When one thinks about portfolio diversification, bonds, in addition to US and International equities should be evaluated.

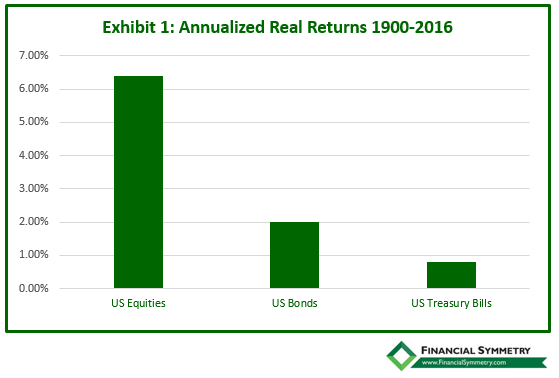

An investor may be tempted to overlook bonds altogether given that investing in equities tends to lead to higher overall returns (see Exhibit 1 below).

So why include bonds in your investment portfolio?

The answer lies in reducing the volatility of your portfolio, providing for short-term cash needs and helping you sleep better at night.

*Equities based on total return, including reinvested dividend income. Bond returns denote the total return, including reinvested coupons on long term government bonds. Bills denotes total the total return, including income, from Treasury bills. All returns are adjusted for inflation and are expressed as geometric mean returns

*Equities based on total return, including reinvested dividend income. Bond returns denote the total return, including reinvested coupons on long term government bonds. Bills denotes total the total return, including income, from Treasury bills. All returns are adjusted for inflation and are expressed as geometric mean returns

Source: Credit Suisse Global Investment Returns Yearbook 2017

Diversification and reduced volatility

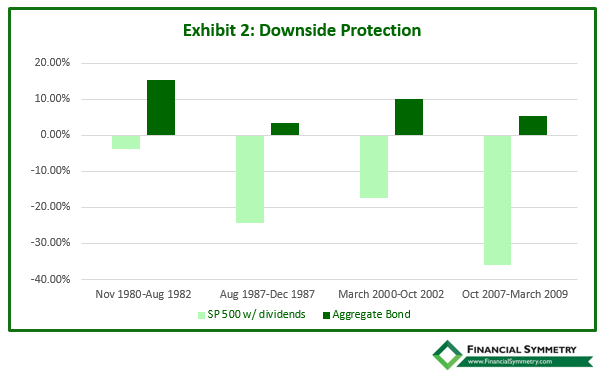

The purpose of allocating a portion on your portfolio to bonds is to reduce overall volatility. There is risk in allocating a large portion of your portfolio towards equities when markets are at high levels. By including bonds in your asset allocation, your overall portfolio risk is reduced given that bonds are not as highly correlated with equity returns and tend to act as a diversifier during market downturns (see exhibit 2 below). Additionally, by allocating a portion of your portfolio to bonds, this allow you to have funds in your portfolio available when stock prices are more attractive to increase your stock allocation.

Today’s Environment and the opportunities it presents

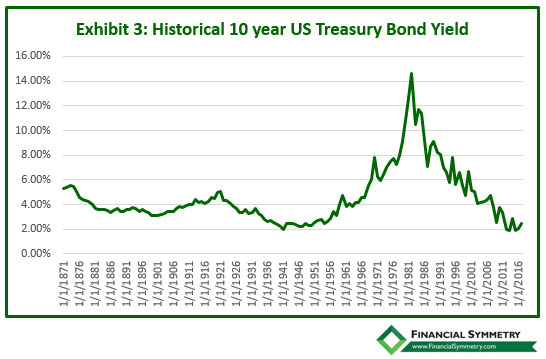

For the past thirty years, we have been in a falling interest rate environment (see Exhibit 3 below). From the all-time highs in the early 80’s, interest rates had fallen to near zero in recent years. This led to outstanding performance in the bond markets. Like equities, bull and bear markets tend to be cyclical. The difference being that while cycles in equity markets tend to last a few years, cycles in bond markets tend to last a few decades as rates can remain low for longer than people expect. For example, it took approximately 19 years for interest rates to rise from just below 2% in 1941 to 4.75% in the early 1960s.

Investing in a rising interest rate environment

Given that bond prices tend to fall when interest rates are on the rise, is now a good time to invest in bonds or should they be avoided? While in the short-term bond prices will decline, rising interest rates are a good thing for bond investors so long as their bond portfolio is adequately prepared. The further out on the duration scale you go; the more bond prices will be affected by interest rate moves. The duration of a bond is the approximate measure of a bond’s price sensitivity to changes in interest rates and is measured in years.

In rising interest rate environments positioning your portfolio towards bonds with shorter maturities, risk for loss of principal will be reduced. The reason for this is that as bonds mature, the principal is available to be reinvested at higher rates. So, while over short time periods, increasing rates can result in negative performance, over time, the benefit of higher interest rates compounds and results in longer term positive performance.

Risks of the Bond Market Index

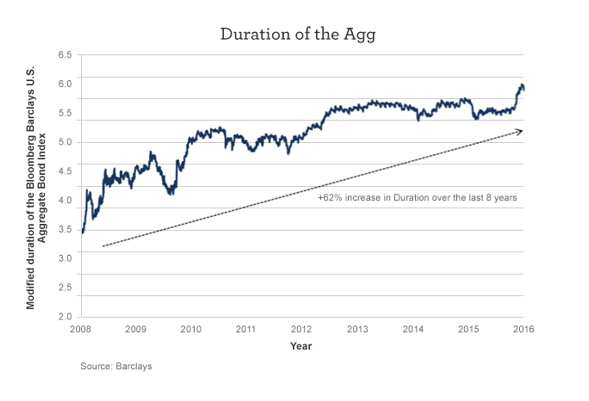

So why not just invest directly into a bond index fund? As outlined in Exhibit 4 below, the duration of the index has extended over the last few years. Keeping in mind that the longer the duration the more sensitive bonds are to rising interest rates, the relative ‘safety’ that bonds typically bring to a portfolio has been diminished.

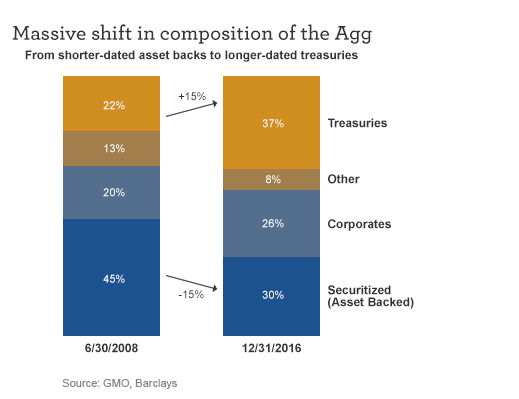

Since the financial crisis in 2008, the Aggregate Bond Index’s underlying composition, which was heavily weighted towards mortgage and other asset backed securities in 2008, has transitioned to US Treasury bonds in recent years. Traditionally, asset backed securities have a shorter duration than the longer-dated US treasuries which is one of the causes of the duration extension of the index.

Expected Bond Returns

Starting bond yields are highly correlated to future bond returns so with the bond market index yield in the low 2% range, index returns should align to that. How do you get higher returns? We don’t recommend reaching for return in the bond market as it should act as a stabilizer when the equity markets decline. That said, the bond market index composition is based on the percentage of bonds outstanding (see Exhibit 5 below). By buying what is a better value and not the highest weight may help increase your return over the index.

Lower Yields

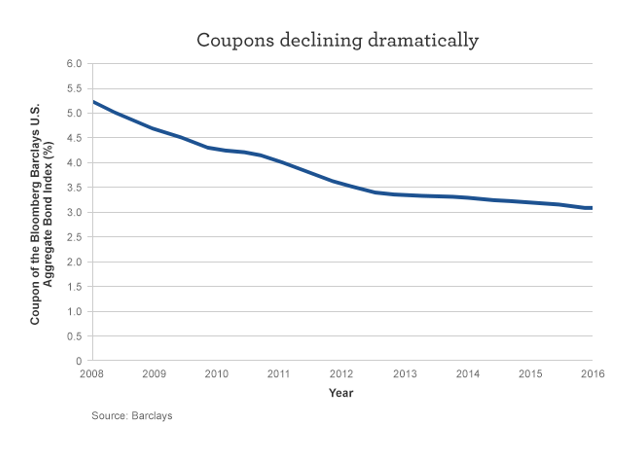

Additionally, corporations are taking advantage of the current environment and locking in low interest rates over longer periods of time. With bonds locked in at lower interest rates, coupons have decreased from over 5% in 2008 to just over 3% (see Exhibit 6 below). Together, these factors have culminated to fundamentally change the composition of the Aggregate Bond Index, and have resulted in an increase in the index’s risk level.

Conclusion

Finally, high quality bonds offer investors something of an emotional hedge against poor behavior. Not every investor is willing or able to have their entire portfolio in the stock market. There’s no use in trying to implement a risky portfolio strategy if periods of poor performance are going to cause you to not stick with it. Bonds can help by providing stability in the event of a stock market sell-off.

Even if bonds were to fall in a down stock market, it wouldn’t be nearly as severe. In this respect, bonds can act as a source of funds for either rebalancing into stocks at lower prices or for selling for cash flow needs. Ultimately, they provide the stability investors crave to alleviate the stress that volatile stock markets can cause.