Why is it so hard to envision our future self?

Dan Gilbert, a Harvard psychology professor and author of Stumbling on Happiness, has found that people are really bad at predicting who they will be in the future.

This is because it’s far easier to remember the past than to imagine the future.

Whether you are graduating college and starting your career, or you are a parent/grandparent with newly minted graduates, we’ve compiled six cornerstone financial principles to get off on the right financial foot.

The earlier you start setting the groundwork for a financially secure life, the easier it can be to stick to the good habits over time and the longer you can reap the benefits of them.

6 Tips to Help Your Future Self

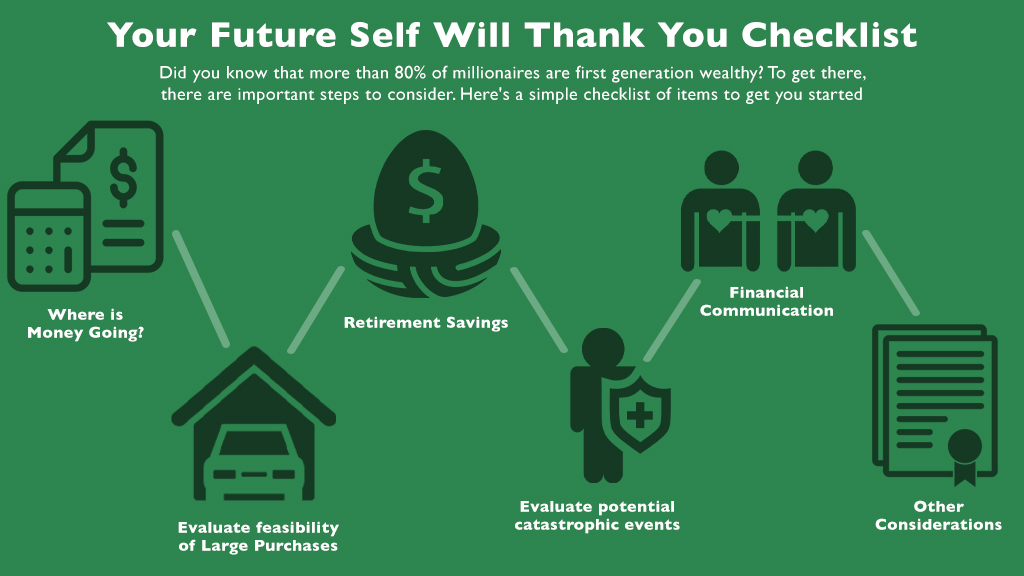

Track your spending. And I mean actually track it. There are plenty of online tools, but a spreadsheet could do the trick. Set aside time to review regularly and make sure your spending stays within what your situation can handle. While you’ll not only keep a more sustainable spending level by knowing where your money is going, you will be able to better prioritize your wants and needs.

Perhaps you’ll find room in your spending to afford your favorite coffee shop latte twice a week that brings you joy by cutting the $50 monthly subscription that’s not as satisfying. The more information you have about your spending habits the better equipped you are to make smarter decisions.

Think twice about your big purchases. When it comes time to consider bigger purchases or commitments make sure you understand how they will affect your long-term situation. Overspending on cars, houses or even apartment leases can strain your monthly budget for years to come. Make sure your big purchases allow you to keep a sustainable spending level, savings rate and some wiggle room each month. Don’t forget to consider related expenses as well. More expensive homes and cars also cost more in the way of maintenance and insurance or you’ll spend more on furnishing a larger home.

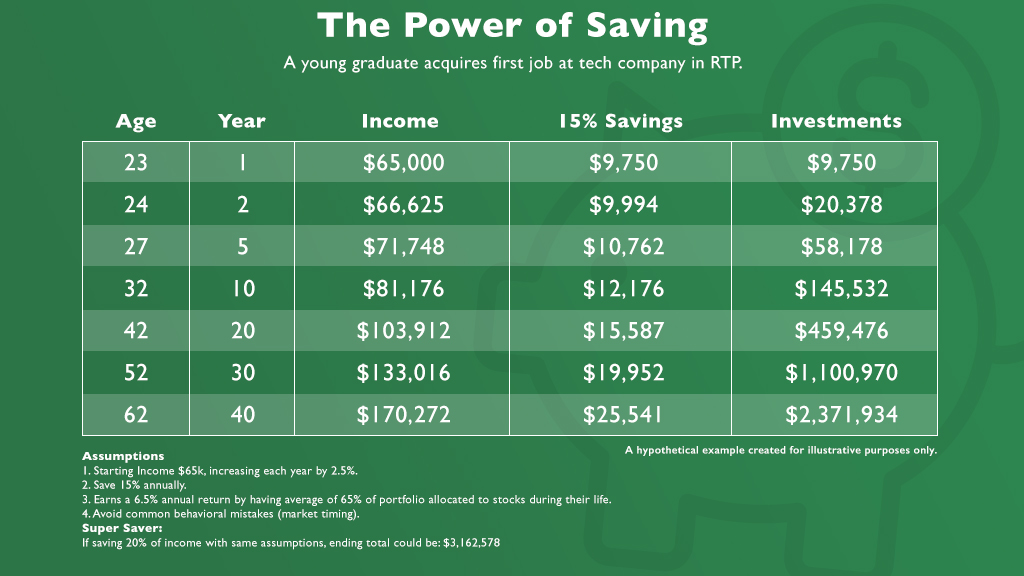

Sign up for your 401k and contribute at least up to what your employer will match. If your employer has a retirement plan and you are eligible to participate make sure you are taking advantage of it. Most employers will match a portion of your contribution and if you don’t make your own contribution you are leaving free money on the table by missing out on your employers. These dollars can really add up between now and retirement, so starting early can make a big difference towards your retirement goals.

Discover the Roth IRA. When just starting out in your career chances are you are in a lower tax bracket and likely able to contribute to a Roth IRA. Make it a point to contribute as much as you can up to the limit in this type of account. Any earnings inside that account are tax free so when you withdraw money from this account in retirement you won’t owe any taxes on it. That is 30+ years of tax-free growth you can start now.

Don’t skip risk planning. While you are young it is hard to make this a priority but there are a few important documents and policies you should have in place. No one likes to plan for death or injury but if not considered today, wishes may not be honored tomorrow. Don’t forget general and healthcare power of attorneys who can make decisions for your finances and health if you are unable to. Also, life and disability insurance are relativity inexpensive to get when you’re young.

Discuss money in your relationships. Communication is key. This may sound cliche, but in the book The Next Millionaire Next Door, more than 80% of millionaires surveyed agreed that having a supportive spouse was a key factor in their economic success.

If you are married, engaged or in a long-term relationship, discussing the details of your financial goals with your partner is essential. It’s likely that each of you have different opinions on spending, debts or investment philosophy. Understanding each other’s goals, expectations and current reality regarding finances is the first and ongoing step to creating a financial life together.

If you need help getting started or have decisions to make revolving your finances, it may help to seek help from a financial advisor. Creating and implementing a financial plan can help put you determine strategies for your specific situation and put on the right track financially.

Outline of This Episode

- [2:35] Know where your money is going

- [5:15] Don’t underestimate the weight of bigger purchases

- [7:23] Sign up for your employer-sponsored retirement plan

- [9:27] Invest in a Roth IRA

- [11:23] Don’t skip risk planning

- [14:00] Discuss money in relationships

- [16:38] Today’s progress principle

Resources Mentioned

- Write a Future Letter to Yourself

- CNBC Article – How to get investors to save more for retirement? Perhaps by saying hello to their future self

- Article – ‘Super savers’ make these sacrifices to help them reach their goals

- Marketwatch – The No. 1 thing people with fat savings accounts scrimp on that you likely don’t

- BOOK – Happy Money by Elizabeth Dunn

- BOOK – The Next Millionaire Next Door by Thomas J. Stanley

- BOOK – Making Money Simple by Peter Lazaroff

Subscribe To This Podcast

Connect With Haley Modlin

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook