Where should you invest now? As I wrote last year in “Should I Own International Stocks?”, in investing it is important to “skate where the puck is going, not where it has been” (Wayne Gretzky). What this means is don’t use historical results to predict future returns. The last 10 years have been very good to US stock investors as we explain further in “Why Have US Stocks Performed So Well”. It is easy to be complacent and assume you can expect the same results for the next 10 years.

Where should you invest now? As I wrote last year in “Should I Own International Stocks?”, in investing it is important to “skate where the puck is going, not where it has been” (Wayne Gretzky). What this means is don’t use historical results to predict future returns. The last 10 years have been very good to US stock investors as we explain further in “Why Have US Stocks Performed So Well”. It is easy to be complacent and assume you can expect the same results for the next 10 years.

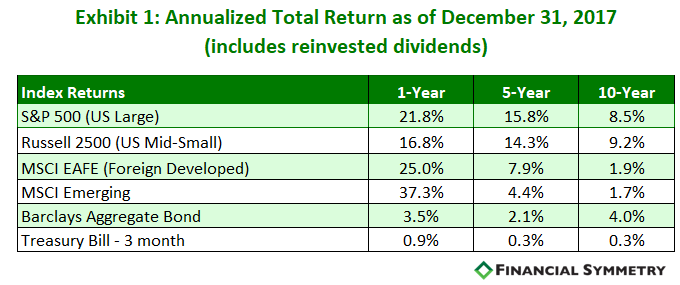

Noted below in Exhibit 1 is historical returns for various indexes over the last one, five and ten years, respectively.

It is important to note the recent market volatility in early February has not materially changed the returns presented in Exhibit 1. As noted above all the world’s stock markets achieved strong returns in 2017 as investors set aside concerns about politics and focused on the broadening expansion. Developed foreign markets outpaced US stocks for the first time since 2012 rising 25.0% vs. 21.8% for the S&P 500. Emerging market equities also outpaced the US, soaring 37.3%. Over the last five/ten years, US stock returns have fared much better than international stocks or bonds.

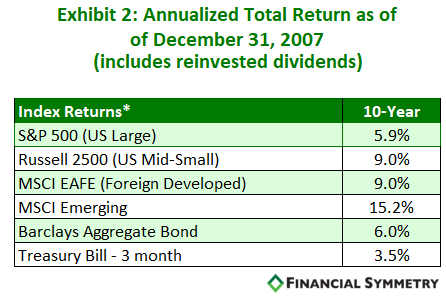

That said, in Exhibit 2 below you see the previous 10-year returns from December 1997 to December 2007 with almost opposite results as emerging markets had the highest returns and S&P 500 the lowest stock returns. An asset class that has high returns over one period often has low returns over the next. This is called mean reversion.

Investment Process

At Financial Symmetry, we meet regularly to review different short-term and long-term market indicators to determine the appropriate investment strategy for all our clients. These indicators include the following:

- Short-Term Indicators = Economic, Sentiment and Technical

- Long-Term Indicator = Valuation

Below is a brief summary of the current state of each indicator as of the beginning of 2018.

Economy

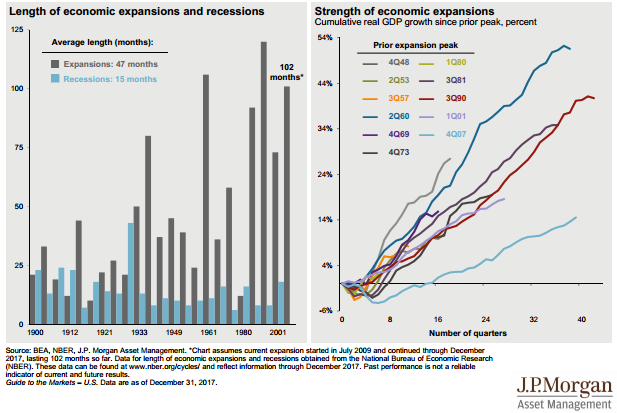

For the first time since the 2008-2009 recession, a synchronized global economic recovery gathers steam. The US job market is solid, consumer confidence rising and low unemployment could result in further economic gains. Although we are eight years into an economic expansion, the cumulative real GDP growth is well below future peaks as noted by the JP Morgan charts below.

The rest of the world appears to be earlier in the economic cycle. Europe seems to have entered a prolonged period of strength, and the euro-zone economy is expected to grow 2% in 2018 according to the International Monetary Fund (IMF). Unemployment in the euro zone has fallen to 8.9, its lowest level since 2009. Similar trends are seen in other parts of the world as well. Overall, growth is expected to increase globally from 2017 to 2018 as predicted by the IMF. As a result, our economic indicators are positive.

Sentiment

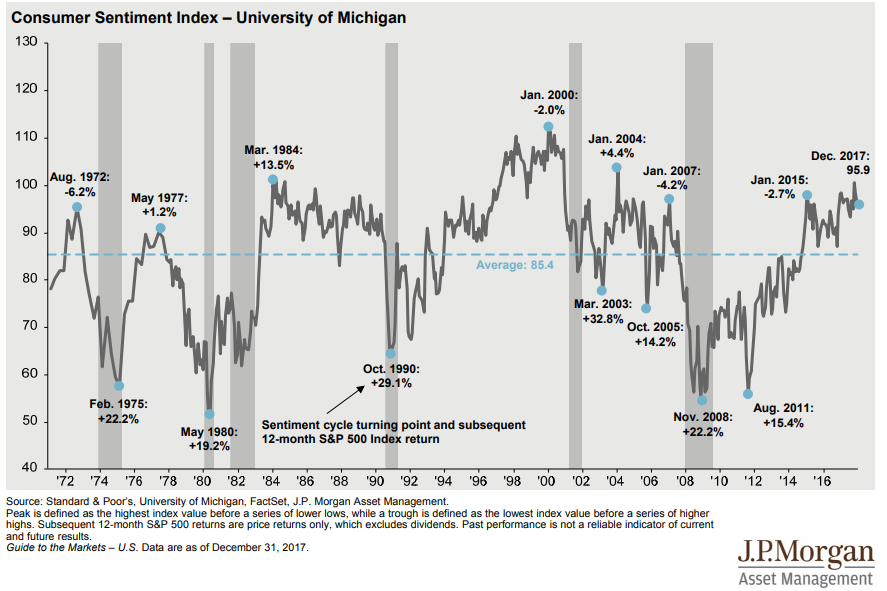

Given the strong recent returns of stocks, economic growth and low unemployment, consumer confidence is very strong as noted by the chart below.

Furthermore, the US stock market was up in every month of 2017 for the first time in history. Although we saw a recent dip in early February 2018 the market has seemed to rebound quickly as of mid-February 2018. Alternative investments (i.e. Bitcoin) have become popular, as this is a “risk on” market with many investors experiencing FOMO (Fear of Missing Out). Risk will return and as Warren Buffett once famously said, “Only when the tide goes out do you discover who’s been swimming naked”. Therefore, we feel it is not the time to take excessive risk but remain cautious with our investment approach. Consumer sentiment can change very quickly as we saw in early February 2018.

Technical

Technical indicators are based on charts and help investors decide when to buy or sell. There are many different technical strategies, but one example is a simple trend-following strategy based on 10-month simple moving average of stock prices. As Meb Faber noted in his blog post titled “Keeping it Simple: Trend and Valution,” following a strategy to invest in stocks only when they are above their 10-month simple moving average has been a successful long-term approach. Where are we today? All major global stock indices prices are above their 10-month simple moving average. Therefore, as a short-term indicator this is positive, but we remain concerned as some of our other indicators have recently turned negative. We also subscribe to third party sources with excellent long-term track records to assist with our strategy.

Valuations

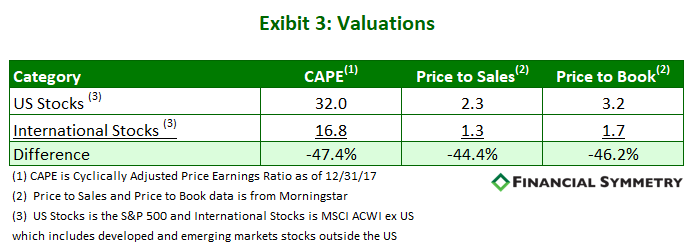

High valuations are consistent with low returns over the following 10-year periods, and low valuations are consistent with high returns over following 10-year periods. However, over shorter periods, stock price movements are very unpredictable and can move up or down a lot regardless of valuation. Where are we today? As noted in Exhibit 3 below, US stocks are expensive compared to history, and international stock valuations are about 40% to 50% lower than the US; however, they are still not cheap.

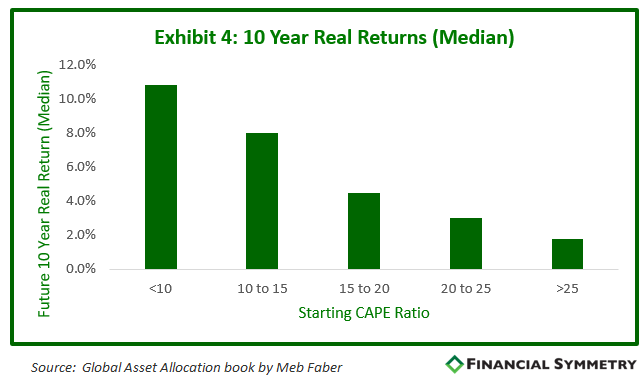

Are valuations good predictors of future returns? According to a study by Research Affiliates titled CAPE Fear: Why CAPE Naysayers are Wrong, starting CAPE Ratio has between a 48% to 91% correlation to future 10-year returns across 12 countries. In addition, below Exhibit 4 is the average future 10-year real return based on starting US CAPE Ratio. As a reminder US stocks are in the >25 category while international stocks are in the 15 to 20 category. So yes, starting valuations do matter over the long-term.

What is CAPE and why use it? CAPE is the cyclically adjusted price earnings ratio that takes the stock market price (i.e. S&P 500) divided by the last ten years inflation adjusted earnings. We use CAPE because it helps smooth out the impact of the business cycle (expansions/recessions) on earnings vs. looking at 1-year results which can have wide swings as we saw in the last recession (2008/2009).

Summary of Stock Indicators

Overall our short-term indicators remain slightly positive while our long-term indicator is negative. We implement this information into our software to provide the appropriate advice for our clients.

As we saw in the late 1990s, when an expensive stock market (US) continues to get much more expensive, even after Alan Greenspan pondered the possibility of “irrational exuberance” of investors, the long game went to the prudent investors who avoided going all in as that bubble inflated further. There is no reason US stocks can’t go higher from their current valuations short-term, but a globally diversified, cautious approach is recommended.

Bonds

With recent stock returns so strong many ask Why include bonds in your portfolio? Because bonds reduce the volatility in your portfolio, provide short-term cash needs and help you sleep better at night during downturns. Historically, future bond returns are much easier to calculate as they are based on the starting yield less expected credit loss. Since starting yields for US government bonds are in the 2.5%-3.5% range, future returns should be similar to these numbers. Corporate bonds (investment grade or high yield) may have higher returns, but they include more risk as the company borrowing could default. Based on current spreads in the corporate bond market, we don’t feel it is time to take excessive risk in bonds.

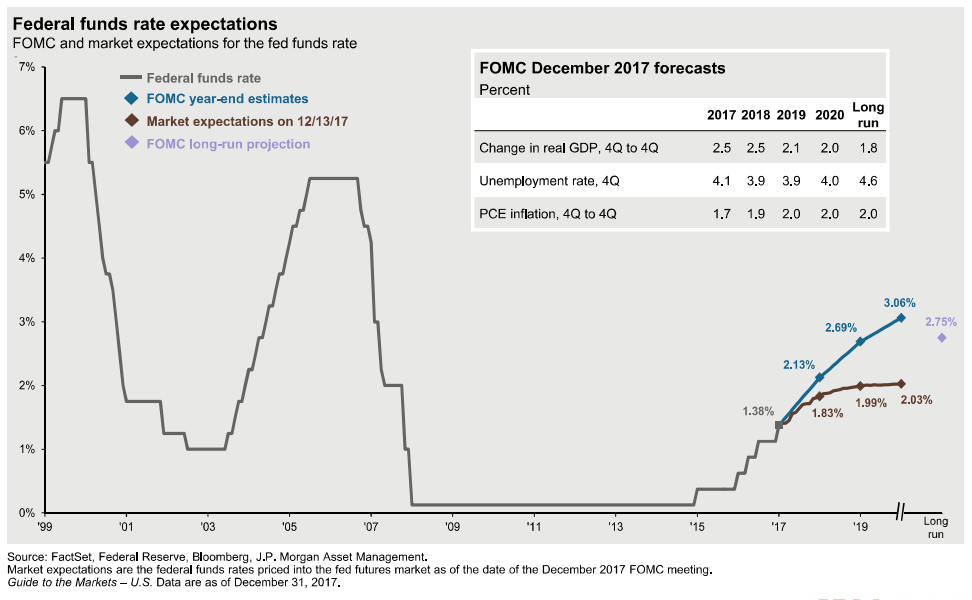

One of the primary reasons stock valuations are high is that interest rates continue to be low and thus competition from interest-bearing assets like bank accounts and bonds is low. This could change if the Federal Reserve (“Fed”) increases interest rates faster than expected due to rising inflation. The decline in stocks in early February were primarily driven by this concern. See below for the market and Fed expectations for future interest rate changes.

Finally, as the Fed continues the path of gradually raising interest rates, many investors go to cash. That said, if rate hikes are gradual, interest earned by bonds can overcome the price impact to deliver a positive return. Therefore, our view is short to intermediate-term high quality bonds are recommended at this time.

What To Expect?

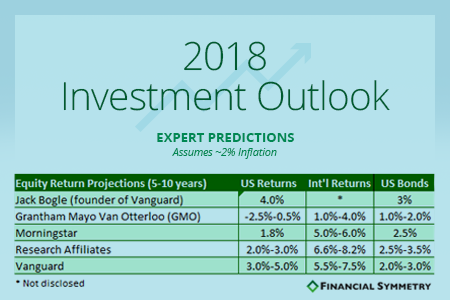

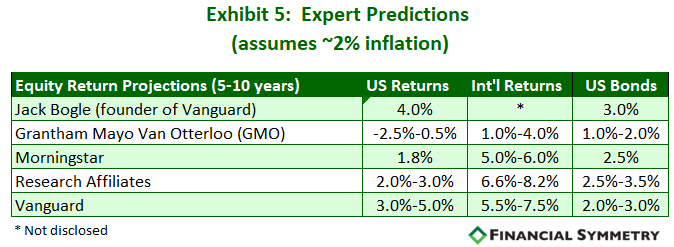

After reviewing historical results and different indicators, what does that mean for future returns? See Exhibit 5 below for projected returns over the next five to ten years from various industry experts for US stocks, international stocks and bonds. Note all sources expect higher returns for international stocks than US stocks or bonds. Although we have not listed the specific expectations for Financial Symmetry, our views are similar.

Conclusion

To summarize, with low returns expected for US stocks and bonds many US based investors will be disappointed with future returns over the next ten years. As a result, individuals may need to either work longer or spend less than expected to reach their financial goals.

For current savers a market decline should be viewed positively as it allows them to buy stocks at cheaper prices. For existing or soon-to-be-retirees it is important to understand your risk capacity and risk tolerance and adjust your asset allocation accordingly. You’ll need equity for long-term growth, but it is important to have high-quality bonds and/or cash for current spending.

What can you do about potential lower returns? First, focus on what you can control (spending, taxes, estate planning, etc.) and your long-term financial plan. If you don’t have a financial plan in place, it’s the perfect time to contact a fee-only financial planner such as Financial Symmetry. Second, implement a long-term, disciplined investment strategy. And no, buying the mutual fund/ETF/stock that has done the best over the last three years is not a strategy. If you don’t have a disciplined strategy or want to learn more about our process click here to download our white paper.