Recent headlines have people thinking more about investing for inflation.

It’s the most recent economic worry, but there’s always something to scare or concern investors. Think about the last 16 months. We’ve had:

- COVID Crash

- 2020 Election

- Reddit/Robinhood/Gamestop

- Crypto Volatility

Now it’s inflation. But it’s a good reminder that listening to the media can be expensive.

In this week’s episode, we are breaking down how to think about and prepare for inflation as it relates to your investment strategy.

How to Think about Inflationary Scenarios

What is inflation?

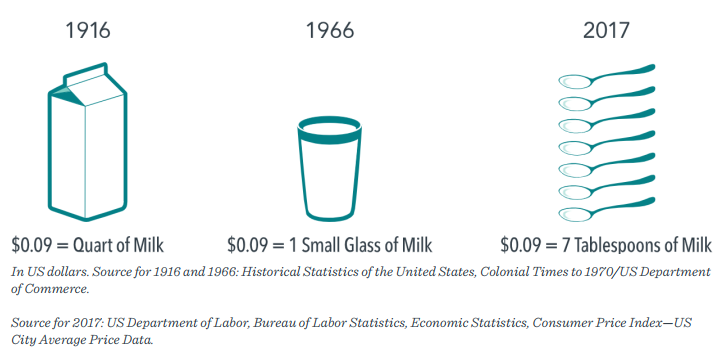

Increases in prices over time. For example, a gallon of milk cost ~$0.26 in 1926 and has increased to ~$3.00 today. Since 1926, inflation has averaged ~3% per year.

On the other hand, deflation is when prices decline over time. These periods are generally driven by economic downturns such as the depression in the late 1920’s/early 1930’s or a brief period during the financial crisis. While the media can make the threat of inflation sound scary, it is a normal part of time passing.

Hyperinflation, however, can be very damaging. While regular inflation has averaged ~3%/yr, hyperinflation is when prices spike very quickly and at much higher rates. For example, Germany in the early 1920’s and more recently, cases in Venezuela and Zimbabwe.

Hyperinflation it typically driven by two primary causes: Government debt in another currency (Germany after WW1) and supply chain shocks (no access to necessary products).

We are not concerned about hyperinflation today.

Current Situation

The last twelve months ending April 30th, 2021 saw an annualized inflation rate of 4.2% after averaging 1-2% over the last 10 years. This is the largest jump in inflation since September 2008.

It is important to keep in mind, however, that these numbers were coming off March/April 2020 lows where inflation declined due to lack of demand for products and services – driven by the COVID crisis.

The big question most are asking: Are these permanent or transitory increases?

Transitory increases are those that are shorter-term or temporary. These have been driven by stimulus checks and government support from the $1.9 trillion American Rescue Plan passed in March 2021.

Permanent increases on the other hand are those in which prices are expected to increase materially year over year. Today, this can be seen somewhat in the Real estate markets.

It is too early to tell which route it will take, but keep in mind that the Federal Reserve wants some inflation as that is their mandate and is healthy for the market. If inflation begins to rise too quickly, they can always raise interest rates to slow down the economy.

What should you do about it?

Inflation is good for stocks and real estate over the long-term. Companies can raise prices leading to higher gross sales and companies have claims on their real assets (buildings, plant, land, equipment, etc.).

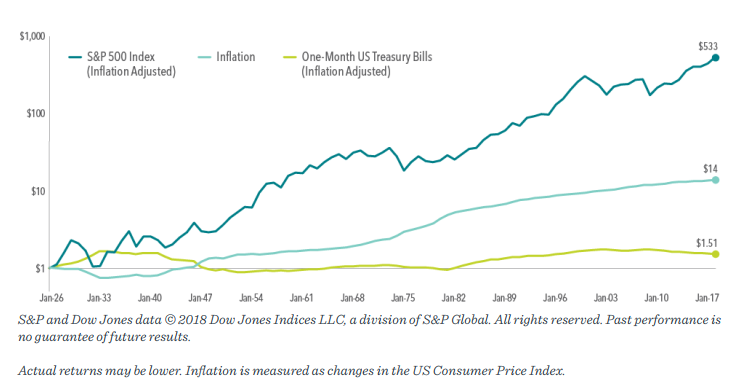

Since 1926, US Large/Small cap stock returns have outpaced inflation by ~7% and 9%, respectively. During that same time period, cash and bonds have barely exceeded inflation.

While cash can feel like a safer option in the short-term, over long periods of time, you can lose purchasing power. For example, if inflation averages 3%/yr while your cash holdings earn 1% or bonds earn 2%, you are losing purchasing power.

Although we can speculate, we don’t know whether we’ll have material or stable inflation over the next decade. Rather than being driven to change strategies based on short term media noise, we recommend sticking to your investment plan and maintain a diversified portfolio constructed based on your capacity and tolerance for risk.

Additional Resources

- Article by Ben Carlson – The Simplest Asset To Hedge Against Inflation

- Article by Dimensional Funds- Inflation: An Exchange Between Eugene Fama and David Booth