The Federal Reserve (“Fed”) recently announced in its January 2014 meeting that it will continue to reduce (aka taper) its bond buying from $75 billion to $65 billion per month in 2014. The Fed has seven remaining meetings in 2014 and it is expected it will reduce the monthly bond purchases by $10 billion per meeting which would wrap up quantitative easing (“QE”) by the end of 2014.

Background

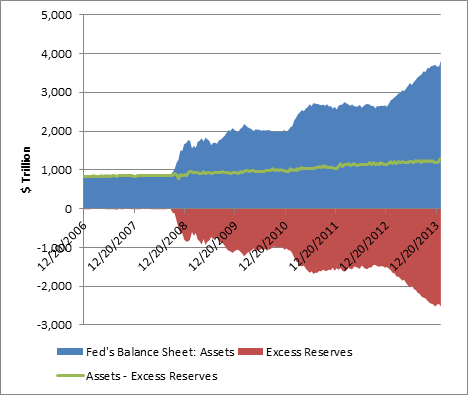

QE actually started in November 2008 and has gone through multiple iterations (e.g. QE1, QE2, etc.). As noted in the chart below its balance sheet increased from a little less than $1.0 trillion in 2008 to almost $4.0 trillion today.

What is Quantitative Easing (“QE”)?

The purpose of QE was to lower long-term interest rates and spur economic growth. History will determine whether QE was successful, but one thing we have noted in the chart below is a material amount of money created by the Fed ended up back on the banks’ balance sheets as excess bank reserves.

Excess bank reserves are the money that banks are holding in excess of required reserves. The data and chart reflect only the excess reserves. Since the financial crisis, excess reserves have grown almost the same proportion as the Federal Reserve’s balance sheet as noted by the green line.

What does it mean?

What this means is a material amount of the “money printing” you hear about through the media has ended up on the banks’ balance sheets and not in the economy through bank lending.

The Federal Reserve and many others are closely watching this green line to see when/if this money will enter the economy. If it does, there is concern it could spark inflation and there are a few actions the Fed could take to reduce that risk. It is also possible that our economy could absorb much more of those excess reserves flowing into the real economy without sparking inflation as the economy may still be operating below potential.

Impact on You

How does the Fed’s decision to taper bond purchases impact you? In the short-term anything is possible. One would expect interest rates to rise as a significant buyer of treasuries and mortgages leaves the market, but after QE1, QE2 and more recently rates actually fell so it is unknown what will happen next.

We don’t anticipate a spike in long-term interest rates anytime soon, but a slow gradual increase over time (see When Will Interest Rates Rise?). Regarding the interest rate on your bank account, the Fed did provide guidance that the Fed Funds rate will likely stay low well after the unemployment rate falls below 6.5%. Which means the return on your savings account is unlikely to change anytime soon.

FSI’s Take

How do the Fed’s actions change our outlook at FSI? Not at all. We focus on the long-term because it is impossible to predict short-term market movements. This is why we implement a long-term investment strategy based on each client’s unique situation. If you have any questions on the Fed’s policy and how it may impact you don’t hesitate to contact us.