While the FAANG stocks have been the most obvious enviable stock positions over the past decade, there are always success stories readily available to raise feelings of doubt and FOMO in even the most disciplined long-term investors.

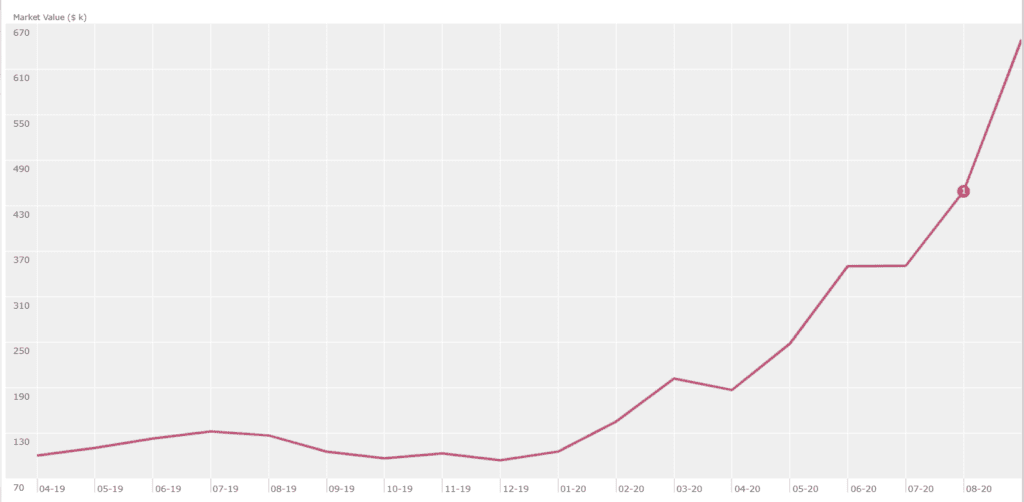

For example, investors who purchased $100,000 of Zoom stock at its IPO price of $36/share in April of 2019 would have earned a cumulative rate of return of about 590% and built a nest egg of ~$650k.

Zoom is one of the most recent examples of a company whose stock performance has exceeded expectations so wildly over the past 18 months that it is tempting to wish we were a part of the action and predict that those results will continue in the future, making us very wealthy in the process.

After all, the path to extreme wealth is often created through very concentrated positions in individual companies. Examples include Bill Gates, Elon Musk, Mark Zuckerberg, Jeff Bezos and many others. What made them so lucky? And why shouldn’t we be able to identify companies that will post results like these?

Temptations to Buy Individual Stocks Are Strong

It’s such a tempting proposition that the allure of buying individual stocks is often compared to the classic tale of Odysseus and his men resisting the Siren songs in Homer’s, “The Odyssey.” The Siren songs were so alluring that men were unable to resist and sailed their boats into the rocks, meeting untimely deaths. Odysseus and his men avoided this fate by plugging their ears with wax and tying Odysseus to the mast so he could hear the songs without steering toward them.

Understand the Risk

While individual stocks might not kill us, they do pose catastrophic risks that have the potential to be detrimental to our wealth. The nature of individual stock returns was studied in detail in Hendrik Besseminder’s 2018 study in the Journal of Financial Economics, “Do Stocks Outperform Treasury Bills?” which covered stock performance from 1926-2015. These are some of the key findings:

- A minority of common stocks have a positive lifetime holding period return, and the median lifetime return is -3.7%

- Only 3.8% of single-stock strategies produced a holding period return greater than the value-weighted market, and only 1.2% beat the equal-weighted market over the full 90-year horizon

- Just 42% of common stocks have a holding period return greater than one-month treasury bills

Larry Swedroe summarizes this research nicely, noting that “Bessembinder’s findings highlight the high degree of positive skewness (lottery-like distributions), and the riskiness, found in individual stock returns. He noted that the 86 top-performing stocks, less than one-third of 1% of the total, collectively accounted for more than half of the wealth creation. And the 1,000 top-performing stocks, less than 4% of the total, accounted for all of the wealth creation. The other 96% of stocks just matched the return of riskless one-month Treasury bills!

The implication is striking: While there has been a large equity risk premium available to investors, a large majority of stocks have negative risk premiums. This finding demonstrates just how great the uncompensated risk is that investors who buy individual stocks, or a small number of them, accept – a risk that can be diversified away without reducing expected returns.”

The overwhelming conclusion is that as much as we would like to think we know what will happen next, the future is unpredictable.

But my FAANG Stocks are doing so well

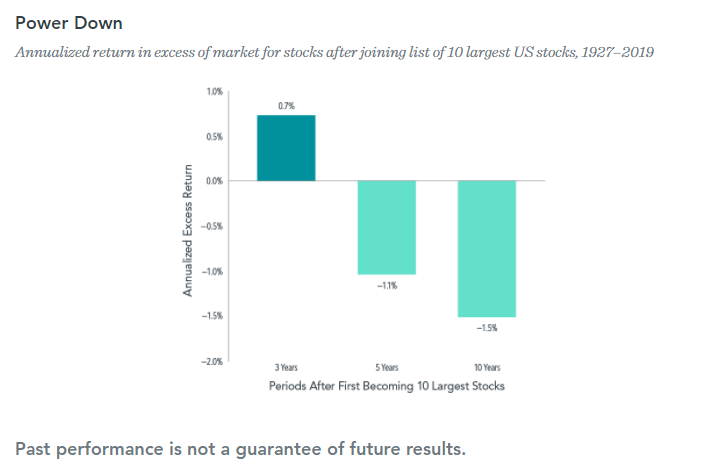

Circling back to the FAANG stocks, history also suggests that the companies that posted the most impressive recent performance are unlikely to do so going forward. The following chart shows the excess market return for stocks after joining the list of the 10 largest US stocks:

6 Steps Before Buying Individual Stocks

While the data is compelling that the odds are stacked against us on individual stocks, often the allure is just too strong. There is no reward without risk, right? Some of us may still want to take advantage of the growth potential of an individual stock position for any number of reasons. Maybe you want to have ownership in the company you work for or do business with frequently. You may have also inherited or been gifted individual stock positions. These might even have sentimental value for your family. Or you may just have a feeling about that company. If you find yourself in one of these situations, we recommend setting a decision-making framework for how you will buy, hold, and sell these positions:

- Perform a portfolio Deep Dive. If you are holding a portfolio of diversified mutual funds or ETFs, it’s likely you already hold a position in the stock(s) you are considering. This means you have already been riding the wave of success and benefiting from the stock’s stellar performance. It has simply been less visible, and the return was muted by subpar performance in other areas. Diversification means you will always hate something in your portfolio, but it also gives you the best odds of long-term success.

- Decide how much. If after performing your portfolio analysis you still decide you want to buy an individual stock, you will need to choose a prudent amount. We recommend individual stock positions account for no more than 5-10% of your portfolio. You don’t want to be overexposed to a position that has the potential to kill you, even if it might make you a killing.

- Consider Taxes. While we never want to let taxes guide our investment strategy, it is prudent to consider how tax efficient the position will be. If the outsized returns you expect come to fruition it may be beneficial to purchase the position inside your Roth or Traditional IRA for tax free or tax deferred gains. Conversely, you may be in a high tax bracket now, but expect that to fall in a few years when you retire. This may present the opportunity to realize any capital gains at a lower rate or even 0% in the future. Take a peek at your financial plan for context.

- Set target prices for buys and sells. Often the stocks that feel most attractive are those with fantastic recent past performance. They are also often very expensive relative to their peers and the broader stock market. Researching the company’s current and historical price to earnings ratio as well as estimates of fair market value is informative for making buy, hold, sell decisions.

- Ask: What if I am wrong? Our natural tendency when faced with the prospect of incredible return potential is toward overconfidence. Make sure your answer to #2 is an amount you are willing to say goodbye to if the outcome is not what you hoped for.

- Ask: What if I am right? If your hopes and dreams come true with a winning stock pick it is important to set rules around trimming that position back to target to periodically take profits, diversify, and reduce risk. Recognize that dabbling in individual stocks is a form of gambling, and it is important to know when to walk away.

For further reading on creating a decision-making framework and avoiding common investor pitfalls, we recommend Daniel Kahneman’s “Thinking Fast and Slow,” and “Decisive,” by Chip and Dan Heath. If you find yourself called by the Siren Song of an individual stock or deciding how to manage positions you may already own, please contact us to discuss the best approach for your personal situation in more detail.

Outline of This Episode

- [3:03] If others can do it, why can’t I pick a winner?

- [6:20] Industrial change can happen very quickly and cause a shift in industries

- [10:02] Perform a portfolio deep dive

- [12:36] Don’t choose an individual stock to make up lost ground

- [15:02] Consider taxes

- [17:16] Set target prices to buy and sell

- [19:39] Ask yourself “what if I’m wrong?”

- [20:39] Ask yourself “what if I’m right?”

- [22:34] List the potential scenarios

Resources Mentioned in this Post

- WSJ article: Amazon’s IPO at 20: That Amazing Return You Didn’t Earn

- FSI Article: The Odds of Success for Individual Stocks

- Tax Loss Harvesting: A Silver Lining in Bear Markets

- Hendrik Bessembinder 2017 Study: Do Stocks Outperform Treasury Bills?

Connect With Chad and Allison

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook