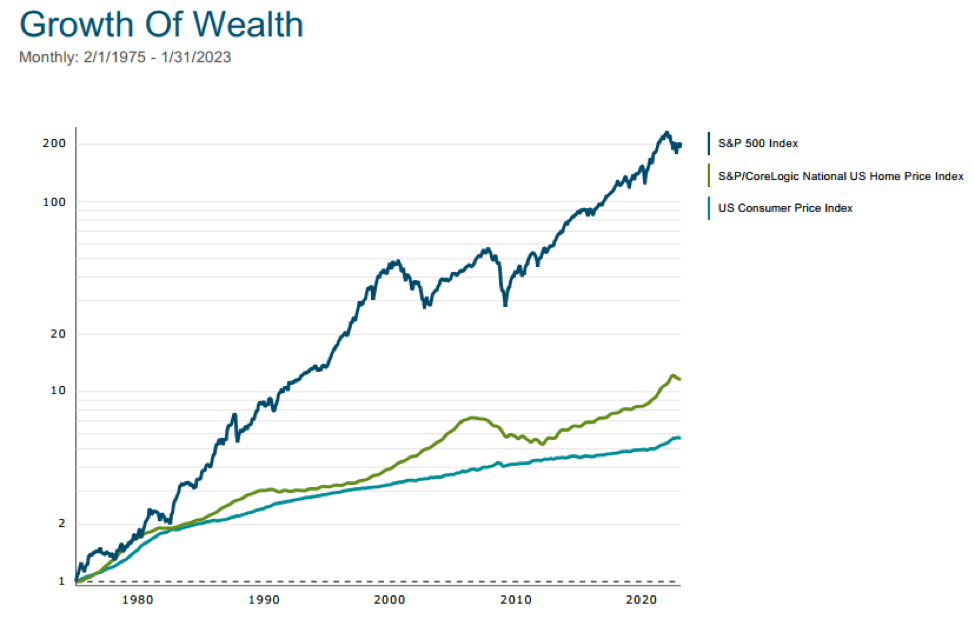

Historically, residential home price appreciation has exceeded inflation, but trailed the stock market over the long-term. As noted in the graph below, from January 1, 1975 to January 31, 2023 the S&P 500 returned 11.72% annualized vs. 5.23% for US National Home Price Index. The good news is both stocks and real estate exceeded inflation which was 3.71%.

The first thing to note in the graph for real estate returns is it excludes rental income and the potential benefit from leverage (debt). Historical data on rental income (net of expenses) is very difficult to determine and although using leverage can enhance returns it also comes with additional risks (e.g. The Great Recession). On the other hand, the real estate returns don’t include many other costs associated with home ownership (mortgage interest, taxes, insurance, closing expenses, repairs, maintenance, capital improvements, etc.). A true rate of return would need to include these costs which is very complicated.

In addition, keep in mind when it comes to rental real estate is that the income generation and asset growth associated are a long game, generally with low-to-no income in the early years with the mortgage payments and ongoing maintenance costs.

Fortunately, as time passes, your rental income should increase, while the mortgage level generally remains the same if you have a fixed rate mortgage. The historical asset growth rate for real estate is slightly above inflation over the long run, though the growth rate in any given year is likely to be higher or lower than inflation.

Expected Costs

Most people new to rental real estate are surprised to learn of all the expenses that are involved with managing rental properties.

Expenses you will need to cover include the following: property tax, insurance, maintenance and repairs, appliance replacements, administrative costs, and more. Additional expenses that you might encounter include management company fees, HOA dues, damage repairs, landscaping, utilities, replaced furnishings, renovations, interior or exterior paint, window and door replacement, plumbing fixes, legal expenses, and more.

Of course, the level of expenses you’ll actually pay will vary depending on what type of rental you have, the location, the condition of the property when you purchase it, the care or lack of care from your renters, etc. But some general rules of thumb to help you plan for what your average annual expenses just to maintain the value of the property, and therefore protect your future rental income, include the following:

- The 50% Rule – Planning on spending 50% of annual rent revenue on rental property costs, not including the mortgage.

- The 1% rule – Expect to spend 1% of the property value per year

- The Square Footage Rule – Set aside $1 per square foot per year

Depending on which option you use, your expected costs can vary widely, but research has shown that the 50% rule or $2.50 per square foot are the average maintenance costs for apartment complexes maintained by professional management companies.

Keep in mind that professional rental companies have economies of scale, meaning they are able to keep their costs per unit or per square foot lower due to having a lot of units vs. the average household who may want 1 or a few rental properties.

Other Important Items to Consider

To help yourself prepare for owning rental real estate, ask yourself the following questions:

- How much are you comfortable spending on the purchase price for the property?

- Do you have cash on hand for the maintenance costs as they arrive? These pop up when you least expect it, and they need to be addressed in a timely manner.

- What is your expected profit and return?

- Will you complete maintenance and repairs yourself or hire a professional?

- Do you have previous experience as a landlord or property manager? If not, will you manage the property yourself or hire a management company?

- Are you prepared to go into this with a business mindset? It’s easy to develop emotional ties to properties that you’ve chosen and fixed up, only to grow disappointed if renters don’t care for the place the way that you would.

- Are you prepared for dealing with tenants or potentially having to evict them?

- If you have a partner or spouse, are you both on the same page about whether to buy?

- How will you handle common tenant issues like smoking, secret pets, infestations, water damage, mold, or damage to the building?

- Are you protected if a tenant decides to sue?

- What’s your end goal of becoming a landlord?

Tips to Keep in Mind If You Decide to Buy a Rental Property

If you’ve answered the questions above and feel confident moving forward, consider the following tips to help aid in your success.

- Maintain a separate account: Just as with any business venture, keep a separate checking account for the rental income and expenses, apart from your personal accounts. This helps tremendously on the tax/accounting side of things and helps you see whether cash flow is positive or negative over time. A separate credit card might be worth using as well instead of a personal card for rental expenses.

- Prioritize a good purchase price: A low purchase price goes a long way when you’re trying to make a profit on real estate.

- Consider whether you should make a plan for entry and exit: For some situations, having an entry gameplan and an exit gameplan ahead of time can help you know when to buy or sell. For example, “We plan to buy a duplex with 2,000 square feet in each unit in the ______ area. We’ll buy if the price is below $_____ because we believe that would be a good value. If the value of the property has grown ___%, we will sell to retain the profit.”

- Consult an estate attorney: Owning additional real estate can make your estate situation more complicated for your heirs should you pass away. An estate attorney can help make sure things are setup to (1) protect you and (2) make things simpler for your heirs.

What to Know About Buying Rental Property in North Carolina

Local real estate broker, Sandy Edwards, of Coldwell Banker Howard Perry and Walston offers some insight on the current state of the local market and what his experience has been like owning a rental property himself in NC:

“The market has stabilized a bit over the last twelve months, making for a more balanced playing field for buyers and sellers. We’re also seeing better prices for investment properties now than we have over the past couple of years. If you’re thinking of taking the plunge, my best advice would be to get a great management company for your property. They take a cut of your profit, but they take care of so much so you don’t have to.”

Other Posts to Read When Considering Real Estate Investing

- “This 33-year-old owns 19 rental properties. Here’s what he says potential investors should know”

- “Becoming a small-time landlord is not some sort of financial genius move. It is an ordinary job and a rather poorly paid one.”

- “Suggested sequence of starting a real estate investing program”

- “How to Think About Home Price Appreciation”

Talk to Your Advisor Before Making a Final Decision

As with any major financial decision, we recommend talking to your advisor to help you weigh the pros and cons of whether buying a rental property makes sense for you. If you’re interested in learning more about financial planning or wealth management, contact us here.