Special needs financial planning is an intricate and delicate process.

A process loaded with challenging emotional and financial decisions. So below we provide 4 steps to think through if planning for your special needs loved one’s future.

More than 40 million individuals or about 10% of total American population are living with a disability according to the US Census. This takes a careful planning approach to assure needs are met.

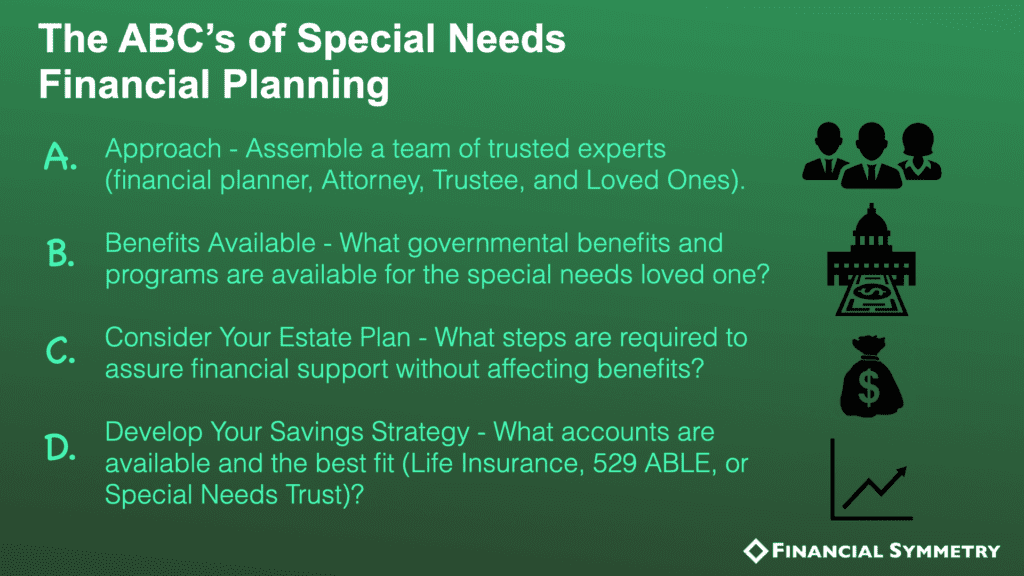

The ABC’s of Special Needs Financial Planning

- Approach: Highlighting the importance of constructing an experienced team to help guide families through the special needs planning process

- Benefits Available: What governmental benefits and programs are available to my special needs loved one now and as they age?

- Consider Your Estate Plan: What steps should be taken to align your estate plan to provide ample financial support to your special needs loved one while making sure their benefits are not negatively affected.

- Develop Your Savings Strategy: What accounts are available for special needs individuals and which are the best fit for your situation

Approach

Often, one professional is not going to be able to provide the needed advice to cover all parts of special needs planning. Instead, we recommend constructing a team of experienced individuals and loved ones.

- Financial Planner: this individual often serves as centerpiece in coordination between the team and can help with developing the best approach during your life to ensure your child will be set up financially as you wish but will also make sure you remain on track for your own financial and retirement goals.

- Attorney: selecting an individual with experience with special needs planning will be key to ensure that your estate plan is set up correctly and the accounts you use to save for your child’s future will maximize the benefit to them without them having to sacrifice benefits that are available to them by the government

- Trustee: Choosing and training; Importance of sibling’s role

- Depending on accounts used in future wealth planning for your child, a decision may need to be made to select a Trustee on a Trust.

- Family member? This is often the most natural choice for trustee as you are close with this individual and they have emotional familiarity with the trust beneficiary. The key here is the degree of trust you are placing in this individual to act in your child’s best interest.

- Alternatively, you can consider naming a bank or attorney as trustee. The benefit here is a layer of expertise/understanding of the mechanics or the trust and transactions involved.

- When setting up the Trust, you will be working with an attorney who will be able to guide you through this decision – the pros and cons of different options and safeguards, such as trust protectors, you can put in place to ensure the Trust is carried out in a way to meet your wishes and provide maximum benefit to your child

- Loved Ones: Selecting a guardian for your loved one and the potential pitfalls to consider

Benefits Available

What governmental benefits are available for my child now and as they age?

- There are 4 predominant programs available to special needs families

- Means Based: meaning eligibility for these programs is based on the financial need of the beneficiary and qualification is based on strict requirements that must be met prior to receiving benefits. Careful planning is necessary to make sure the special needs individual continues to remain eligible over time

- Medicaid

- Can cover healthcare expenses such as in-home care, hospitalization costs and nursing home care

- Supplemental Security Income (SSI)

- Eligibility for SSI enables the individual to qualify for food stamps and Medicaid. It does have a low poverty threshold – if the individual has greater than $2,000 in assets in their name, they will become ineligible for SSI

- Medicaid

- Non-Means Based:

- Medicare

- Not means based – so no ‘investigation’ will occur to determine whether the individual is eligible for benefits

- Functions like Medicare in the common sense – age 65+

- Social Security Disability Insurance (SSDI)

- Not means based – so no ‘investigation’ will occur to determine whether the individual is eligible for benefits

- Available to individuals or special needs children of an individual who has died, retired, or become disabled.

- What if my child has never worked?

- A special needs child – under age 22 – who is not working can obtain SSDI benefits based on their parent’s prior earnings history

- Medicare

- Means Based: meaning eligibility for these programs is based on the financial need of the beneficiary and qualification is based on strict requirements that must be met prior to receiving benefits. Careful planning is necessary to make sure the special needs individual continues to remain eligible over time

Consider your Estate Plan

- Division of Assets for Heirs

- It is important to consider the financial need of each of your heirs/descendants. Often parents divide their wealth up in equal portions – but in a situation such as future wealth planning with a special need’s child, such divisions may be inappropriate

- Consider your special needs child’s ability to earn income in the future and their need for financial assistance vs. another child who may be able to lead a more self-sufficient financial life.

- Consider the types of funds being transferred into your child’s account for their benefit – retirement accounts/IRAs can create

- What about loved one’s estate plans? What happens if someone passes wealth to the child directly? Importance of coordinating!

- Account Beneficiaries

- Remember: Beneficiary listing on your accounts trump your Will!

- What happens if I have my special needs child listed as a direct beneficiary vs. listing a trust/account for their benefit?

- What about life insurance? Can proceeds from my policy go directly to my child since they are generally tax free?

- Guardianship

- Prepare a memo of intent: this takes a step back from a purely financial focus and really goes through important information related to your child such as their day to day activities, likes/dislikes, needs that will need to be provided, etc to make the transition to their new caregiver as smooth as it possibly can be

- Financial/Healthcare Power of Attorney

- Who is going to make health and financial decisions on your behalf should you become incapacitated while your loved one is living? These two documents are a key part of any solid estate plan – and this topic only emphasizes their importance more.

Develop Your Savings Strategy

- Which of these options is best suited for my situation?

- 529 ABLE: Achieving a better life experience – ABLE act was passed with the goal of providing a special savings account for disability related expenses – and can be used to cover qualified expenses such as housing, education, transportation, assistive technology, and numerous others.

- Pros:

- Nontaxable – funds within 529 ABLE grow tax free, and if withdrawn for qualified expenses, withdrawals are tax free

- Simpler and lower cost to fund and maintain than a special needs trust

- Cons:

- Annual funding cap – $15,000/yr

- Asset Limit – if balance is above $100k, government benefits may be reduced until balance is brought below that level

- Account must be set up for an individual who had onset of disability prior to age 26

- Payback provision: upon the death of the beneficiary, funds remaining in the account will be used to pay Medicaid for services rendered during the lifetime of the beneficiary before being released to family members (note, depending on Special Needs Trust selected, this may also occur with those)

- Pros:

- Special Needs Trust: established by placing funds and other assets within a trust under the control of a trustee – at a high level it is an account designed for the financial protection of an individual with a disability and is a way to pool assets to aid your special needs child without sacrificing eligibility for government benefits. Goal is to provide financial assistance above and beyond what they receive from the government

- Pros:

- No funding cap

- No asset limits

- Less strict limitations on withdrawals to cover expenses (can withdraw for wider range of expenses child may incur)

- Cons:

- More expensive and complex to open and maintain

- Growth/Income is often taxable, and as such will likely require a tax return to be filed annually to include Trust income (importance of relationship with accountant/tax preparer)

- Note: there are different types of trusts available, each with its own benefits so it is important to consult with an attorney familiar with special needs planning to determine which will be the best fit for you and your family

- Pros:

- 529 ABLE: Achieving a better life experience – ABLE act was passed with the goal of providing a special savings account for disability related expenses – and can be used to cover qualified expenses such as housing, education, transportation, assistive technology, and numerous others.

- As you can see, careful planning is necessary to ensure your loved one is financially secure and savings have been structured in such a way that they do not inadvertently lose benefits provided to them by the government

Resources

- Book – The Special Needs Planning Guide

- LOMAH podcast – Special Needs Financial Planning Series

- Academy of Special Needs Planners

- Article – How to Plan Finances to Raise a Special Needs Child

Connect With Grayson and Chad

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook