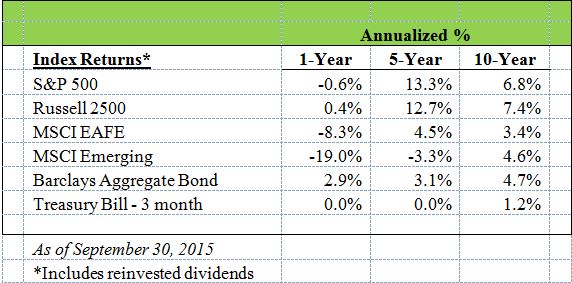

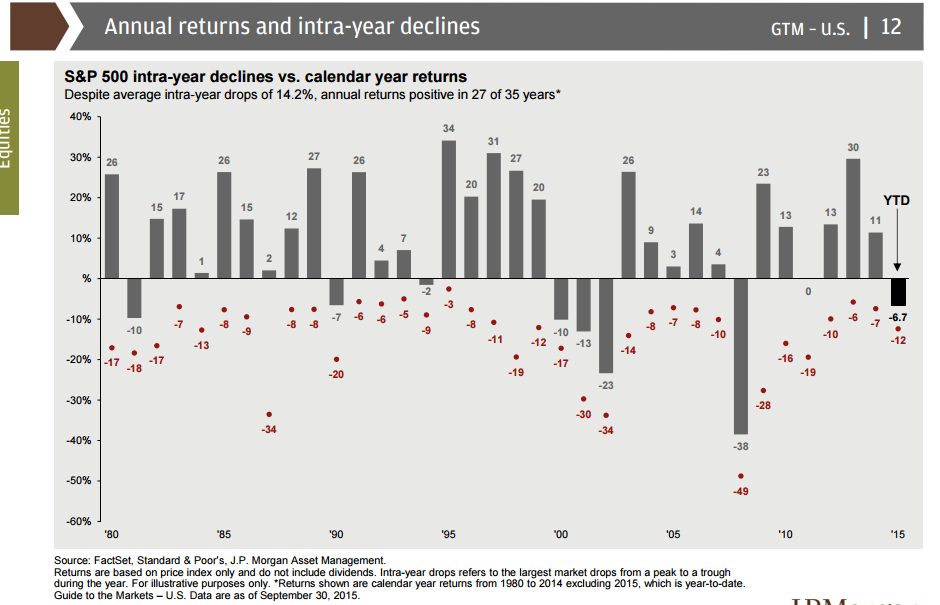

All major equity asset classes are negative for the month and YTD as we have seen increased volatility the last few months as discussed in our last month’s outlook. Investors need to realize the recent volatility we are experiencing is normal compared to long-term averages. For example, as noted in the chart below from JP Morgan’s Guide to the Markets that over the last thirty-five years the average intra-year decline is approx. 14.2% and through the end of September 2015 we are only at 12.0%. Why does it feel much worse? If you look at the last three years the intra-year decline is much lower than average so many investors have forgotten the feeling of seeing losses in their accounts for the quarter or year. This is why stocks return more than fixed income over the long term because in the short-term they are riskier. You’ll also note from this chart that even with this intra-year volatility 27 out of the last 35 years the stock market has been up. Therefore, it is important to stick to your investment plan in both good and bad markets.

Federal Reserve

The all anticipated Fed decision resulted in no change to their target interest rate of 0-0.25%. Here’s why from their statement,

“Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term. Nonetheless, the Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move towards levels the Committee judges consistent with its dual mandate.”

Although recent domestic activity has been positive the Fed is worried what a rate hike would do to a slowing global economy, especially China. We’ve included a good article below on China that discusses this topic further. Our opinion is that the Federal Reserve will remain cautious with their decision to raise interest rates as they don’t want to repeat 1937-38 when rates and taxes were raised too quickly after the Great Depression. This will likely result in lower than normal interest rates for an extended time period.

What is your Investment Strategy?

Finally, we have included below an interesting article called Selling is the Easy Part. Studies show that most investors are able to diligently follow an established set of rules when making the sell decision, but the challenge is getting back in as buying can be very difficult. The article finishes by focusing on a few different options for investors to deal with these market scenarios. The most successful is to follow an investment process you have set up in advance that takes into account your personality, knowledge of the markets and ability to stick with the plan. The “don’t have a plan in place and just wing it strategy” does not help you reach your long-term goals.

If you don’t have a strategy in place the next article, Is It Worth Having a Financial Advisor, summaries studies completed by Vanguard and Morningstar of the benefits and attempts to quantify the amount.

Interesting articles read this last month

Is It Worth Having a Financial Advisor

Before you Figure out Money, think about happiness

You’re Too Young for a Will. Right?

The China Syndrome: Meltdown or Recovery Ahead?